Swiss Franc The Euro has risen by 0.22% to 1.069 EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However, in early Asia activity, Trump adviser Navarro seemed to have told Fox News that the US-China trade deal was over. This played on market fears that Trump was making good on his threat to walk away from talks. A ripple went through the capital markets, equities were sold, and the dollar was bought. The

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, Currency Movement, EMU, Featured, newsletter, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

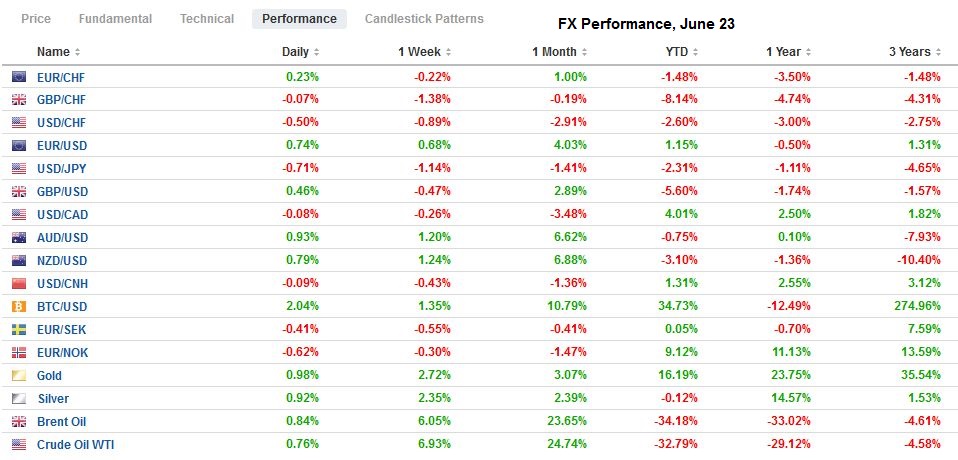

Swiss FrancThe Euro has risen by 0.22% to 1.069 |

EUR/CHF and USD/CHF, June 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After early indecision, investors ramped the demand for risk assets, encouraged perhaps by indications that the Trump Administration going to support at least another trillion-stimulus package. The NASDAQ rallied to new record highs, and the dollar got thumped across the board. However, in early Asia activity, Trump adviser Navarro seemed to have told Fox News that the US-China trade deal was over. This played on market fears that Trump was making good on his threat to walk away from talks. A ripple went through the capital markets, equities were sold, and the dollar was bought. The comment was “clarified” and walked back, including by Trump himself. This, coupled with better than expected European PMIs help risk-taking appetites to recovery. Asia Pacific equities rallied, led by the 1.6% gain in Hong Kong. The rally continued into Europe, and US shares are firmer as well. The bond market is mostly little changed, but the risk-on mood is seeing the peripheral premium narrow. The US 10-year stable a bit firmer near 72 bp. The dollar is broadly lower, with the sterling, the Canadian dollar, and yen struggling. The Scandis are leading the move. Emerging market currencies are mostly higher, and the JP Morgan Emerging Market Currency Index is rising for the third consecutive session. Gold is firm, a little below $1760, and the multi-year high set last month near $1765. Oil is firm, and the August WTI contract is straddling the $41 a barrel level as it edges into the gap created in March that extends to about $42.15. |

