Asset Price Levitation One of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this is now standard operating procedure. For example, in Japan this explicit intervention into the stock market is being performed with the composed tedium of a dairy farmer milking his cows. The activity is more art than science. Similarly, if you stop – even for a day – pain swells in certain sensitive areas. The “Tokyo Whale” Haruhiko Kuroda explains his asset purchase madness with a few neat little slides. Photo credit: Stringer / Xinhua Press / Corbis In late April, a Bloomberg study found that the Bank of Japan (BOJ), through its purchases of ETFs, had become a top 10 shareholder in about 90 percent of companies that comprise the Nikkei 225. At the time, based on “estimates gleaned from publicly available central bank records, regulatory filings by companies and ETF managers, and statistics from the Investment Trusts Association of Japan,” Bloomberg assumed the BOJ was buying about 3 trillion yen (.2 billion) of ETFs every year.

Topics:

MN Gordon considers the following as important: Bank of Japan, Central Banks, Debt and the Fallacies of Paper Money, Featured, Haruhiko Kuroda, newslettersent, significantly overvalued, The Stock Market, wealth effect

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Asset Price LevitationOne of the more preposterous deeds of modern central banking involves creating digital monetary credits from nothing and then using the faux money to purchase stocks. If you’re unfamiliar with this erudite form of monetary policy this may sound rather fantastical. But, in certain economies, this is now standard operating procedure. For example, in Japan this explicit intervention into the stock market is being performed with the composed tedium of a dairy farmer milking his cows. The activity is more art than science. Similarly, if you stop – even for a day – pain swells in certain sensitive areas. |

|

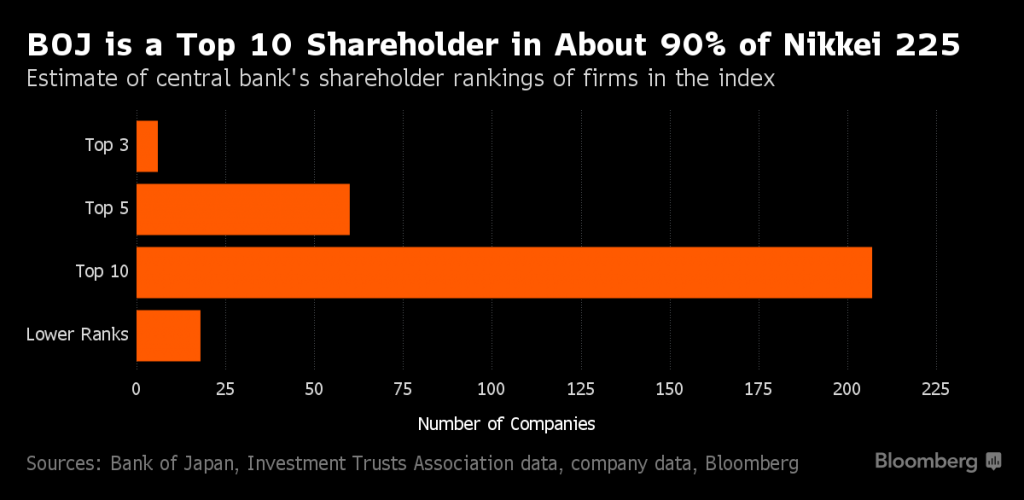

| In late April, a Bloomberg study found that the Bank of Japan (BOJ), through its purchases of ETFs, had become a top 10 shareholder in about 90 percent of companies that comprise the Nikkei 225.

