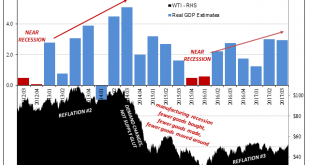

Oil prices were riding high after several weeks of steady, significant gains. It’s never really clear what it is that might actually move markets in the short run, whether for crude it was Saudi Arabia’s escalating activities or other geopolitical concerns. Behind those, the idea of “globally synchronized growth” that is supposedly occurring for the first time since before the Great “Recession” while it may not have...

Read More »FX Daily, November 14: Euro Rides High After German GDP

Swiss Franc The Euro has risen by 0.22% to 1.1646 CHF. EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sterling is trading in the lower end of yesterday’s range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26....

Read More »FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

Swiss Franc The Euro has fallen by 0.25% to 1.1539 CHF. EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these...

Read More »FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative...

Read More »Losing Economic ‘Reflation’

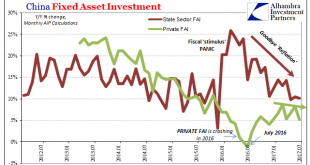

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More »China: Losing Economic ‘Reflation’

The backbone of China’s internal economy has been its ghost cities, but not as they may be ghost towns now, rather in how little time they might take to fill up. If the lag was relatively small because of restored growth, more would be needed and the Chinese building economy rolling ever onward. “Reflationary” prices were often Chinese prices of just that perceived process. The perceptions of a possible “hard landing”...

Read More »FX Daily, August 14: Sigh of Relief Weighs on Yen and Gold, while Lifting Equities and the Dollar

Swiss Franc The Euro has risen by 0.64% to 1.1425 CHF. EUR/CHF and USD/CHF, August 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The lack of new antagonisms over the weekend between the US and North Korea has prompted the markets to react accordingly. Already before the weekend, we detected some signs that at least some market participants had begun looking past...

Read More »China’s Economy Shorthand the Largest Asset Bubble in Human History

The term “ghost city” is a loaded one, often deployed to skew toward a particular viewpoint. In the context of China’s economy, it has become shorthand for perhaps the largest asset bubble in human history. While that may ultimately be the case, in truth China’s ghost cities aren’t about the past but its future. There is a great deal that is misunderstood about the country’s path toward urbanization and modernity. A...

Read More »FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

Swiss Franc The Euro has fallen by 0.05% to 1.1028 CHF. EUR/CHF - Euro Swiss Franc, July 17(see more posts on EUR/CHF, ) - Click to enlarge FX Rates After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major...

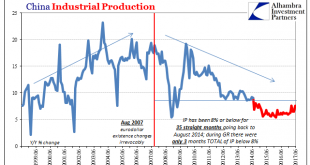

Read More »Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level. If there’s a country in the world which is really...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org