Alhambra Investments CEO Joe Calhoun discusses the latest information about markets, specific categories affecting the economy. [embedded content] Related posts: Monthly Macro Monitor – October 2018 (VIDEO) Monthly Macro Monitor – December 2018 (VIDEO) Monthly Macro Monitor – August Monthly Macro Monitor – September 2018 Monthly Macro Monitor –...

Read More »Monthly Macro Monitor – January 2019

A Return To Normalcy In the first two years after a newly elected President takes office he enacts a major tax cut that primarily benefits the wealthy and significantly raises tariffs on imports. His foreign policy is erratic but generally pulls the country back from foreign commitments. He also works to reduce immigration and roll back regulations enacted by his predecessor. This President is widely rumored to have...

Read More »Living In The Present

The secret of health for both mind and body is not to mourn for the past, nor to worry about the future, but to live in the present moment wisely and earnestly. Buddha Review It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable...

Read More »Monthly Macro Monitor – November 2018

Is the Fed’s monetary tightening about over? Maybe, maybe not but there does seem to be some disagreement between Jerome Powell and his Vice Chair, Richard Clarida. Powell said just a little over a month ago that the Fed Funds rate was still “a long way from neutral” and that the Fed may ultimately need to go past neutral. Clarida last week said the FF rate was close to neutral and that future hikes should be “data...

Read More »Monthly Macro Monitor – October 2018 (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Monthly Macro Monitor – October 2018 Special Edition: Markets Under Pressure (VIDEO) Monthly Macro Monitor – September 2018 Monthly Macro Monitor – September Monthly Macro Monitor – August Monthly Macro Monitor – August 2018 Global Asset...

Read More »Monthly Macro Monitor – October 2018

Stocks have stumbled into October with the S&P 500 down about 6% as I write this. The source of equity investors’ angst is always hard to pinpoint and this is no exception but this correction doesn’t seem to be due to concerns about economic growth. At least not directly. The most common explanation for the pullback in stocks – 6% doesn’t even qualify as a correction – is rising interest rates but I think it is a...

Read More »Monthly Macro Monitor – September

This has already been one of the longest economic expansions on record for the US and there is little in the data or markets to indicate that is about to come to an end. Current levels of the yield curve are comparable to late 2005 in the last cycle. It was almost two years later before we even had an inkling of a problem and even in the summer of 2008 – nearly three years later – there was still a robust debate about...

Read More »Global Asset Allocation Update – September 2018

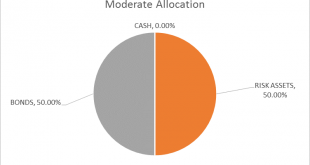

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is 50/50. Decoupling anyone? That’s what the market is whispering right now, that the recent troubles in foreign economies is contained and won’t affect the US. The most obvious example of that trend is the performance of US stocks versus the rest of the world. I am painfully aware of the...

Read More »Monthly Macro Monitor – August

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: In Next Crisis, Gold Won’t Drop Like 2008, Report 19 August 2018 FX Daily, August 17: Dollar Limps into the Weekend Monthly Macro Monitor – August 2018 FX Daily, August 14: Brief Respite but Little Relief Global Asset Allocation Update –...

Read More »Monthly Macro Monitor – August 2018

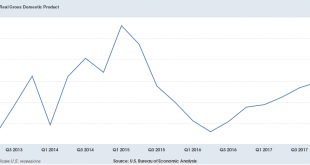

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%). The US economy is definitely accelerating out of the 2016 slowdown. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org