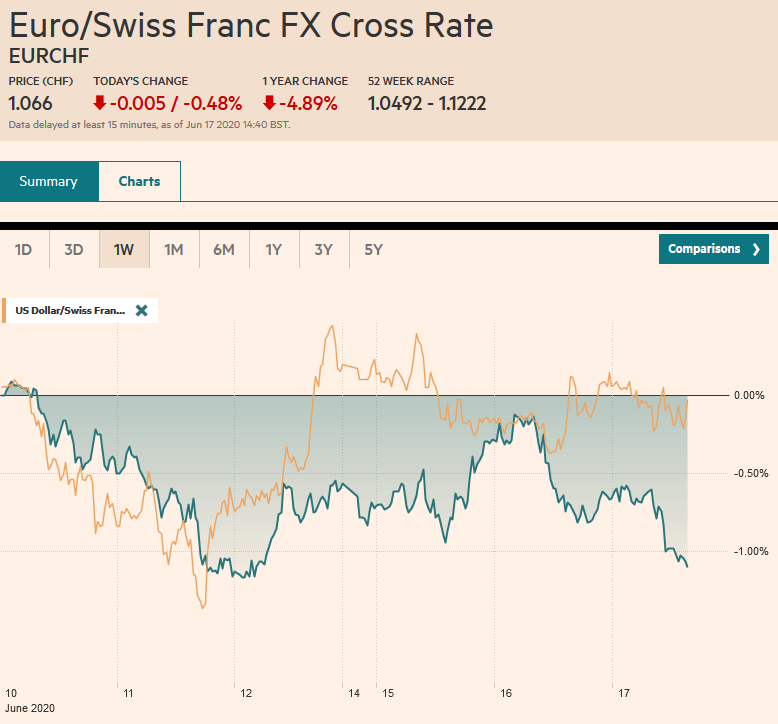

Swiss Franc The Euro has fallen by 0.48% to 1.066 EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the Dow Jones Stoxx 600 is firm near yesterday’s highs. It has entered but not yet filled the gap created by the sharply lower opening on June 11. The S&P 500 is in the same position. It is firm, but last week’s gap extends to 3181.50 and has not been filled. We are not convinced that the corrective forces

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, brl, China, Currency Movement, ECB, Featured, India, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.48% to 1.066 |

EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

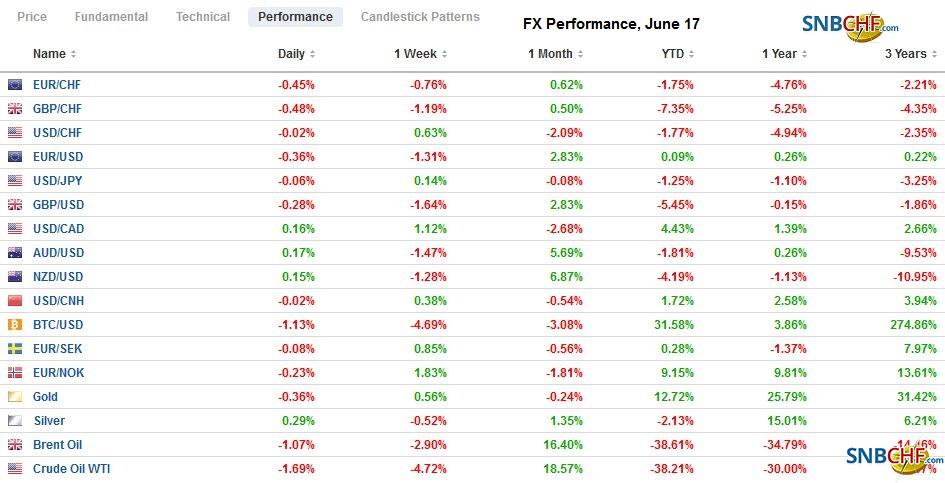

FX RatesOverview: Investors have not yet completely shaken off the angst that saw equities slide last week. All equity markets in the Asia Pacific region, but Japan, edged higher today, including China, India, and South Korea, where political/military tensions are elevated. Europe followed suit, and the Dow Jones Stoxx 600 is firm near yesterday’s highs. It has entered but not yet filled the gap created by the sharply lower opening on June 11. The S&P 500 is in the same position. It is firm, but last week’s gap extends to 3181.50 and has not been filled. We are not convinced that the corrective forces have been exhausted. Bond markets are quiet, with yields mostly 1-2 bp higher. The 10-year US Treasury yield is slightly lower around 74 bp. The dollar is firmer against the majors, except the Swiss franc, which is holding on to minor gains. Among emerging market currencies, the South Korean won is under some pressure, as warned by the non-deliverable forward market yesterday. Earlier gains among some of the more liquid and accessible emerging markets currencies have been pared in the European morning. The JP Morgan Emerging Market Currency Index is essentially flat ahead of the markets opening in the Americas. Gold is heavier but continues to consolidate in Monday’s range (~$1704-$1734), and oil is a little heavier with the July WTI contract pushing lower after the $39 area was rebuffed yesterday. API’s estimate was for a 3.8 mln barrel build, and if confirmed by the EIA estimate today, it would be the second weekly build for the first time in over a month. |

FX Performance, June 17 |

Asia Pacific

China and India are having problems with their neighbors and each other. It is this latter conflict that has bubbled over first. The seven-week intensified stand-off between the two turned deadly in recent days. There is still great restraint, but the Sino-Indian rivalry is likely entering a new and more intensive phase. It is also a useful reminder to those who see China as a global hegemon. Sure, it needs to dominate the continent first, and although it is a significant trade partner for many, its projection of political influence is not unchecked.

