Mining Stocks, Gold Prices and Commodity Price Trends Gold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity exhibiting similar performance. In retrospect, if one invested in gold, one not only made much better returns, one also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much below its cost of production. Moreover, depending on the jurisdiction, owning gold might have resulted in lower (or no) tax liabilities. I am often amused when investors talk about leverage that mining equities offer— a large proportion of investors in the mining sector are driven by this, a sort of casino mentality. As experience over the last 16 years shows, leverage has been a myth and has actually been negative. In their chase for leverage, investors missed out on value-investing and profiting from wealth-creation. Let’s dissect this. South Deep gold mine in South Africa Photo via mining.com – click to enlarge. As you can see in the following three graphs, there is often a very close correlation between the prices of commodities. Energy and Fertilizer Prices Energy and fertilizer prices – click to enlarge. Gold vs.

Topics:

Jayant Bhandari considers the following as important: Chart Update, commodities, Featured, Gold and its price, newsletter, On Economy, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Mining Stocks, Gold Prices and Commodity Price TrendsGold has gone up >400% over the last 16 years. Ironically, it is hard to find a gold mining equity exhibiting similar performance. In retrospect, if one invested in gold, one not only made much better returns, one also took a relatively insignificant risk in comparison to owning equities—equities can go to zero while it is hard for a commodity to fall much below its cost of production. Moreover, depending on the jurisdiction, owning gold might have resulted in lower (or no) tax liabilities. I am often amused when investors talk about leverage that mining equities offer— a large proportion of investors in the mining sector are driven by this, a sort of casino mentality. As experience over the last 16 years shows, leverage has been a myth and has actually been negative. In their chase for leverage, investors missed out on value-investing and profiting from wealth-creation. Let’s dissect this. |

