In the FT, Mehreen Khan reports about the resurgence of deposit flight.

Read More »Video: The Swiss National Bank Is Acting Like A Hedge Fund

By EconMatters In this Video, we discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy? Central Banks have really...

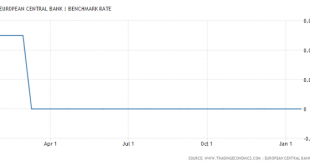

Read More »Interest Rate Differentials Increasing Financial Market Leverage To Unsustainable Levels

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

Read More »Vollgeld, the Blockchain, and the Future of the Monetary System

Presentation at the Liechtenstein Institute about the Vollgeld initiative, the blockchain revolution, and their possible effects on banks and the monetary system. Report in Liechtensteiner Vaterland, February 1, 2017. HTML. Interview in Wirtschaft Regional, February 4, 2017. PDF.

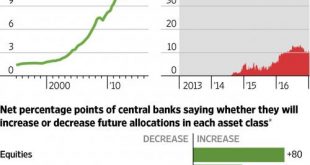

Read More »80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded “fake news” by the established financial “kommentariat.” What a difference eight years makes, because today none...

Read More »These Are The 3 Main Issues For Europe In 2017

Submitted by George Friedman and Jacob Shapiro via MauldinEconomics.com, What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake....

Read More »The Bank of England and its Contemporaries

In the Journal of Economic Literature, William Roberds reviews Christine Desan’s “Making Money: Coin, Currency, and the Coming of Capitalism” and he provides his own perspective on European monetary history. … the transition of the Bank of England’s notes from the status of experimental debt securities (in 1694) to “as good as gold” (1833) required more than a century of legal accommodation and business comfort with their use. Desan emphasizes England’s traditions of nominalism (as...

Read More »Tax Evasion in a (the) New World

In the FT, Vanessa Houlder reports about the tax evasion business. The new regulatory environment has led to portfolio adjustments and new types of behavior, and it exposes vast differences in enforcement across countries: Diamonds in vaults rather than financial assets. Trusts in South Dakota rather than anonymous bank accounts. Moving to a different country rather than just shifting assets. FATCA versus the Common Reporting Standard. The article also links to an article by Kara Scannell...

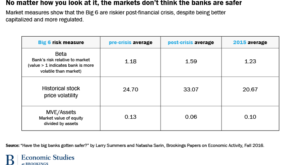

Read More »Have Banks Become Less Risky?

In BPEA, Natasha Sarin and Larry Summers argue that bank stock has not: … we find that financial market information provides little support for the view that major institutions are significantly safer than they were before the crisis and some support for the notion that risks have actually increased. … … financial markets may have underestimated risk prior to the crisis … Yet we believe that the main reason for our findings is that regulatory measures that have increased safety have been...

Read More »How Does the Blockchain Transform Central Banking?

The blockchain technology opens up new possibilities for financial market participants. It allows to get rid of middle men and thus, to save cost, speed up clearing and settlement (possibly lowering capital requirements), protect privacy, avoid operational risks and improve the bargaining position of customers. Internet based technologies have rendered it cheap to collect information and to network. This lies at the foundation of business models in the “sharing economy.” It also lets...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org