In the NZZ, Axel Lehmann offers his views on the prospects of blockchain technologies in banking. Lehmann is Group Chief Operating Officer of UBS Group AG. New possibilities: Higher efficiency; lower cost; more robustness and simpler processes; real-time clearing; no need for intermediaries; information exchange without risk of interference automated “smart contracts;” automated wealth management; more control over transactions; better data protection; improved possibilities for macro...

Read More »Private Sector Rescue for Italian Bank

In the FT, Rachel Sanderson and Martin Arnold report that the board of Monte dei Paschi is about to approve a recapitalization led by JPMorgan in order to avoid the alternative, a bailin according to European rules. Other news sources reported that the European Commission had made it clear that it rejected the proposal by Italy’s prime minister (supported by the ECB president) to change the rules and let the Italian government finance the recapitalization. EU finance ministers and Angela...

Read More »Inside Paradeplatz

On his blog, Lukas Hässig suggests that a leading Swiss banker might have exploited insider information. The comments to the post are even more revealing than the article.

Read More »Bank of England Opens Access to Payment System

A progress update by the Bank of England describes the Bank’s intention, over time, to extend direct access to RTGS to non-bank Payment Service Providers (firms granted the status of E-Money Institutions or Payment Institutions in the UK), collectively known as PSPs. By extending RTGS access, our objective is to increase competition and innovation in the market for payment services.

Read More »Covered Interest Parity and the Risk-Taking Channel

In a speech, Hyun Song Shin points out that CIP increasingly fails to hold: the Dollar interest rate implied by FX swaps vis-a-vis the Euro, Yen, Pound or Swiss Franc is “too high.” Moreover, the deviation is negatively correlated with the Dollar’s spot exchange rate: When the Dollar appreciates, the deviation from CIP widens. Shin argues that bank behavior explains the deviation: … the US dollar is used widely throughout the global banking system, even when neither the lender nor the...

Read More »Sovereign Debt in Bank Balance Sheets

In the FT, Martin Arnold reports about estimates by Fitch according to which European banks would have to raise up to €170bn of extra capital or sell almost €500bn of sovereign debt if regulators push ahead with plans to break the “doom loop” tying lenders to their governments … The European Commission and the European Central Bank support steps in that direction while some European governments oppose them.

Read More »Deposit Insurance: Economics and Politics

On VoxEU, Charles Calomiris and Matthew Jaremski discuss the origins of bank liability insurance. They argue that it is redistribution, not the aim to boost efficiency, which explains a lot of the action. … there are two theoretical approaches to explaining the creation and expansion of deposit insurance. The first is an economic approach grounded in potential efficiency gains from limiting bank runs (i.e. the public interest motivation). The second is a political approach grounded in the...

Read More »Commitment Against Alchemy?

In the FT, Martin Wolf discusses Mervyn King’s proposal to make the central bank a “pawnbroker for all seasons” as laid out in King’s recent book “The End of Alchemy.” Lord King offers a novel alternative. Central banks would still act as lenders of last resort. But they would no longer be forced to lend against virtually any asset, since that very possibility must create moral hazard. Instead, they would agree the terms on which they would lend against assets in a crisis, including...

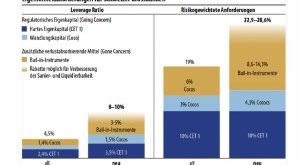

Read More »Capital Requirements for Large Swiss Banks

They have been increased. The illustration is taken from Finanz und Wirtschaft. Report by Hansueli Schöchli in the NZZ.

Read More »Banks Without Debt

In his blog, John Cochrane points to SoFi, a FinTech company, as proof that banking services can be delivered by institutions without the traditional characteristics of a bank. SoFi finances loans by selling equity. The loans are securitized and the cash is reinvested in loans. As John points out: A “bank” (in the economic, not legal sense) can finance loans, raising money essentially all from equity and no conventional debt. And it can offer competitive borrowing rates — the supposedly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org