FX Performance, June 23 |

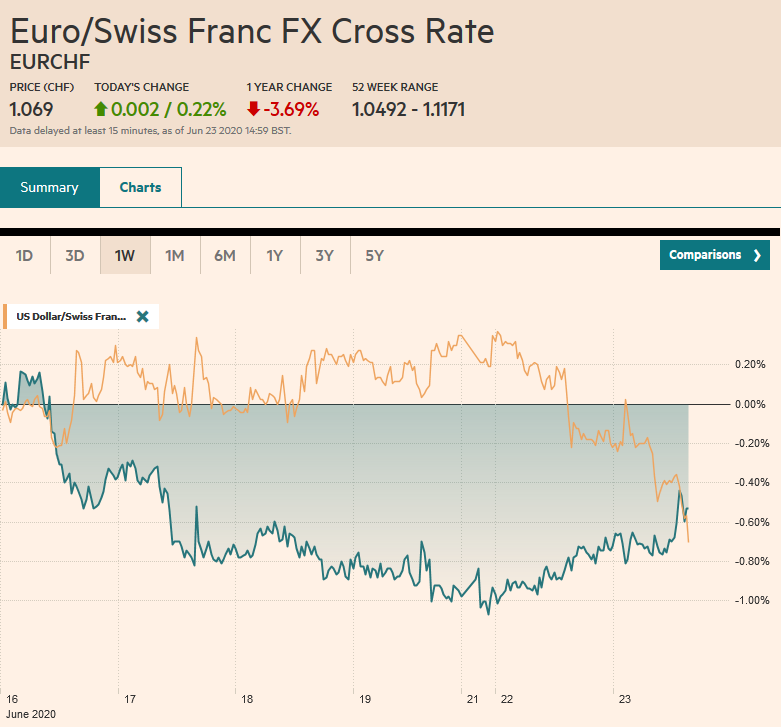

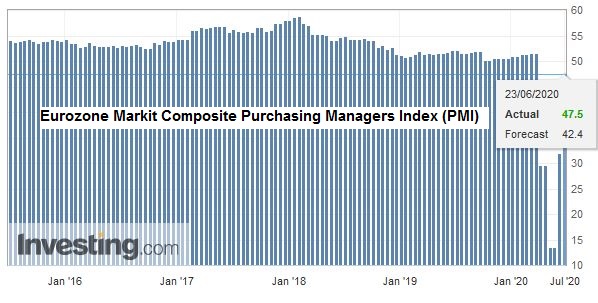

Asia PacificJapan’s preliminary composite PMI rose to 37.9 from 27.8. While this is a constructive development, a key element disappointed. The manufacturing PMI slipped lower to 37.8 from 38.4. The service PMI rose to 42.3 from 26.5. |

Japan Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Australia’s preliminary PMI underscores the recovery underway. The manufacturing PMI just missed the 50 boom/bust level by rising to 49.8 from 44.0. However, the service PMI jumped to 53.2 from 26.9, and this helped carry the composite reading to 52.6 from 28.1.

Japan is risking provoking China. The Ishigaki city assembly, which has administrative authority over a disputed island in the East China Sea, renamed it Tonoshiro Senkaka from Tonoshiro ostensibly to avoid confusion between its own area with the same name. China and Taiwan objected quickly. Tensions in the area have been rising as China has been disrupting fishing in the waters for some time. China has also been sending planes into Taiwan’s airspace, and there are the recent hostilities with India. Separately, India is reportedly considering a new law to limit foreign portfolio investment from countries with which it shares a border, i.e., China.

The dollar rose to a four-day high against the yen a little above JPY107.20. Nearby resistance is seen in the JPY107.50-JPY107.65 band. The greenback has finished the North American session below JPY107 for the past three sessions. It fell every day last week, but now is trying to string together a back-to-back advance, the first since June 4th and 5th. The Australian dollar is firm and has entered a band of resistance from $0.6920 to $0.6950. A move above there would signal the underlying trend is continuing and a retest on this month’s earlier high near $0.7065. The PBOC set the dollar’s reference rate a little stronger than the models, but it did not prevent the greenback from slipping for the third consecutive session.

