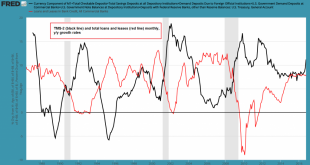

A Very Odd Growth Spurt in the True Money Supply The growth rates of various “Austrian” measures of the US money supply (such as TMS-2 and money AMS) have accelerated significantly in recent months. That is quite surprising, as the Fed hasn’t been engaged in QE for quite some time and year-on-year growth in commercial bank credit has actually slowed down rather than accelerating of late. The only exception to this is...

Read More »Inflation Expectations Rise Sharply

Mini-Panic Over Inflation After Trump’s Election Victory We have witnessed truly astonishing short term market conniptions following the Donald Trump’s election victory. In this post we want to focus on one aspect that seems to be exercising people quite a bit at present, namely the recent surge in inflation expectations reflected in the markets. Will we have to get those WIN buttons out again? A 1970s “whip...

Read More »Dissection of the Long-Term Asset Bubble

The Long Term Outlook for the Asset Bubble Due to strong internals, John Hussman has given the stock market rally since the February low the benefit of the doubt for a while. Lately he has returned to issuing warnings about the market’s potential to deliver a big negative surprise once it runs out of greater fools. In his weekly market missive published on Monday (entitled “Sizing Up the Bubble” – we highly...

Read More »Stock Market Volatility, Gold and the Election

Pre-Election Market Movers – Mr. Comey and the Trio Infernal Before this Monday, the S&P 500 Index went down nine days in a row. While this was almost unprecedented (or in any case, a very rare event) the decline was quite small overall. The timing of the pullback and the subsequent strong rebound on Monday suggests that Mr. Comey’s letters to Congress regarding the FBI investigation into official emails by...

Read More »Gold Sector Correction – Where Do Things Stand?

Sentiment and Positioning When we last discussed the gold sector correction (which had only just begun at the time), we mentioned we would update sentiment and positioning data on occasion. For a while, not much changed in these indicators, but as one would expect, last week’s sharp sell-off did in fact move the needle a bit. Gold – just as nice to look at as it always is, but slightly cheaper since last week. Photo...

Read More »Gold Sector Correction – Where Do Things Stand?

Sentiment and Positioning When we last discussed the gold sector correction (which had only just begun at the time), we mentioned we would update sentiment and positioning data on occasion. For a while, not much changed in these indicators, but as one would expect, last week’s sharp sell-off did in fact move the needle a bit. Gold – just as nice to look at as it always is, but slightly cheaper since last week. Photo...

Read More »Japan’s Planners Ratchet up Monetary Experimentation

A Litany of Failures It was widely expected that the BoJ would announce something this week after it promised to perform a comprehensive review of its monetary policy. It certainly did deliver a major tweak to its inflationary program, but its implications were seemingly not entirely clear to everybody (probably not even to the BoJ). There were many reasons for the BoJ to review its policies. For one thing, they...

Read More »Gold Sector Correction – What Happens Next?

[unable to retrieve full-text content]The gathering of central planners at Jackson Hole was widely expected to bring some clarity regarding the Fed’s policy intentions. This is of course a ridiculous assumption, since these people have not the foggiest idea what they are doing or what they are going to do next. Like all central planners, they are forever groping in the dark.

Read More »Gold Trends: The Myth of Leverage

Mining Stocks, Gold Prices and Commodity Price Trends Gold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity exhibiting similar performance. In retrospect, if one invested in gold, one not only made much better returns, one also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much...

Read More »Insanity, Oddities and Dark Clouds in Credit-Land

Insanity Rules Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller. Corporate and government debt have been soaring for years, but investor appetite for such debt has evidently grown even more. A huge mountain of interest-free risk has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org