On August 12, 1985, Japan Airways flight 123 left Tokyo’s Haneda Airport on its way to a scheduled arrival in Osaka. Twelve minutes into the flight, the aircraft, a Boeing 747, suffered catastrophic failure when an aft pressure bulkhead burst. The airplane had been improperly repaired from a tailstrike (the tail of the aircraft actually hitting the runway pavement) seven years earlier, and therefore wasn’t sufficiently...

Read More »Monthly Macro Monitor: Well Worried

Don’t waste your time worrying about things that are well worried. Well worried. One of the best turns of phrase I’ve ever heard in this business that has more than its fair share of adages and idioms. It is also one of the first – and best – lessons I learned from my original mentor in this business. The things you see in the headlines, the things everyone is already worried about, aren’t usually worth fretting...

Read More »The Real End of the Bond Market

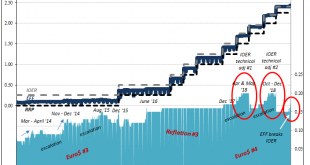

These things are actually quite related, though I understand how it might not appear to be that way at first. As noted earlier today, the Fed (yet again) proves it has no idea how global money markets work. They can’t even get federal funds right after two technical adjustments to IOER (the joke). But as esoteric as all that may be, recent corporate statements leave much less doubt at least as to the primary effect....

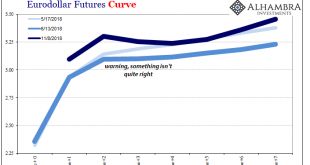

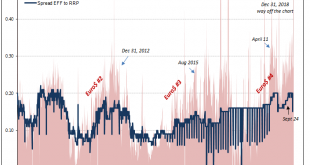

Read More »Chart(s) of the Week: Reviewing Curve Warnings

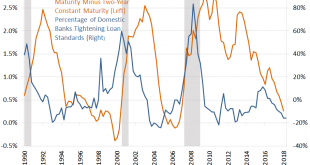

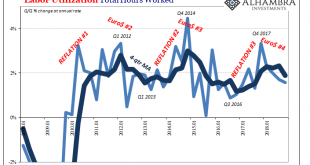

Quick review: stocks hit a bit of a rough patch right during the height of inflation hysteria. At the end of January 2018, just as the US unemployment rate had finally achieved the very center of attention, global markets were rocked by instability. Unexpectedly, of course. Over the next several weeks, share prices sagged and people blamed it on a number of things: Korean War, the unemployment rate itself (the economy...

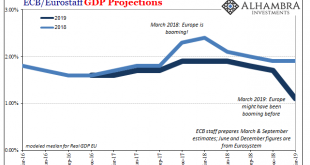

Read More »Not Buying The New Stimulus

What just happened in Europe? The short answer is T-LTRO. The ECB is getting back to being “accommodative” again. This isn’t what was supposed to be happening at this point in time. Quite the contrary, Europe’s central bank had been expecting to end all its programs and begin normalizing interest rates. The reaction to this new round was immediately negative: The euro and euro zone government bond yields fell sharply...

Read More »No Surprise, Hysteria Wasn’t a Sound Basis For Interpretation

What gets them into trouble is how they just can’t help themselves. Go back one year, to early 2018. Last February it was all-but-assured (in mainstream coverage) that the US economy was going to take off. The bond market, meaning UST’s, was about to be massacred because the overheating boom would force a double shot down its throat. Not only would safety instruments like UST’s have to contend with the unemployment...

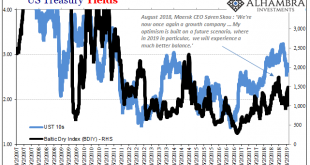

Read More »Sinking Shippers Signal Global Goods Troubles

It infects every boardroom across the world. Big business requires decent forecasting, yet time and again it seems they are deprived of what they desperately need. Instead, even after this last decade, the world’s largest companies continue to be surprised by weakness that is far more prevalent than strength. It has been the one constant. Central bankers declare their policies successful, ignoring mountains of...

Read More »FOMC Minutes: The New Narrative Takes Shape

Nothing the Fed did today, or has done up to today, has changed the curves. Eurodollar futures and UST’s, they are both still inverted. The former sharply inverted. The only thing that has changed since early January is the narrative – and not in a charitable way. It is treated as a positive when it is a pretty visible signal about deteriorating circumstances. Interpretations matter. Conventional wisdom seems settled...

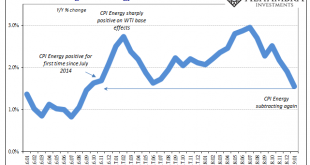

Read More »Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria. CPI Changes On Energy 2016-2019 - Click to enlarge Live by oil, now die by...

Read More »More Of What Was Behind December, And Not Just December

As more and more data rolls in even in this delayed fashion, the more what happened to end last year makes sense. The Census Bureau updated today its statistics for US trade in November 2018. Heading into the crucial month of December, these new figures suggest a big setback in the global economy that is almost certainly the reason markets became so chaotic. After all, money dealers don’t need this kind of statistical...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org