Beijing is seeing a new rise in the virus and has moved from level 3 to level 2 response. Movement in and out of the city is restricted, and schools return to virtual classrooms. While Beijing had nearly eradicated the virus, a different story is emerging in the US. Many are flattering themselves with the idea that some states like Florida and Texas are also experiencing a second-wave. But it seems that the increased cases are still part of the first wave, which was not fully dealt with prior to the re-openings.

Japan’s May trade deficit was smaller than expected at JPY833.4 bln. Exports fell 28.3% from a year ago after April’s nearly 22% decline. Auto exports to the US and Europe slumped. Exports overall to the US were off 56% but only 1.9% to China. Imports fell 26.2% in May after a 7.1% decline in April. The median forecast in the Bloomberg survey called for a 20.4% decline. Energy (price?) and consumer goods imports (clothes from China) fell. Supply chains appear to be slowly coming back online, and this was also the signal from Singapore’s trade figures. As an entrepot, Singapore’s trade data often is seen reflecting regional trends. Its non-oil exports fell 4.5% year-over-year, better than the 6% decline anticipated after falling 5.1% in April. Electronic exports surged 12.5%. The median forecast was for a 2.5% increase after a 0.6% decline in April.

The dollar has been confined to a little more than a quarter a yen range today below JPY107.50, where a roughly $365 mln option is set to expire. A $1.1 bln option at JPY107.25 also expires today. The Australian dollar is trading within yesterday’s range. The session high was recorded near $0.6925 in late Asia, but selling pressure in early Europe has pushed it back toward $0.6885. Initial support is seen in the $0.6835-$0.6850 area. Hong Kong officials continue to defend the band, but pressure may ease shortly as Hong Kong rates have eased relative to US rates, and the IPO-related demand may also be nearly complete. The PBOC’s reference rate for the dollar was slightly lower than the bank models, and the greenback remained within the ranges seen Monday and Tuesday.

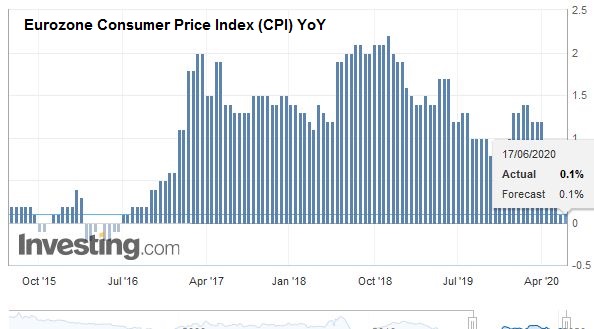

EuropeThe allotment of the much-awaited ECB’s Targeted Long-Term Refinancing operation will be announced tomorrow. Recall, these three-year loans by the ECB are where the rate is linked to banks meeting a lending target. If achieved, the loans that will be announced will give the borrower 100 bp a year. Moreover, the loan can re-paid in a year, which in essence if a free option. |

Eurozone Consumer Price Index (CPI) YoY, May 2020(see more posts on Eurozone Consumer Price Index, ) Source: investing.com - Click to enlarge |

| Banks may roll as much as 600 bln euros from existing programs into this new one given the ultra-attractive terms. This will flatter the gross figure, but the net figure maybe even more important. It represents the new addition to the ECB’s balance sheet and perhaps as much as third of its Pandemic Emergency Purchase Program (now 1.25 trillion euros through the middle of next year). |

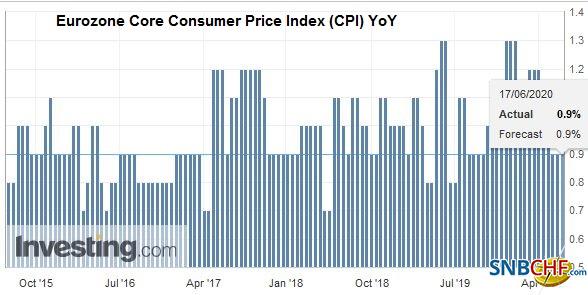

Eurozone Core Consumer Price Index (CPI) YoY, May 2020(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

The UK’s May CPI figures were mostly in line with expectations, and in any event, will not be much of a factor at tomorrow’s Bank of England meeting, which is widely expected to result in an extension of its bond-buying program. A GBP100 bln increase is the minimum, but a GBP200-GBP250 bln increase seems more likely. The preferred measure of UK CPI includes owner-occupied housing costs, and it rose 0.7% year-over-year in May after a 0.9% increase in April. The core measure ticked down to 1.2% from 1.4%. It is the lowest in four years. Deflation in producer prices continues to be experienced. Input prices were 10% lower than a year ago, while output prices were off 1.4%.