|

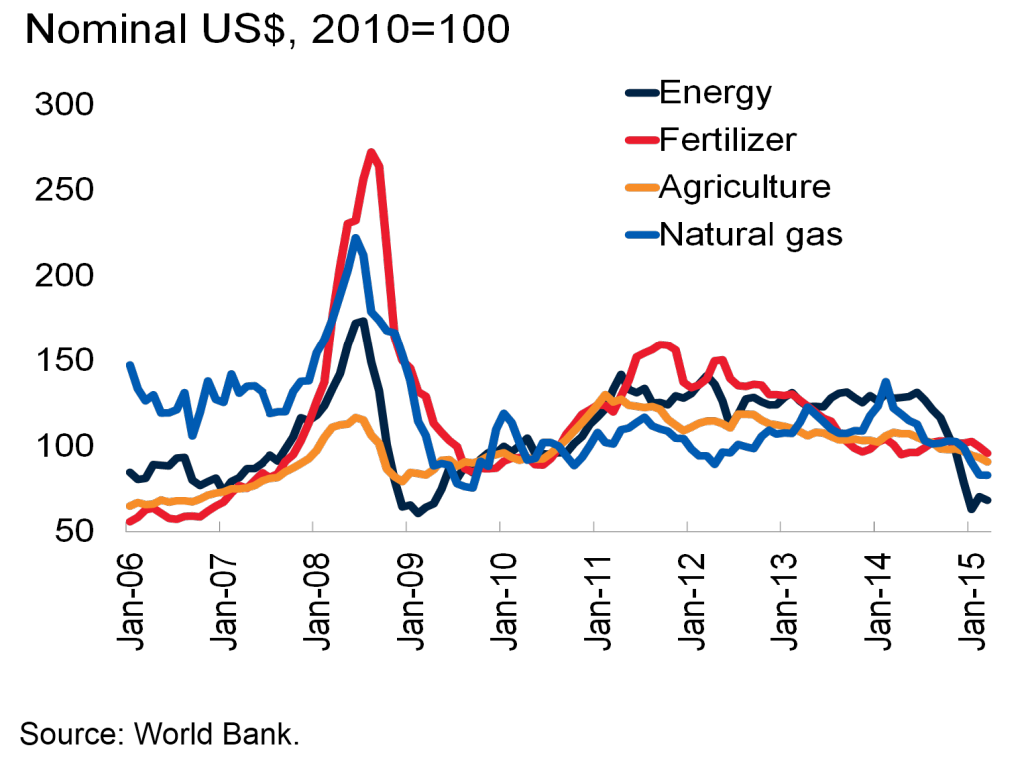

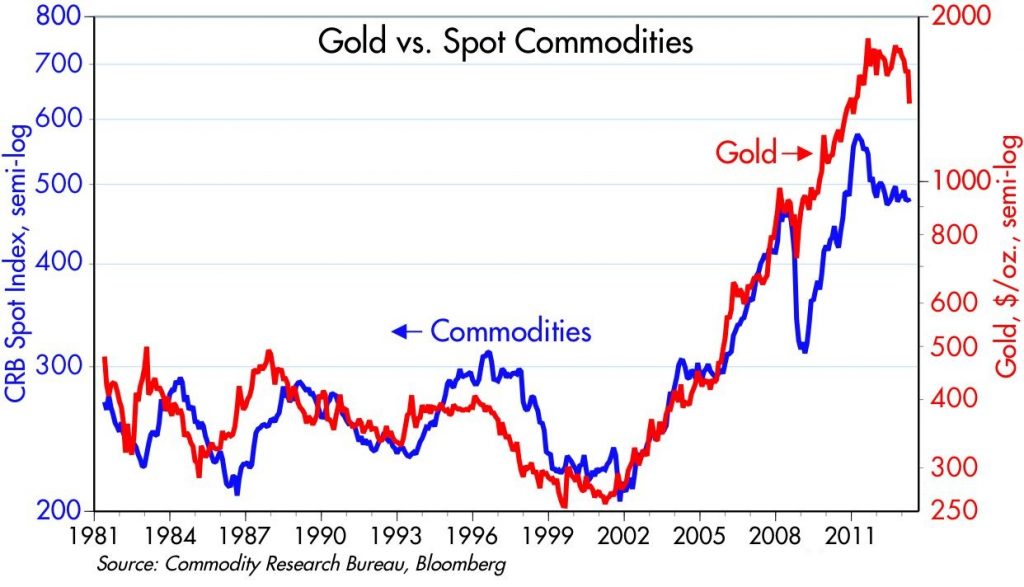

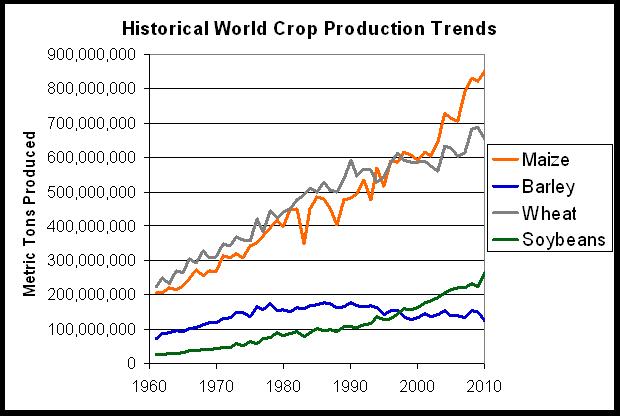

| As you can see in the following three graphs, there is often a very close correlation between the prices of commodities. |

Energy and Fertilizer Prices |

Gold vs. Spot CommoditiesWhen the price of a certain metal increases, the cost of its production increases as well, as a consequence of the prices of commodities (iron, oil, etc.) that go as ingredients into production rising as well, leaving at best an uncertain, unpredictable degree of leverage in the equation. |

Gold vs. Commodities |

Commodity Prices Are Cyclical and Move in UnisonWhen a particular commodity goes up in price, other commodities go up as well. |

Different commodity groups compared |

| As the following graph — on how production of certain commodities has changed over the years — shows, the invisible hand of the market using profit signals ensures that the quantity of commodities produced changes at the margin (and eventually by a huge amount) as a result of continual price feedback ensuring that the market pricing trends of most commodities stay similar. |

Historical World Crop Production Trends |

A Conservative Approach to Valuation

I meet a lot of people who have very bullish opinions on their favorite commodity, which sometimes is like a deity in their minds. They then invest without performing much due diligence in associated equities. Why should they, when they think gold is going to US$5,000 and silver to $100 an ounce? In fact, they then often gravitate toward the worst projects at current metal prices, which seemingly offer massive leverage.

The problem is of course that they forget to account for what would happen to the cost of production if gold and silver really were to rise that much. The end result is that the mining sector tends to be expensive, with superstitious expectations of leverage being priced in.

In short, many investors in the mining sector forget about valuation and invest on what looks attractive – the Kim Kardashian effect – instead of in what offers value. Ultimately the mining sector is a value destroyer – it consumes more investor money than it pays out in dividends. The fountainhead of this value destruction are investors who “invest” superstitiously and based on linear thinking.

With quite legitimate macro-views on current politics and economics (money printing by the Fed, oppressive regulations, increase in a culture of entitlements, etc.), a lot people start making specific, fine-tuned predictions (gold going to the moon, US dollar crashing, for example) about the future. They forget that the world is too complex, with too many movable parts to make such specific predictions.

When it comes to mining equities, it is best to use the current spot prices of the metals to perform valuation estimates. If you are bullish on a metal just buy that metal or a proxy for that metal – see the above charts for possible proxies.

As I always use spot prices for my valuation, low-grade projects (supposedly, but often not, offering leverage) are usually of no interest to me. Also, although I am very bullish on gold, in my view gold-equities have moved too far ahead of themselves, and have by now priced in a huge increase in gold price. This makes me very defensive toward the sector in my investment approach.

Charts by: World Bank, Scott Grannis, Stifel Nicolaus & Co, Science 2.0

Jayant Bhandari’s work can be followed at www.jayantbhandari.com