Summary: Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe. August has begun off with clear price action. The US dollar is stronger against nearly all the major currencies. Bond yields are higher. Equities and...

Read More »Blades Whirring Over Japan?

Japanese central bankers are not in an enviable position. The year-over-year growth rate of the country’s core consumer price index was -0.4 percent in May, marking the third consecutive monthly decline—and this after three years of Abenomics. Brexit certainly hasn’t helped. The yen has strengthened from ¥121 to the dollar in February 2016 to ¥105 in late July. That’s had the effect of reducing import prices, but it has also put downward pressure on inflation. Japan economists on...

Read More »BOJ fails to meet expectations on easing

Macroview Further action may come once the BOJ has fully reviewed the effectiveness of existing policies, but for now the focus is turning to the latest fiscal package On 29 July, the Bank of Japan (BOJ) announced that it would keep the current pace of monetary base expansion unchanged at JPY80 trillion per year and left the policy interest rate unchanged at -0.1%.Although the central bank did announce a doubling of its purchases of exchange-traded funds (ETFs) and an expansion of its...

Read More »FX Daily, July 29: Kuroda Hesitates, Yen Advances, Focus Turns to Europe and North America

Prospects for the Swiss Economy Remain Favourable The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the...

Read More »Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Summary: Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP. Tomorrow could be among the most challenging sessions of the third quarter. The focus is primarily on Japan and Europe, but the US reports its first estimate of Q2 GDP. After a six-month soft...

Read More »Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today’s uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of “helicopter money” is about to be unveiled in Japan by the world’s most experimental central bank. However, as Nomura’s Richard Koo warns, central banks may get much more than they bargained for, because helicopter money “probably marks the end of the road for believers in the omnipotence of monetary policy who have...

Read More »FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

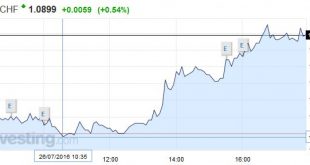

Swiss Franc The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical. USD/CHF Finally over 200DMA? After USD/CHF broke the 200 days moving average (0.9854), and a descending channel since November 2015. This break could lead to a new pattern building. If the SNB has sustained the rise with some...

Read More »FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

Summary: FOMC statement will not likely close door on September hike, though economists are more inclined for a December move. There is great uncertainty surrounding the BOJ’s outlook. We suspect odds favor tweaking assets being purchased rather than cutting rates further or dramatically increasing JPY80 trillion balance sheet expansion. European bank stress test results due at the end of the week. Contrary to...

Read More »The Central Planning Virus Mutates

Chopper Pilot Descends on Nippon Readers are probably aware of recent events in Japan, the global laboratory for interventionist experiments. The theories of assorted fiscal and monetary cranks have been implemented in spades for more than a quarter of a century in the country, to appropriately catastrophic effect. Amid stubbornly stagnating economic output, Japan has amassed a debt pile so vast since the bursting of...

Read More »The Day They Killed the Dollar

Hell With Air-Conditioning LAS VEGAS – It was 113 degrees outside when we rolled through Baker, California, a few days ago. We drove along in comfort, but our sympathies turned to the poor pilgrims who made their way to California in covered wagons. How they must have suffered! Our suffering didn’t begin until we checked into the Planet Hollywood Hotel in Las Vegas. What a horrible place. You stand in line for half...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org