This economic cycle is one of the longest on record for the US, eight years and counting since the end of the last recession. It has also been, as almost everyone knows, a fairly weak expansion, one that has managed to disappoint both bull and bear. Growth has oscillated around a 2% rate for most of the expansion, falling at times perilously close to recession while at others rising tantalizingly close to escape...

Read More »Retail Sales Conundrum

Retail sales were thoroughly disappointing in June. Whereas other accounts such as imports or durable goods had at least delivered a split decision between adjusted and unadjusted versions, for retail sales both views of them were ugly. Seasonally-adjusted first, spending last month was down for the second straight time. Worse than that, estimated sales were just barely more than in January. The economy in 2017 is not...

Read More »Global Asset Allocation Update: Not Yet

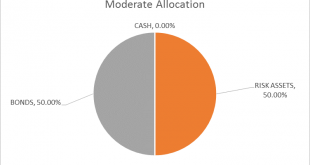

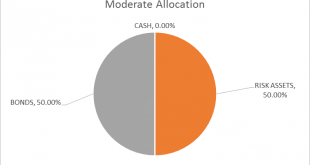

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. Growth and inflation expectations rose somewhat since last month’s update. The change is minor though and within the range of what we’ve seen in recent months. The most significant change from last month is the continued...

Read More »Bi-Weekly Economic Review: Attention Shoppers

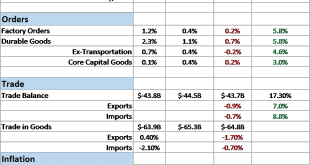

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market...

Read More »Der Bondmarkt vertraut Trump nicht mehr

Das Fed erhöht die Leitzinsen, doch die «Trump Reflation» bleibt aus. Bild: Carlos Barria (Keystone) Janet Yellen ist guten Mutes. Die Vorsitzende der amerikanischen Notenbank (Fed) und ihre Kollegen haben am Mittwoch den Leitzins abermals um 0,25 Prozentpunkte erhöht. Es war die vierte Zinserhöhung, seit das Fed im Dezember 2015 den Pfad der Nullzinsen verlassen hatte. Steigende Leitzinsen – konkret geht es dabei um die Federal Funds Rate, also den Zinssatz, zu dem sich Banken...

Read More »Der Bondmarkt vertraut Trump nicht mehr

Das Fed erhöht die Leitzinsen, doch die «Trump Reflation» bleibt aus. Bild: Carlos Barria (Keystone) Janet Yellen ist guten Mutes. Die Vorsitzende der amerikanischen Notenbank (Fed) und ihre Kollegen haben am Mittwoch den Leitzins abermals um 0,25 Prozentpunkte erhöht. Es war die vierte Zinserhöhung, seit das Fed im Dezember 2015 den Pfad der Nullzinsen verlassen hatte. Steigende Leitzinsen – konkret geht es dabei um die Federal Funds Rate, also den Zinssatz, zu dem sich Banken...

Read More »Bi-Weekly Economic Review: The Return of Economic Ennui

The economic reports released since the last of these updates was generally not all that bad but the reports considered more important were disappointing. And it should be noted that economic reports lately have generally been worse than expected which, if you believe the market to be fairly efficient, is what really matters. The disappointing employment report and the generally less than expected tone of the reports...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs. Based on the bond markets there has been little change in the growth and inflation outlook since the last asset allocation update. Based on...

Read More »Bi-Weekly Economic Review

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff. Politics has been front and center recently but...

Read More »Bi-Weekly Economic Review

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched. I said during that entire time that while the problems in the energy...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org