At the time, based on “estimates gleaned from publicly available central bank records, regulatory filings by companies and ETF managers, and statistics from the Investment Trusts Association of Japan,” Bloomberg assumed the BOJ was buying about 3 trillion yen ($27.2 billion) of ETFs every year. The rate of buying has likely accelerated since then. |

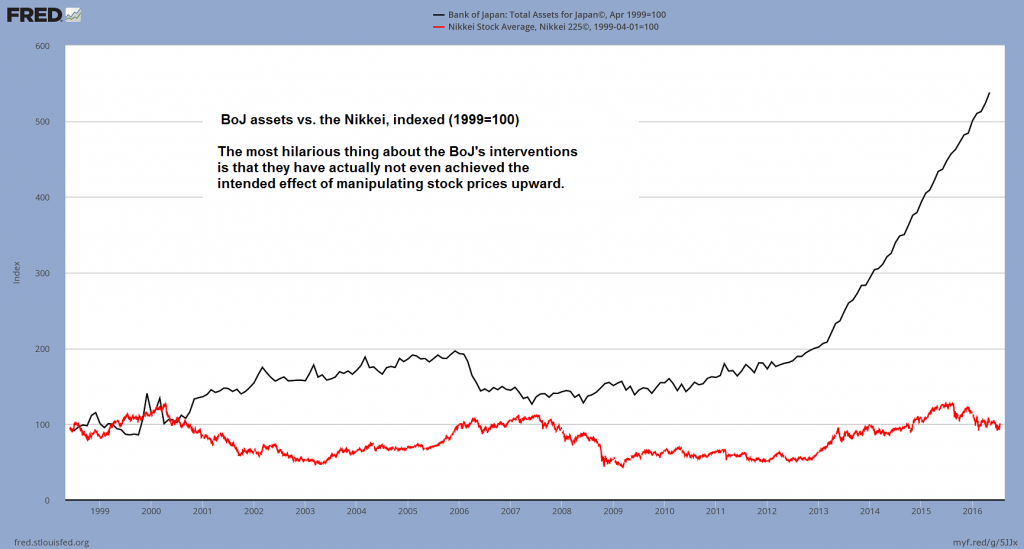

If the BoJ continues down this road, a problem akin to the socialist calculation problem is bound the emerge – this is to say, it will emerge on an even broader scale. As we have previously discussed in these pages, central banking is as such already a special case of the socialist calculation problem as it pertains to the financial sector (see “Central Banks and the Socialist Calculation Problem” for the details) – click to enlarge. |

| In fact, this week ZeroHedge reported, via Matt King of Citibank, that net global central bank asset purchases had surged to their highest since 2013. This seems to explain why, even with investors pulling money out of equity funds for 17 consecutive weeks, and at a pace that suggests a full flight to safety, stock markets are trading at all-time highs.

In short, central banks are pumping “liquidity” into stock markets faster than investors are pulling their money out. The main culprits, at the moment, are the BOJ and the European Central Bank (ECB). Similar efforts may soon come from a central banker near you. |

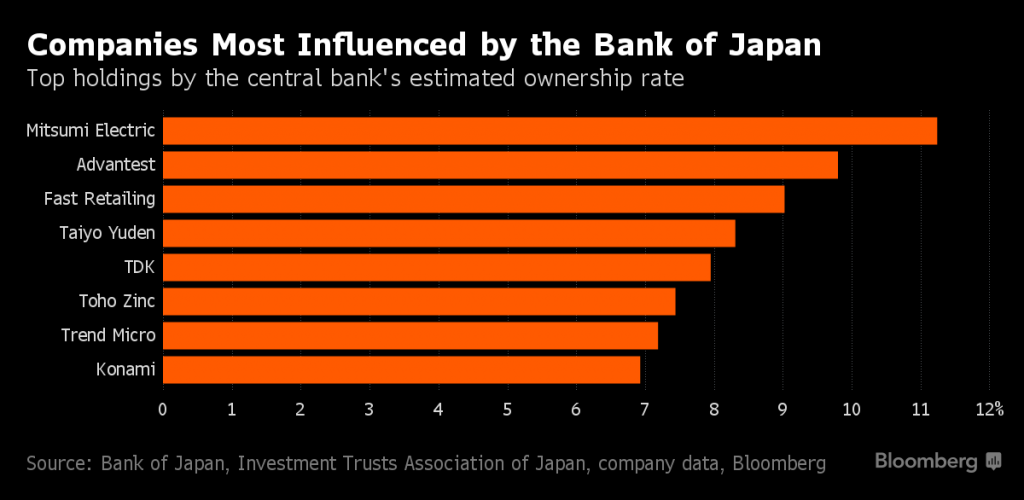

While the BoJ is a “passive” investor at present, its purchases of stocks still represent a creeping nationalization of Japan’s industries. This seems highly unlikely to end well – since the BoJ will not dare to divest itself from these holdings out of fear that it might crash the stock market – click to enlarge. |

