Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this is now standard operating procedure. For example, in Japan this explicit intervention into the...

Read More »FX Daily, July 14: Will BOE Ease on May Day?

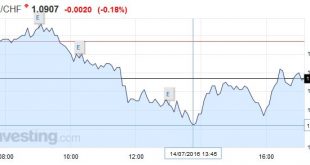

Swiss Franc The euro-Swiss is moving back to reality, after the risk-on run in the beginning of the week. The continued yen weakening is slightly negative for the franc given that some algorithms correlate the two safe-haven currencies. Click to enlarge. United Kingdom After a nearly three weeks of turmoil following the UK referendum, there is now a sense of order returning to UK politics. Two elements of the new...

Read More »“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that – as we predicted last week – Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

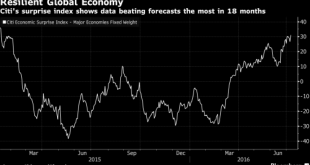

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More »Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces “Krugman Era” economics and deeper into the new “Bernanke Era” economics of helicopter money. As a result Japan’s citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives. The gold price is up double digits in the past month and as we said last night, something big is coming as Japan...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »Three unintended consequences of NIRP

Submitted by Patrick Watson via MauldinEconomics.com, Central bankers use low or negative interest rates so that it leads to more investment. For them interest rates are a consequence of the currently very low inflation rates. Patrick Watson argues in the exactly opposite way: Falling prices are a consequence of low interest rates and not the opposite: We see two reasons why this can be true: High, maybe excessive investment is happening in China (alas not in Europe). Cheap costs of...

Read More »The Japanese Popsicle Affair

Shinzo Abe and Haruhiko Kuroda, professional yen assassins Photo credit: Toru Hanai / Reuters Policy-Induced Contrition in Japan As we keep saying, there really is no point in trying to make people richer by making them poorer – which is what Shinzo Abe and Haruhiko Kuroda have been trying to do for the past several years. Not surprisingly, they have so to speak only succeeded in achieving the second part of the equation: they have certainly managed to impoverish their fellow Japanese...

Read More »FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

The US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable that it begins recovering first. Its recent resilience was noted, but that has evaporated today, but a 0.8% drop by early European activity. We had noted the divergence between what...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org