Swiss Franc The Euro has fallen by 0.04% at 1.1277 EUR/CHF and USD/CHF, September 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The dollar traded above JPY112 in early Asia, for the first time since early August but it could not take out the high recorded then (~JPY112.10) and has come off a bit in Europe. There is a $493 mln option struck at JPY112 that will expire...

Read More »FX Daily, July 16: Dollar Softens a Little as Market Awaits Developments

Swiss Franc The Euro has fallen by 0.05% to 1.1683 CHF. EUR/CHF and USD/CHF, July 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is slightly softer against most of the major currencies but is in narrow ranges ahead of today’s key events, which include US retail sales and the debate in the UK parliament over Brexit. The yen is the main exception. The local...

Read More »FX Daily, June 14: Dollar Punished Ahead of ECB

Swiss Franc The Euro has risen by 0.43% to 1.1568 CHF. EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge The US dollar is slumping against all the major currencies in the aftermath of the hawkish Federal Reserve. In fact, the inability of the greenback to hold on to the gains scored in the initial reaction to the Fed’s hike, optimism on the economy,...

Read More »FX Daily, May 15: Firm US Rates Underpin Greenback

Swiss Franc The Euro has fallen by 0.44% to 1.1877 CHF. EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a...

Read More »FX Daily, April 17: Dollar Recovers from Further Selling as Turnaround Tuesday Unfolds

Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, April 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After the retreating in the North American session yesterday, despite a rebound in retail sales after three-months of declines, the greenback has been sold further in Europe and Asia. The euro edged through last week’s high near $1.24, and...

Read More »China’s Questionable Start to 2018

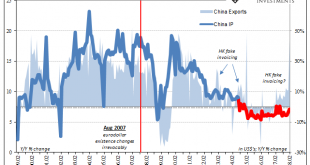

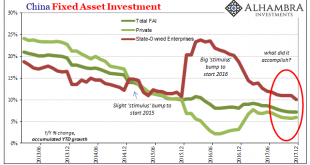

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week). Despite this attempt to offset them, there remains...

Read More »The Blatant Dishonesty of the ‘Boom’

Why do humans tend to behave in herds? It’s a fundamental question that only recently have researchers been able to better understand. On the one hand, it doesn’t take an advanced degree in some neurological science to see the basis behind it; survival for our ancestors often meant getting along with the crowd. There are times when that very trait applies still. In 2009, neurologists in the UK conducted function...

Read More »FX Daily, January 18: Currencies Consolidate After Chop Fest

Swiss Franc The Euro has fallen by 0.20% to 1.174 CHF. EUR/CHF and USD/CHF, January 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed’s Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%,...

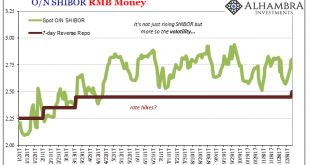

Read More »Chinese Are Not Tightening, Though They Would Be Thrilled If You Thought That

The PBOC has two seemingly competing objectives that in reality are one and the same. Overnight, China’s central bank raised two of its money rates. The rate it charges mostly the biggest banks for access to the Medium-term Lending Facility (MLF) was increased by 5 bps to 3.25%. In addition, its reverse repo interest settings were also moved up by 5 bps each at the various tenors (to 2.50% for the 7-day, 2.80% for the...

Read More »FX Daily, December 14: US Rates Bounce Back, but Dollar, Hardly

Swiss Franc The Euro has risen by 0.18% to 1.1673 CHF. EUR/CHF and USD/CHF, December 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US interest rates have recovered the drop seen after the FOMC yesterday, but the dollar at best has been able to consolidate its losses and at worst, seen its losses extended. The Fed boosted its growth forecasts and lower unemployment...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org