Wealth Effect ReduxOther than attempting to, somehow, boost the economy by levitating the stock market, the objective of this explicit central banking intervention is unclear. The popular theory seems to be that the “wealth effect” of inflated asset prices stimulates demand in the economy. The premise, as we understand it, is supposed to play out along the following narrative… or a derivative thereof. As stock portfolios bubble out investors feel better about their lot in life. Some of them even buy flat screen televisions. Others buy wearable fitness trackers and matching gym shorts. Before you know it, gross domestic product goes up – along with wages – and unemployment goes down. An economic boom ensues. If you don’t buy it, there are even ridiculous abstractions – like liquidity trap graphs – that provide academic cover for central banks to pump “liquidity” into ETFs. According to these graphs, pumping into government debt no longer provides the stimulus they’re after. They reason that inflating stocks, and the theory of the wealth effect, may do the trick. Naturally, we have some reservations. Namely, what are the side effects? What are the unintended consequences? What happens to a market of stocks when central banks become the largest shareholders. Shingo Ide, chief equity strategist at NLI Research Institute in Tokyo, hints at an answer: “For those who want shares to go up at any cost, it’s absolutely fantastic that the BOJ [or any central bank] is buying so much. But this is clearly distorting the sanity of the stock market.” |

The most striking thing about the BoJ’s stock market interventions is that they have failed to do the trick – net-net, the Nikkei is going sideways since 2013. So there is actually not even a detectable “wealth effect”. We have no idea why they are doing it at all – even from the perspective of the interventionists it doesn’t seem to make any sense – click to enlarge. |

Destination MarsMoreover, BOJ and ECB asset purchases are not just distorting their respective stock markets. Remember, markets are connected these days more than ever. Central bank liquidity pumping into one market can show up in another. At the moment, dollar based U.S. blue chip stocks – especially those that pay a dividend – are the hot product. This week the S&P 500 hit a new all-time high. Every inkling inside of us, from our gut to our brain to our big toe, says stocks should have already crashed. They are overvalued to the extreme by various valuation measurements. The Shiller price-to-earnings ratio of the S&P 500 Index was 26.92 at last Thursday’s market close. That’s well above its 16.68 long term average. Likewise, the Buffett indicator – market capitalization to gross national product – ended the day at 122.9 percent. This is considered “significantly overvalued.” It certainly looks a crash in waiting. But is it imminent? Over the last decade we’ve consistently under-appreciated the ultimate extreme limits of the effects of radical central banking policies. Whether it was residential property prices in the mid-2000ds or present day government debt yields, we continue to be shocked and dismayed by how far prices can drift out of orbit from the economy. At the moment, this goes for the U.S. stock market too. |

The Shiller P/E ratio (or “CAPE”, or “P/E 10”) from 1870 to June 2016 – in the meantime it is even higher. Historically the stock market was only more overvalued at the peaks of 1929 and 2000 (and during the final run-up to those peaks) – neither of which was a particularly good time to buy stocks – click to enlarge. |

Destination Mars?

In this respect, we must recognize and attempt to fully appreciate that global central banks are on a collective suicide mission. They think that printing money and buying stocks will save us from ourselves. In practice, this means that before stocks melt down we could be treated to the grand spectacle of an epic melt-up – a historical monument to the insanity of central bankers.

We don’t like it. What’s more, the overall destruction to the economy and personal living standards will be grave. But we cannot deny the reality of the parallel universe we find ourselves in. All reservations must be suspended. Stocks may not only shoot to the moon. They may keep on going to Mars – and Hades – before this is over.

Charts by Bloomberg, St. Louis Fed, Doug Short/Advisorperspectives

Chart and image captions by PT

M N. Gordon is the editor and publisher of the Economic Prism.