The media quickly picked up on Jay Powell’s comments this week from Chicago. Much less talked about was why he was in that particular city. The Federal Reserve has been conducting what it claims is an exhaustive review of its monetary policies. Officials have been very quick to say they aren’t unhappy with them, no, no, no, they’re unhappy with the pitiful state of the world in which they have to be applied. That’s not...

Read More »Janus Powell

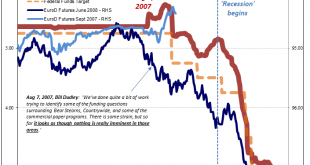

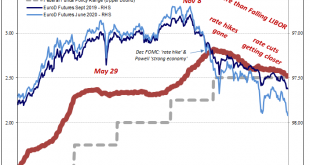

Again, who’s following who? As US Treasury yields drop and eurodollar futures prices rise, signaling expectations for lower money rates in the near future, Federal Reserve officials are catching up to them. It was these markets which first took further rate hikes off the table before there ever was a Fed “pause.” Now that the Fed is paused, it’s been these same markets increasingly projecting not just a rate cut or two...

Read More »What Kind Of Risks/Mess Are We Looking At?

The fact that the mainstream isn’t taking this all very seriously isn’t anything new. But how serious are things really? That’s pretty much the only question anyone should be asking. What are the curves telling us about what’s now just over the horizon? I hesitate to use 2008 comparisons too often because many people immediately jump to extrapolations, especially in these more esoteric market indications. If you say...

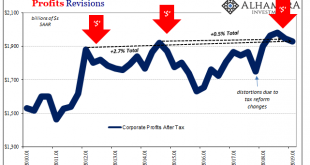

Read More »More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

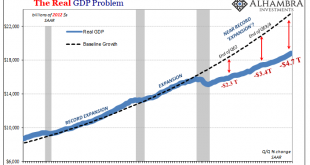

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message. Accompanying this first revision was the first set of estimates for corporate profits. For the second straight...

Read More »Europe Comes Apart, And That’s Before #4

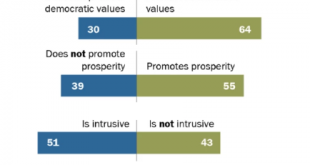

In May 2018, the European Parliament found that it was incredibly popular. Commissioning what it calls the Eurobarameter survey, the EU’s governing body said that two-thirds of Europeans inside the bloc believed that membership had benefited their own countries. It was the highest showing since 1983. Voters in May 2019 don’t appear to have agreed with last year’s survey. For the first time since 1979, Social Democrats...

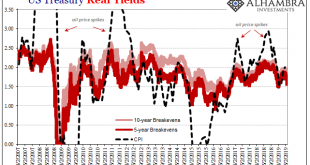

Read More »The Transitory Story, I Repeat, The Transitory Story

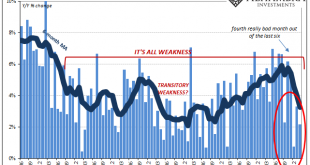

Understand what the word “transitory” truly means in this context. It is no different than Ben Bernanke saying, essentially, subprime is contained. To the Fed Chairman in early 2007, this one little corner of the mortgage market in an otherwise booming economy was a transitory blip that booming economy would easily withstand. Just eight days before Bernanke would testify confidently before Congress, the FOMC had met to...

Read More »Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture: This neglect of other aspects of the system has been made easier by another...

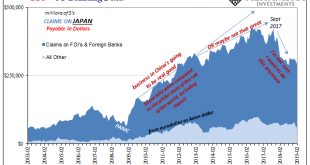

Read More »What Tokyo Eurodollar Redistribution Really Means For ‘Green Shoots’

Last April, monetary officials in Japan were publicly contemplating ending asset purchases under QQE. This April, they are more quietly wondering what other financial assets they might have to buy just to keep it all going a little longer. I’d suggest something like the clouds passing over the islands or the ocean water surrounding them. Nobody would notice either way and it would be equally as effective. Before the...

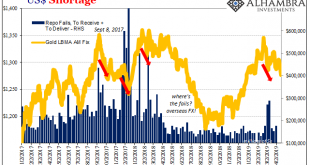

Read More »COT Blue: Distinct Lack of Green But A Lot That’s Gold

Gold, in my worldview, can be a “heads I win, tails you lose” proposition. If it goes up, that’s fear. Nothing good. If it goes down, that’s collateral. In many ways, worse. Either way, it is only bad, right? Not always. There are times when rising gold signals inflation, more properly reflation perceptions. Determining which is which is the real challenge. Corroboration and consistency are paramount. Gold had been...

Read More »Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks. There had been noises overseas, troubling indications that had gone on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org