Overview: Financial strains eased yesterday, and short-term yields jumped. The two-year US yield jumped 25 bp to pierce 4%. Yet, the dollar fell against most of the major currencies yesterday and is mostly softer today. Banking stress is ebbing. The Topix bank index snapped a three-day decline and jumped nearly 2% today to recoup the lion's share of its three-day decline. The Stoxx 600 index of EMU banks is extending yesterday's 1,7% advance. The AT1 ETF up about...

Read More »Higher for Longer Helps the Dollar while Weighs on Equities

Overview: The jump in prices paid in yesterday's US ISM manufacturing coupled with the stronger eurozone inflation, with a new cyclical high reported in the core rate, underscores the market theme of higher-for-longer. This is seen as dollar supportive but also negative for risk-assets, including and especially equities. European benchmark 10-year yields are up another couple of basis points today and the 10-year US Treasury yield is pushing above 4% for the first...

Read More »Ueda Day

Overview: Rising rates and falling stocks provided the backdrop for the foreign exchange market this week. The dollar appreciated against all the G10 currencies but the Swedish krona, which is still correcting higher after the hawkish pivot by the central bank. The market looks for a later and higher peak in the Fed funds rate. This coupled with the risk-off sentiment helped the dollar extend its recovery after falling since last September-October. The yen's...

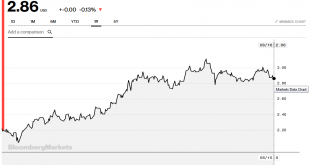

Read More »US Interest Rate Adjustment Post-Jobs is Over as the 2-Year Yield Backs Away from 4.50%

Overview: The capital markets have shrugged off the more than 1% loss of the Nasdaq and S&P 500 yesterday and have jumped back into risk assets. The stocks and bonds have been bought and the dollar sold. Chinese and Hong Kong shares gained more than 1% today. Japan was mixed and Taiwan and South Korean equites saw minor losses. Europe's Stoxx 600 is up over 1%. Nasdaq futures are up nearly 1.2% while the S&P 500 is lagging slightly. European bonds yields are...

Read More »Sharp Dollar Setback may offer Bulls a Bargain

Overview: The dollar is having one of the largest setbacks in recent weeks. We expected the dollar to soften ahead of next week’s CPI, which may fan ideas/hopes of a peak in US price pressures, but the magnitude and speed of the move is surprising, and likely speaks to the extreme positioning. Still, we caution that the intraday momentum indicators are stretched, and the underlying bullish sentiment, may see North American operators take advantage of the dollar’s...

Read More »FX Daily, March 16: Equities Firm, but Markets Tread Gingerly

Swiss Franc The Euro has fallen by 0.33% to 1.1024 EUR/CHF and USD/CHF, March 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Yesterday’s new record highs in the S&P 500 and Dow Jones Industrial helped set the tone for today’s advance in the Asia Pacific region and Europe. The MSCI Asia Pacific Index snapped a two-day decline, with other major markets rising today. The Dow Jones Stoxx 600 had edged to new...

Read More »FX Daily, April 2: Optimism on Oil Deal Steadies Risk Appetites…for the Moment

Swiss Franc The Euro has fallen by 0.34% to 1.0547 EUR/CHF and USD/CHF, April 2(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After US stocks dropped more than 4% yesterday, investor sentiment has improved, apparently sparked by ideas that the pain will force oil producers to find a way to reduce supply. Oil prices have surged, with the May WTI contract rallying around 7%. Asia Pacific equities were mostly...

Read More »Forex Forensics: The Case of the Yen

Over the past five sessions, the yen is the strongest of the major currencies, appreciating about 1.7% against the US dollar, eclipsing the Swedish krona, which rallied strongly today after the Riksbank’s surprise rate hike. Given the sell-off in equities and the decline in markets, the yen’s strength is not surprising. What was surprising though was the dollar’s resilience against the yen earlier this month as equities...

Read More »Capital Flocks to the US

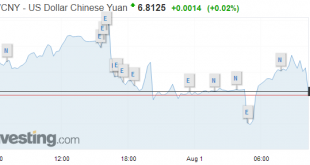

The US policy mix gets a privileged place in our understanding of what is the dollar. Tighter monetary policy and looser fiscal policy could be the closest thing to an elixir for currencies. It is the policy mix that the US is pursuing. The idea is that such a policy mixed draws capital inflows. This is exactly what is happening. The June TIC data was reported yesterday, and there was a net purchase of $114.5 bln of US...

Read More »Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China’s practices are a source of frustration and animosity broadly and widely. Chinese officials do not seem to understand why Europe, for example, does not...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org