Here’s a piece of news that the remaining human members of Wall Street’s FX sales and trading desks probably don’t want to hear. According to the Financial Times, six of the world’s largest banks have decided to join a blockchain project called “utility coin” that will allow banks to settle trades in securities denominated in different currencies without a money transfer. What’s worse, the banks expect to begin...

Read More »Negative Rates: The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other...

Read More »The New Gold Rush… For Gold Vaults

Negative interest rates and the populist uprising that spurred the UK to vote for Brexit and Americans to elect Trump has helped reignite a rush into physical safe haven assets like gold and silver, which however has led to a shortage of safe venues where to store the precious metals (unlike bitcoin, gold actually has a physical dimension). And now companies that operate storage facilities for precious metals and other valuables are ramping up their capacity to help cash in on the soaring...

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

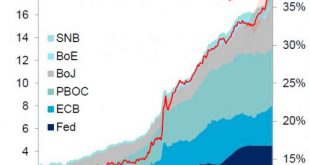

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we’ll present the data and evidence that they’ve not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we’re talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that...

Read More »Money and Credit in Germany

In its April 2017 Quarterly Report, the Deutsche Bundesbank discusses the role of banks in the creation of money. Findings from a wavelet analysis indicate that in Germany, money and credit move in parallel in the long run. In an appendix, the report mentions possible welfare costs of curbing maturity transformation, with reference to Diamond and Dybvig’s work. This is not convincing. Unlike in the typical (microeconomic) banking model, aggregate central bank provided money need not be...

Read More »Macroeconomic Effects of Bank Solvency vs. Liquidity

In a CEPR discussion paper, Òscar Jordà, Björn Richter, Moritz Schularick, and Alan M. Taylor suggest that higher bank capital ratios help stabilize the financial system ex post but not ex ante, and that illiquidity breeds fragility. Abstract of their paper: Higher capital ratios are unlikely to prevent a financial crisis. This is empirically true both for the entire history of advanced economies between 1870 and 2013 and for the post-WW2 period, and holds both within and between...

Read More »`Brussels’ to Disrupt European Banking

The Economist reports that forthcoming European payments regulation has the potential to disrupt the industry. Provided the customer has given explicit consent, banks will be forced to share customer-account information with licensed financial-services providers. … payment services … could become more integrated into the internet-browsing experience … With access to account data … fintech firms could offer customers budgeting advice, or guide them towards higher-interest savings accounts...

Read More »Switzerland’s WIR-Bank

In the Berner Zeitung, Mischa Aebi reports that many firms have closed their accounts at WIR-bank. The bank had imposed new requirements stipulating that account holders must accept at least 3% of their sales to be paid in WIR money.

Read More »On the Performance of Swiss Portfolio Managers

In the NZZ, Michael Schaefer reports on a study about the performance of Swiss portfolio managers in 2016. The median portfolio returns in all investment strategies except those not investing in stocks fell short of the corresponding benchmark returns. Only a fifth of the portfolios generated returns in excess of their benchmark. These numbers do not yet account for management fees. No portfolio manager generated high returns across all strategies. But some managers consistently generate...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org