ifo Schnelldienst 16/2018, August 23, 2018. PDF.

Read More »“Kosten und Nutzen eines Vollgeldsystems (Costs and Benefits of `Sovereign Money’),” ifoSD, 2018

ifo Schnelldienst 16/2018, August 23, 2018. PDF.

Read More »Kontantupproret

Kontantupproret (“cash rebellion”) in Sweden—not everybody is pleased with the prospect of a cashless society. David Crouch reports in The Guardian.

Read More »“Kunden sollten zwischen Sichtguthaben und elektronischem Notenbankgeld wählen können (Let People Choose Between Deposits and Reserves),” NZZ, 2017

NZZ, August 17, 2017. HTML, PDF. The Vollgeld initiative may point to a problem but it does not propose a viable solution. Even with Vollgeld, the time consistency friction with its Too-Big-To-Fail implication would persist. A more flexible, liberal approach appears more promising. It would give the general public a choice between holding deposits and reserves. Financial institutions and central banks around the world are pushing in that direction.

Read More »Digital Swiss Francs

The Swiss National Bank held its annual general meeting of shareholders (web TV). In response to one of the questions posed by shareholders Thomas Jordan suggested (2:58–2:59) that possibly a digital Swiss Franc might be introduced sometime in the future.

Read More »Money, Banking, and Dreams

In another excellent post on Moneyness, J P Koning likens the monetary system to the plot in the movie Inception, featuring a dream piled on a dream piled on a dream piled on a dream. Koning explains that [l]ike Inception, our monetary system is a layer upon a layer upon a layer. Anyone who withdraws cash at an ATM is ‘kicking’ back into the underlying central bank layer from the banking layer; depositing cash is like sedating oneself back into the overlying banking layer. Monetary...

Read More »“Elektronisches Notenbankgeld ja, Vollgeld nein (Reserves for All, But no Sovereign Money),” NZZ, 2016

Neue Zürcher Zeitung, June 16, 2016. PDF, HTML. Ökonomenstimme, June 17, 2016. HTML. Vollgeld seems attractive because it decouples the supply of money from intermediation. By enabling everyone to use legal tender for electronic payments, electronic base money would satisfy a need. Vollgeld would prevent bank runs, at least partly; render deposit insurance unnecessary and reduce moral hazard; could help stabilize the credit cycle; and would redistribute seignorage to the central bank. But...

Read More »The 2015 Update: Risks on the Rising SNB Money Supply

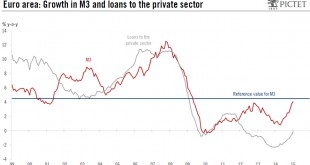

Since the financial crisis central banks in developed nations increased their balance sheets. The leading one was the American Federal Reserve that increased the monetary base (M0, often called “narrow money”), followed by the Bank of Japan and recently the ECB. In most cases the extension of narrow money did neither have an effect on banks’ money supply, the so called “broad money” (M1-M3), nor on price inflation. For the Swiss, however, the rising money supply concerned both narrow and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org