Today is so far the first session in two weeks in which the euro has not traded above $1.13, where an 825 mln euro option is set to expire. It is near the recent lows around $1.1225, and last week’s low was a little lower (~$1.1215). A break signals a move toward $1.1150-$1.1175 initially. Note that Merkel has reiterated her caution that an agreement on the Recovery Fund is unlikely at this week’s EU Summit (conference call on June 19). Sterling reversed lower from almost $1.2690 yesterday, and follow-through selling has pushed it to about $1.2535 in the European morning. A trendline drawn off the March and May lows comes in today near $1.2415 and $1.2430 tomorrow.

America

US retail sales jumped 17.7% in May, more than twice what the median forecast in the Bloomberg survey anticipated, and the April slump was revised to -14.7% from -16.4%. This bodes well for next week’s report personal consumption, which is a considerably broader measure. The early call was for around a 5% increase, but after the retail sales report, economists will likely revise up their forecasts. The components used for GDP calculations rose by 11%, which was also twice the projection. The Atlanta Fed’s GDP tracker now projects a 45.4% contraction in Q2 at an annualized pace rather than 48.5% it saw a week ago. When combined with the poor industrial production figures (1.4%, half the median forecast and a downward revision to -12.5% from -11.2%) suggests that demand was met out of inventories. Business inventories fell by 1.3% in April. As we have noted before, the change in GDP may look like a “V,” but the level of GDP will likely be much flatter.

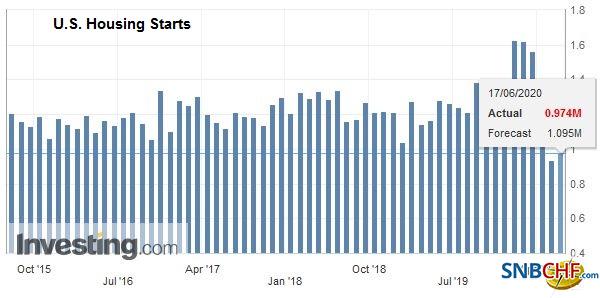

| The US reports May housing starts and permits data today. A significant bounce is expected after declines of 30.2%, and 21.4% were reported, respectively. The 1.1 mln unit pace of the median forecast in the Bloomberg survey would bring housing starts back up to four-year lows. Last May, housing starts rose by at a nearly 1.27 mln pace and an almost 1.3 mln unit pace average in 2019. Fed Chair Powell delivers the second leg of his semiannual testimony before Congress. Today it is before the House Financial Services Committee. Powell is not breaking new ground but reiterating his cautious outlook and concern that more spending (fiscal policy) is needed. Canada report May CPI figures. Although the headline rate will likely move out of deflation, the underlying rates, which have remained considerably more stable, maybe a touch softer. The Bank of Canada is concerned that weak demand will open the output gap, which in turn, limited price pressures. |

U.S. Housing Starts, May 2020(see more posts on U.S. Housing Starts, ) Source: investing.com - Click to enlarge |

The US Treasury’s report on capital flows reported earlier this week showed that foreign investors bought a net $125 bln of US securities in April. It was fully accounted for by short-term paper as foreign investors sold $128 bln long-term securities. Canada reported that foreigners bought a record C$47 bln of its bonds (C$18 bln were government bonds) and C$7 bln money market instruments. Foreign investors sold about C$5 bln of equities.

Weak pre-existing conditions and poor policy response to the Covid crisis is delivering a massive blow to the Brazilian economy. Yesterday’s news of a 16.8% month-over-month drop in retail sales (17.5% decline with a broader measure that includes parts and vehicles) provides a backdrop for today’s central bank meeting. Recall that Copom cut the Selic rate target by 200 bp to 4.50% in H2 19. It now sits at 3.0%, following a 75 bp cut in May. At the time, most had expected a 50 bp move. It had had not cut by more since 2018. This time, economists recognize the more aggressive Another 75 bp cut is widely expected, which would exhaust the room the central bank had identified previously. The main focus is whether the increased deflationary impulse, which includes the 9% appreciation of the Brazilian real since the last meeting, it sees scope for additional rate cuts or whether it needs to innovate.

The US dollar is consolidating within yesterday’s range against the Canadian dollar. The CAD1.3475-CAD1.3500 band offers important technical support. A $780 mln option at CAD1.3500 expires today. Initial resistance is pegged around CAD1.3600CAD1.3630. The greenback recovered from the slip below MXN22.00 yesterday, and it is little changed on the day (~MXN22.32) ahead of the North American open. A move through MXN22.50 targets MXN22.95-MXN23.00.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,brl,China,Currency Movement,ECB,Featured,India,newsletter