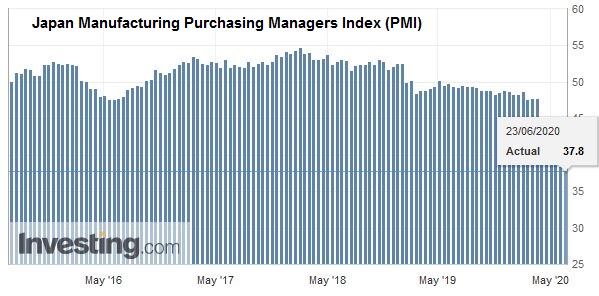

EuropeThe preliminary PMI readings were better than expected and reinforce the sense that the worst is passed. The aggregate composite reading rose to 47.5 from 31.9. |

Eurozone Markit Composite Purchasing Managers Index (PMI), June 2020(see more posts on Eurozone Markit Composite PMI, ) Source: investing.com - Click to enlarge |

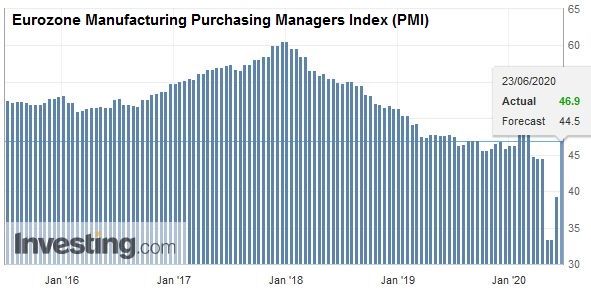

| This was a result of the 46.9 reading for manufacturing, up from 39.4, |

Eurozone Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

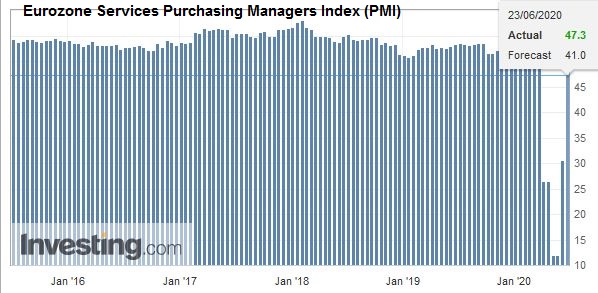

| and a rise in the service PMI to 47.3 from 30.5. Still, it is far from all clear, as new orders and employment weakened. |

Eurozone Services Purchasing Managers Index (PMI), June 2020(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

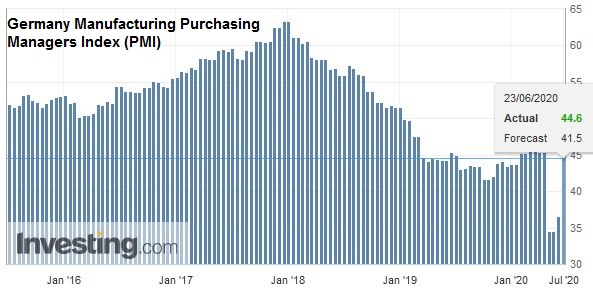

| Germany reported improvement, but all the readings were below the 50 boom/bust level. Manufacturing rose to 44.6 from 36.6, and services rose to 45.8 from 32.6. The composite advanced to 45.8 from 32.3. France was more impressive. All of its readings were above 50. Manufacturing jumped to 52.1 from 40.6. Services rose to 50.3 from 31.1. The composite now stands at 51.3 from 32.1. |

Germany Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on Germany Manufacturing PMI, ) Source: investing.com - Click to enlarge |

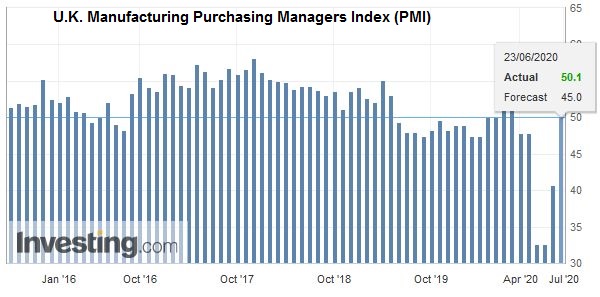

| The UK surprised as well. The manufacturing PMI edged over 50 to 50.1, and the services PMI rose to 47.0 from 29.0. The composite recovered to 47.6 from 30.0. Separately, note that Japan is pushing for a less ambitious trade deal with the UK that can be concluded next month, which would allow the Diet to approve it this year. The UK is also in trade talks with Australia, New Zealand, the US, and, of course, the EU. |

