During Donald Trump's first term, some investors bought into the Trump 1.0 Put. The trade was based on the market's belief that Trump believed the stock market's performance was a referendum on his presidency. Accordingly, investors thought that Trump would do everything he could to backstop the stock market if it fell. Thus, some investors thought it worthwhile to sell puts, collect the proceeds, and sit back comfortably, not fearing losses. According to a...

Read More »Behavioral Economics: Managing Your Inner Voice

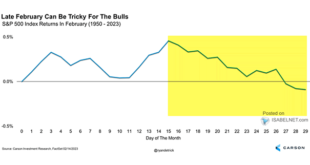

The combination of extremely rich equity valuations, high interest rates, and a new President taking bold actions will likely continue to whip stocks around for the foreseeable future. Alongside those volatility-provoking factors is that the S&P 500 just posted two annual twenty-plus percent gains in a row. Accordingly, seeing average or below-average returns this year and volatility spikes should not be surprising. If we are correct about volatility, it's...

Read More »Behavioral Economics: Managing Your Inner Voice

The combination of extremely rich equity valuations, high interest rates, and a new President taking bold actions will likely continue to whip stocks around for the foreseeable future. Alongside those volatility-provoking factors is that the S&P 500 just posted two annual twenty-plus percent gains in a row. Accordingly, seeing average or below-average returns this year and volatility spikes should not be surprising. If we are correct about volatility, it's...

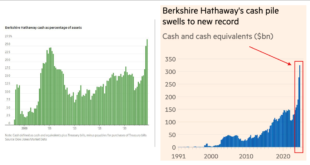

Read More »Cash At Buffett’s Berkshire Continues To Grow

In its annual letter to shareholders this past weekend, Warren Buffett's Berkshire Hathaway announced that it had increased its cash holdings to $334 billion. As the Financial Times chart on the right shows, Berkshire's cash balances have more than doubled over the last few quarters to its highest level. Additionally, cash as a percentage of assets, graphed on the left, shows it now holds more cash as a percentage of its portfolio than before the 2008 financial...

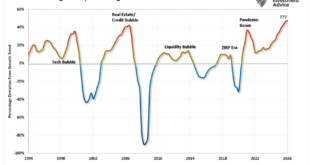

Read More »Estimates By Analysts Have Gone Parabolic

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing exuberance on Wall Street. As noted last week, correlations between all asset classes, whether international or emerging markets, gold or bitcoin, have all gone to one. Unsurprisingly, rationalizations justify illogic when too much money is chasing too few assets. Therefore, it should not be...

Read More »The Importance of Emergency Funds in Retirement Planning

When planning for retirement, most people focus on savings, investments, and budgeting for daily living expenses. However, one critical component that often gets overlooked is an emergency fund. Having an emergency fund in retirement is essential for maintaining financial stability and peace of mind. Unexpected expenses, such as medical bills or home repairs, can derail even the most carefully constructed financial plan. This guide explains the importance of...

Read More »The Stability-Instability Paradox

Inside This Week's Bull Bear Report The Stability-Instability Paradox How We Are Trading It Research Report - Tariffs Are Not As Bearish As Headlines Suggest Youtube - Before The Bell Market Statistics Stock Screens Portfolio Trades This Week Market Shakes Off Inflation Data I am back from traveling, and we have a good bit to catch up on since our last report. If you missed it, I provided an update on Tuesday, updating all the weekly technical and...

Read More »The Impact Of Tariffs Is Not As Bearish As Predicted

There are many media-driven narratives about the impact of tariffs on the economy and the markets. Most of them are incredibly bearish, predicting the absolute worst possible outcomes. For fun, I asked ChatGPT what the expected impact of Trump's tariffs will likely be. Here is the answer: "One of the immediate consequences of increased tariffs is higher consumer prices. Tariffs function as an import tax, and companies that rely on foreign goods often pass these...

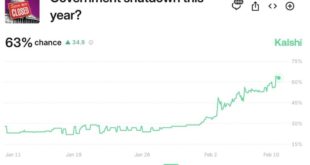

Read More »The Fiscal Freeze Is Coming

In mid-March, the government is expected to hit the debt ceiling. As has seemingly become the norm, dire threats from both political parties will start shortly. However, despite the fiery rhetoric, they often get resolved before the government shuts down. Might the coming fiscal standoff be a little different? Our colleague Greg Valliere, a long-time Washington DC insider, explains why a shutdown may be more likely this time. Greg starts his latest article by asking...

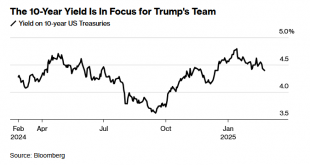

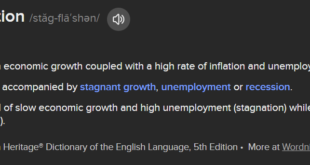

Read More »CPI Rose More Than Expected

The January CPI report was troubling as it rose more than expected. The monthly rate rose by 0.5%, about 0.2% above expectations. The core monthly rate was a tenth of a percent above expectations, at 0.4%. The year-over-year CPI rate rose to 3% from 2.9%. The latest CPI data argues inflation is stuck in a range above the Fed's 2% target. Accordingly, we should assume that the Fed will almost certainly be on hold for quite a while. The market tends to agree with that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org