In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

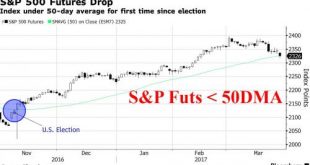

Read More »Global Stocks Slide, S&P Futures Tumble Below 50DMA As “Trump Trade” Collapses

Global stocks are lower across the board to start the week, as concerns about Trump's administration to pull off a material tax reform plan finally emerge, pressuring S&P futures some 20 points lower this morning, following European and Asian shares lower, while crude oil prices fall unable to find support in this weekend's OPEC meeting in Kuwait where a committee recommended to extend oil production cuts by another 6 months. Safe havens including the yen and bonds climbed as did gold,...

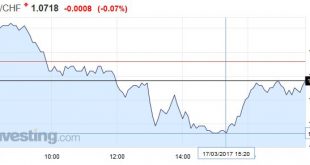

Read More »FX Daily, March 17: Dollar Remains Heavy

Swiss Franc EUR/CHF - Euro Swiss Franc, March 17(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF Article 50 – Invocation Imminent With the House of Commons voting against amendments to the brexit bill, it was passed to the Queen for approval which was really a formality, more a mark of respect to a bygone age. Article 50 is now ready to be invoked at anytime. It is anticipated to be next week. I am of...

Read More »Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

Gold Investing 101 - Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II) Investors looking to gold again but gold buyers need to exert caution Royal Mint - a royally expensive way to help the government Unallocated gold - unsecured creditor of a bank? If you cannot hold it, you do not own it Own gold bullion coins as insurance, to reduce counter party risk and to preserve wealth Conclusion - Reduce counter parties, Don’t over complicate Yesterday we...

Read More »Germany’s Gold remains a Mystery as Mainstream Media cheer leads

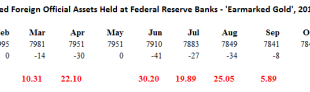

On 9 February 2017, the Deutsche Bundesbank issued an update on its extremely long-drawn-out gold repatriation program, an update in which it claimed to have transferred 111 tonnes of gold from the Federal Reserve Bank of New York to Germany during 2016, while also transferring an additional 105 tonnes of gold from the Banque de France in Paris to Germany during the same time-period. Following these assumed gold bar...

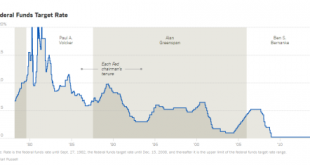

Read More »Are Rate Hikes Bad For Gold?

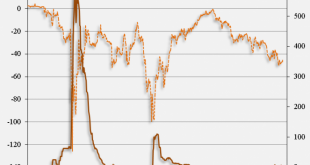

Here are two different looks at Fed rate hikes since Volcker. The charts are the same, but one presentation is a lot funnier than the other. Federal Funds Target RateThe above image from the New York Times article A History of Fed Leaders and Interest Rates. - Click to enlarge Here’s an alternative view courtesy of @HedgeEye. - Click to enlarge Let’s take the fist chart and see what correlations exist between...

Read More »What Will Trump Do About The Central-Bank Cartel?

Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

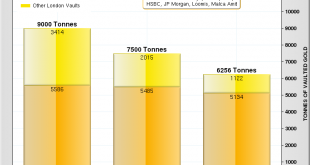

Read More »Gold Bullion Banks To “Open Vaults” In Transparency Push

London Gold Bullion Banks To “Open Vaults” In Transparency Push London’s gold bullion market, which is centuries old, is said to be seeking transparency with plans to reveal how much gold bullion is held in vaults in and around London city according to gold bullion banks. These include gold bullion bars held and controlled by the Bank of England, as reported by Henry Sanderson in the Financial Times. The move is being...

Read More »Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states? A sovereign state is...

Read More »FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Summary: Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China’s PMI are among the data highlights. Three major central banks meet in the week ahead, and there are several important reports due out that will give investors more insight into how the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org