U.K. Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on U.K. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

EC President von der Leyen and European Council President took a sharper tone with China as the summit wound down. The complaint was two-fold. First, there has been no progress over the past year on addressing the “unbalanced trade and investment relationship.” The EU is China’s largest trading partner. Second, it pressed China to step back from the brink in Hong Kong and was critical of its human rights record. Europe also publicly accused China of waging cyber-attacks.

The euro is building on yesterday’s recovery. Yesterday it traded near $1.1170 at the lows and rallied a cent. Today, the single currency entered an important technical band in the $1.1295-$1.1325 area. A move above there signals a retest on the $1.1420 high seen on June 10. Intraday support is pegged near $1.1255. Sterling is struggling. It did reach a three-day high a little above $1.2510 but has returned to the $1.2450 area in the European morning. A break of the $1.2420 area would be disappointing now.

AmericaThe US is threatening to reimpose a 10% tariff on aluminum imports from Canada unless Ottawa “voluntarily” restricts exports. The US also took action against four more China-based news sources, including CCTV, People’s Daily, China News Service, and Global Times. They will be regarded as government agents and now press. In addition, President Trump halted several employment-based visa programs for work and study. |

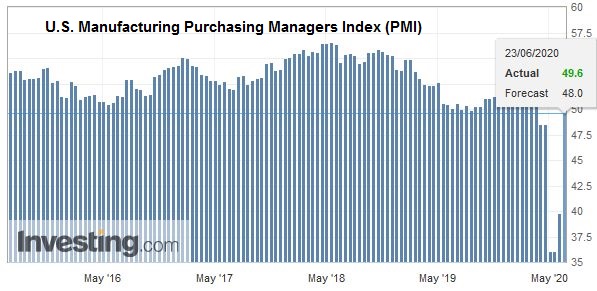

U.S. Manufacturing Purchasing Managers Index (PMI), June 2020(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Canada, Mexico, and Brazil have light economic calendars today. The data focus is squarely on the US with the preliminary PMI (look for a jump to almost 50 from 37 in May). New home sales (May) and the Richmond Fed’s manufacturing survey for June are also out today. Note that housing starts and existing home sales disappointed expectations. The US Treasury sells two-year notes today as part of this week’s more than $300 bln bill and note sale. The MSCI announces details of its annual market classification review, which is important for some asset managers.

Although some balked at the need for additional fiscal measures after the stronger than expected May employment data, there should be little doubt than another US stimulus package is in the works. It is partly driven by economic logic and concern that after an initial pop, the recovery will be painstakingly slow and that the bridge that the Fed can provide over illiquidity cannot conceal insolvency indefinitely. It is also partly driven by the political logic and the upcoming elections. Despite the hyperbolic claim that the Fed is keeping everything afloat, business failures with over $50 mln in liabilities at their highest level in more than a decade. Meanwhile, nearly a quarter of US states are reporting sharp increases in the contagion, and this will hamper the recovery even as some openings continue. California and Texas are threatening to reimpose stay-in-place orders if the virus continues to spread.

The US dollar made a new eight-day low against the Canadian dollar but held above CAD1.35. Below there, the 200-day moving average is near CAD1.3480 and then CAD1.3455. Initial resistance is seen in the CAD1.3540-CASD1.3560 area. The dollar has been mostly confined to yesterday’s range against the Mexican peso (~MXN22.30-MXN22.7350). Mexico’s relatively high real and nominal rates continue to attract flows, while the macro backdrop is deteriorating, and the spread of the virus has prompted the mayor of Mexico City to delay the city’s re-opening. Support for the greenback may be in the MXN21.90MXN22.00 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,Currency Movement,EMU,Featured,newsletter,U.K.