Sterling reached a new 11-month high against the dollar earlier today, but the dovish take away from the Bank of England has seen sterling reverse lower. It has now fallen below the previous day’s low, and a close below there (~$1.3190) would confirm the bearish key reversal pattern. Support near the week’s low just below $1.3100 is holding, and if that goes, the $1.30 level can be tested. A break of $1.2930, the low...

Read More »Cool Video: Dollar Drivers on Bloomberg

I had the privilege to be at Bloomberg today and discussed with Vonnie Quin and Mark Barton. A clip to the Cool Video can be found here. There were three talking points. First was the observation that while the President took credit for the record stock market, the strength of the economy, the low unemployment rate, and business confidence, there was no mention of the dollar, which poised to close lower for its seventh...

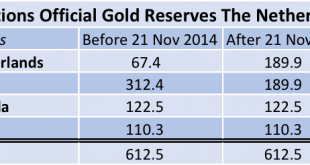

Read More »Did The Dutch Central Bank Lie About Its Gold Bar List?

Head of the Financial Markets Division of the Dutch central bank, Aerdt Houben, stated in an interview for newspaper Het Financieele Dagblad published in October 2016 that releasing a bar list of the Dutch official gold reserves “would cost hundreds of thousands of euros”. In this post we’ll expose this is virtually impossible – the costs to publish the bar list should be close to zero – and speculate about the far...

Read More »Property Market In Dublin Is Inflated and May Burst Again

Commercial Property Market Is Inflated and May Burst Again by David McWilliams Dublin property investors had better hope that Brexit happens soon. They should also hope that it’s not just a ‘hard’ Brexit, but a granite Brexit — a Brexit that’s as hard as possible. They should be betting on the buffoonery of Boris Johnson, down on both knees praying for a massive barney between Davis and Barnier. A granite Brexit might prompt the migration of hundreds of corporate refugees from isolated...

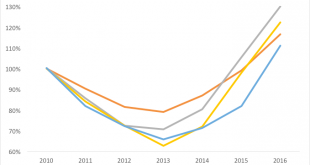

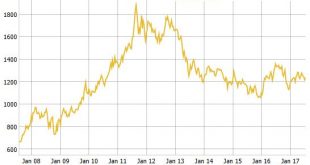

Read More »Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing

Gold Hedges Against Currency Devaluation and Cost Of Fuel, Food, Beer and Housing - Gold hedge against currency devaluation - cost of fuel, food, housing- True inflation figures reflect impact on household spending- Household items climbed by average 964%- Pint of beer sees biggest increase in basket of goods - rise of 2464%- Bread rises 836%, butter by 1023% and fuel (diesel) up by 1375%- Gold rises 2672% and hold's its value over 40 years- Savings eaten away by money creation and...

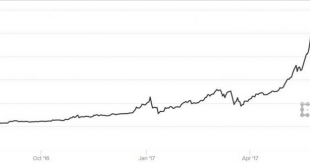

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

– Bitcoin volatility shows not currency or safe haven but speculation – Volatility still very high in bitcoin and crypto currencies (see charts) – Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900 – Bitcoin least volatile of cryptos, around 75% annualised volatility – Gold much more stable at just 10% annualised volatility – Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More »RTGS Open To Non-Bank Payment Service Providers

The Bank of England has announced plans to open its central-bank-money settlement system (RTGS) to non-bank payment service providers. This, it hopes, will promote competition, innovation, and financial stability by creating more diverse payment arrangements.

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term - Bitcoin volatility shows not currency or safe haven but speculation- Volatility still very high in bitcoin and crypto currencies (see charts)- Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900- Bitcoin least volatile of cryptos, around 75% annualised volatility- Gold much more stable at just 10% annualised volatility- Bitcoin volatility against USD about 5-7 times vol of traditional...

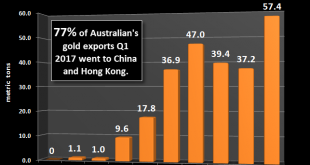

Read More »“Time To Position In Gold Is Right Now” – Rickards

“Time To Position In Gold Is Right Now” – Rickards - "Time to position in gold is right now” - James Rickards- Fed has hit the ‘pause’ button; No more rate hikes for foreseeable future- Fed’s theories "bear no relation to reality" and has "blundered by raising rates"- Growth is weak, inflation is weak, retail sales and real incomes are weak- Tight money, weak economy & stock bubble classic recipe for market crash- Reduce allocations to stocks and reallocate to...

Read More »Sterling, McCafferty, and BOE Policy

Summary: BOE hawk is arguing for a sooner unwind of QE. He did not favor the renewed asset purchases after the referendum. Sterling has been meeting resistance near $1.30 for past two months. Sterling’s advance today is being attributed to comments by a member of the Bank of England’s Monetary Policy Committee McCafferty. However, we suspect it was a news item that was used to justify the price gains that was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org