Yesterday's CPI report was seemingly the last hurdle for the Fed to cut interest rates. With the CPI index matching Wall Street forecasts, the Fed Funds futures market now implies a 97% chance the Fed will cut rates next Wednesday. The data was OK but elicits fears that the downward price progress has stalled. The CPI rate was 0.3%, a tenth higher than last month. The year-over-year rate rose from 2.6% to 2.7%. Core CPI was +0.3% monthly and +3.3% annually. The...

Read More »China Is No Longer The Marginal Buyer Of Oil

From 2010 through 2022, the US Energy Information Administration (EIA) calculates that global oil demand grew by 10 million barrels per day (Mb/d). Over 60% of the demand growth was due to China's phenomenal economic growth. For context, American demand increased by less than 10%. The graph below shows that China once drove global oil demand, but that is no longer true. Given the impact oil prices have on inflation, this is an essential macroeconomic factor to...

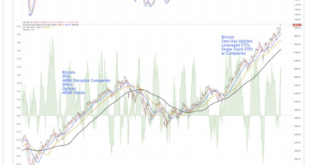

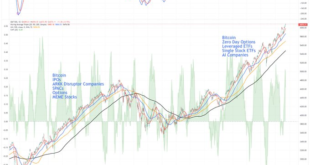

Read More »MicroStrategy And Its Convertible Debt Scheme

MicroStrategy (MSTR) stock is soaring alongside Bitcoin. In the wake of extreme confidence, we fear many MicroStrategy investors fail to grasp the inherent risks with its unique convertible bond funding and leverage scheme. A recent podcast featuring Tom Lee presented some positive facts about MicroStrategy's recent convertible bond offering but failed to tell the whole story. Left out of Tom Lee's enthusiastic outlook is that the "novel strategy" can also bankrupt...

Read More »Portfolio Rebalancing And Valuations. Two Risks We Are Watching.

While analysts are currently very optimistic about the market, the combined risk of high valuations and the need to rebalance portfolios in the short term may pose an unanticipated threat. This is particularly the case given the current high degree of speculation and leverage in the market. It is fascinating how quickly people forget the painful beating of taking on excess risk and revert to the same thesis of why "this time is different." For example, I recently...

Read More »How to Build a Diversified Investment Portfolio for Long-Term Growth

Investing for the long term is a journey that requires careful planning, patience, and, most importantly, diversification. Building a diversified investment portfolio is essential for mitigating risk and ensuring steady growth over time. By spreading your investments across different asset classes, you can weather market fluctuations and achieve your financial goals more effectively. In this article, we’ll explore why diversification matters, outline key asset...

Read More »Housing Affordability Brings Market To A Standstill

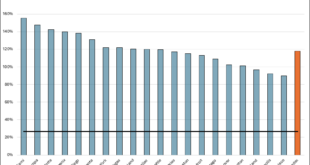

Housing affordability helps explain why residential real estate transactions have reached a standstill. Over the last five years, housing prices have surged. Per the Case-Shiller 20 City Home Price Index, home prices from 20 of the largest cities have risen between 33% and 80%. Over the same five-year period, mortgage rates jumped from 3.68% to 6.81%. Wage growth has helped to offset the higher prices and mortgage rates. However, with the median wage growth of 26%...

Read More »2025 – Do Economic Indicators Support Bullish Outlooks?

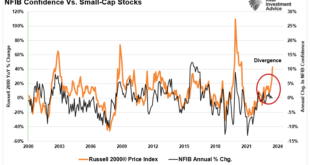

Inside This Week's Bull Bear Report 2025 - Do Economic Indicators Support Bullish Outlooks How We Are Trading It Research Report -The Kalecki Profit Equation And The Coming Reversion Youtube - Before The Bell Market Statistics Stock Screens Portfolio Trades This Week Everybody Is Very Bullish Last week, we discussed how speculation and leverage have returned in earnest to the market as investors rush to take on increasing levels of risk. With...

Read More »The Dollar And Oil Foresee A Santa Rally For Bonds

Bond yields are primarily driven by macroeconomic factors such as inflation and economic growth. Given their impact on inflation and the economy, the U.S. dollar and oil prices are frequently well correlated with bond yields. Therefore, bond traders often take their cue from the dollar and oil markets. The dollar (blue), as graphed on the right, has been on a tear since early October. As is typical, bond yields (orange) closely followed the dollar higher. The...

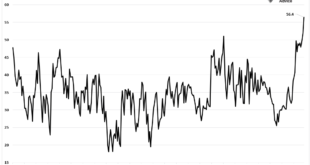

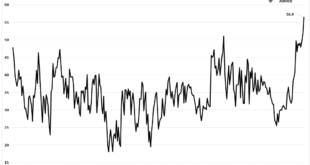

Read More »Leverage And Speculation Are At Extremes

Financial markets often move in cycles where enthusiasm drives prices higher, sometimes far beyond what fundamentals justify. As discussed in last week's #BullBearReport, leverage and speculation are at the heart of many such cycles. These two powerful forces support the amplification of gains during upswings but can accelerate losses in downturns. Today’s market environment shows growing signs of these behaviors, particularly in options trading and leveraged...

Read More »In Store Sales Falter Despite A Good Black Friday

Based on early Black Friday sales estimates, sales were strong, but shoppers were much more inclined to take advantage of online sales than go to the malls and stores in person. Mastercard SpendingPulse estimates that in store sales only grew by 0.7% from last year, while online sales rose by nearly 15%. Facteus, another data source, claims that in-store sales fell by 5.4% compared to an increase of 8.5% for online sales. Per ABC News and Adobe Analytics: Black...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org