Swiss Franc The Euro has fallen by 0.03% to 1.0802 EUR/CHF and USD/CHF, September 9(see more posts on EUR/CHF, USD/CHF, ) Source: investing.com - Click to enlarge FX Rates Overview: News that the AstraZeneca Phase 3 test had to be stopped to study the adverse reaction of one subject added to the uncertainty of investors amid one of the more significant reversals of risk appetites since March. Equities continued to slump in the Asia Pacific region, with many...

Read More »FX Daily, September 8: US Threats to Decouple from China and the Greenback Strengthens

Swiss Franc The Euro has fallen by 0.09% to 1.0813 EUR/CHF and USD/CHF, September 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets remain on edge. US-China tensions are escalating. Strained Brexit talks are set to resume today. Profit-taking in the tech space has continued. The ECB meeting is around the corner. The MSCI Asia Pacific Index snapped a three-day slide today with most markets moving...

Read More »FX Daily, September 4: Markets Look for more Solid Footing, but Need to Get Passed US Jobs Data

Swiss Franc The Euro has risen by 0.14% to 1.0789 EUR/CHF and USD/CHF, September 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic sell-off of US shares yesterday is the main focus, capturing the limelight from other forces, including today’s US employment report. It was the third-worst session for the S&P 500 since the March 23 bottom, and the other two did not see follow-through selling. ...

Read More »Trumps Handelspolitik: Note ungenügend

Donald Trump wollte Amerika wieder gross machen – und China wirtschaftlich in die Knie zwingen. Doch sein Handelskrieg ist alles andere als eine Erfolgsgeschichte. Ausser Spesen… : Das US-Handelsdefizit hat sich trotz Trumps Bemühungen erhöht. Foto: Getty Images Die Amerikaner wählten 2016 Donald Trump zu ihrem Präsidenten, weil er versprach, Amerika wieder gross zu machen. Um das zu erreichen, sollte China wirtschaftlich in die Knie gezwungen werden. Anderthalb Jahre...

Read More »FX Daily, July 13: Risk Appetites Firm, but the Greenback is Mixed

Swiss Franc The Euro has risen by 0.46% to 1.068 EUR/CHF and USD/CHF, July 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit-taking seen in China ahead of the weekend was a one-day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets...

Read More »FX Daily, July 10: Surge in Coronavirus Spooks Investors as China Takes Profits

Swiss Franc The Euro has risen by 0.22% to 1.0629 EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Record fatalities in a few US states, coupled with new travel restrictions in Italy and Australia, have given markets a pause ahead of the weekend. News that two state-backed funds in China took profits snapped the eight-day advance in Shanghai at the same time as there is an attempt...

Read More »Second Wave Global Trade

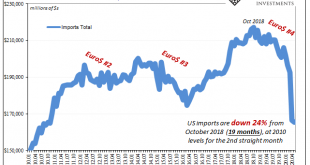

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting. Getting closer to a bottom. Unlike any of the sentiment numbers, however, these trade figures better demonstrate just how far from a rebound let alone recovery the world...

Read More »Trumps wahre China-Politik

US-Präsident Donald Trump geht es im Handelskrieg mit China bloss um seine eigene Position. Und nicht um einen fairen Aussenhandel. Da schien der Handelskrieg beigelegt: Trump und Xi Jinping am G20-Gipfel in Japan 2019. Foto: Keystone Seit der Corona-Krise ist der Handelskrieg in den Hintergrund gerückt. Doch seine Ursachen sind nicht behoben. Im Gegenteil: Gerade wegen der Krise verschärfen sie sich weiter. Angesichts einer schwachen Nachfrage im Inland sind alle...

Read More »Cool Video: Dollar, Trade, and China on TDA Network

I began my career as a reporter on the floor of the Chicago Mercantile Exchange, covering the currency futures and short-term interest rate futures for a news wire. Among other things, I learned that often, the locals, people trading with their own money and wits, would take the opposite side of trades of the institutional players. The institutional operators had deeper pockets but were looking to lay-off risk. It was a David vs. Goliath story often. It is,...

Read More »FX Daily, July 6: New Record Number of Covid Cases Doesn’t Curtail Appetite for Risk

Swiss Franc The Euro has risen by 0.07% to 1.064 EUR/CHF and USD/CHF, July 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A new daily high number of contagions globally has been reported, but the risk-appetites have been stoked. Chinese stocks have been on a tear. The Shanghai Composite rallied 5.7% today to bring the five-day advance to 13.6%. Most other regional markets, including Hong Kong, rallied as well...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org