[unable to retrieve full-text content]Laws of politics have been turned upside down. The Intellectuals Yet Idiots can make no sense of it. The underdog who ‘tell it how it is’ appeal to people while established reasoning does not.

Read More »The FOMC Butterfly that Will Ruin the World

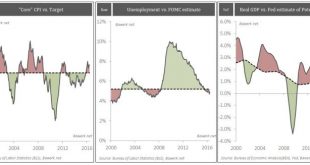

Imagine the financial crisis knocked you out and you did not wake up from the coma that followed until this day. Then, presented with the following three charts you were asked to guess where the federal funds rate was trading. Given the fact that the core CPI is on a steep uptrend and currently over the arbitrarily set 2 per cent target; unemployment below what the FOMC regards as full employment and; GDP running at a...

Read More »Household Savings Rate Compared

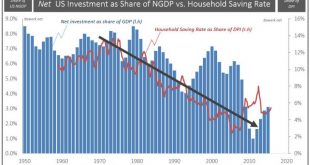

We critized GDP growth that in many Western economies (e.g. Greece) has become mostly an indicator of consumption and activity. We emphasized that GDP growth in the form of consumption-driven (hyper-) activity (aka Bawerk’s “GDC” Gross Domestic Consumption) must finally lead to a depreciating currency, inflation, falling government bond prices and wealth in real terms. Instead, GDP should be driven by investment and...

Read More »Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience we believe it says something...

Read More »Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »Dumbest monetary experimental end game in history (including Havenstein and Gono’s)

We have seen several explanations for the financial crisis and its lingering effects depressing our global economy in its aftermath. Some are plain stupid, such as greed for some reason suddenly overwhelmed people working within finance, as if people in finance were not greedy before 2007. Others try to explain it through “liberalisation” which is almost just as nonsensical as government regulators never liberalised...

Read More »Circulus in probando

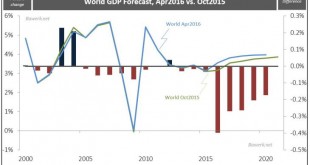

In the latest semi-annual Keynesian incantation spewed out by the world’s best pseudo-scientists, we learn that growth has been too slow for too long and that in itself is the cause of slow growth. First, they promote debt-funded consumption because spending – money supply/credit and velocity – is equivalent to nominal GDP growth, and as long as you have nominal GDP growth you can always add more debt to the existing stock ad infinitum. That obviously came crashing down in 2008. At that...

Read More »Greenspan, the Sheepherder

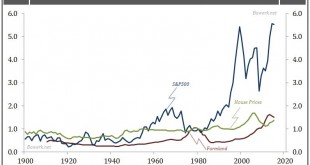

It is common knowledge by now that Federal Reserve Chairman Alan Greenspan oversaw, enabled and approved of, a major transition in the US economy. His infamous “Greenspan-put” in which his actions at the central bank would be driven, if not dictated, by the whims of financial markets, clearly led to higher asset prices. Investors obviously picked up on the strong bias in the Greenspan-Fed’s conduct of monetary policy as they slashed rates at the tiniest hiccup in financial markets, and...

Read More »The Credit Multiplier – Revisited

In last week’s article, we explained how the yield curve could cause GDP to contract in The Yield Curve and GDP – a causal relationship. Some of our readers suggested the analysis was wrong on back of an outdated view of modern money creation. The critics claim modern banks are not dependent on central bank reserves to create additional money; citing a Bank of England article from 2014 (which we have been well aware of) [A] common misconception is that the central bank determines the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org