The combination of covid lockdowns, money pumping, and attempts to force a new green economy are taking their toll. This is not going away any time soon. Original Article: “It’s Not Just the USA: The Economic Instability Is Global” The actions of the authorities in developed countries, essentially an extension of the Keynesian economic policy discourse, have brought the economies into disrepute. These actions consist of immense stimulus and virtually unfunded...

Read More »Davos Man Is at It Again: The 2022 Annual Meeting of the World Economic Forum

The annual meeting of the World Economic Forum (WEF) in Davos is perhaps the world’s most unpopular conference, and the WEF’s founder and chairman, Klaus Schwab, one of the world’s most despised figures. Often compared to “Dr. Evil,” the character Mike Meyers played in the Austin Powers series, and routinely likened to a James Bond supervillain on the internet, Schwab is seen as a messianic megalomaniac leading a nefarious cabal of world leaders and corporate heads...

Read More »Carl Menger and the Austrian School of Economics

A Selection from The Historical Setting of the Austrian School of Economics. 1. The Beginnings What is known as the Austrian School of Economics started in 1871 when Carl Menger published a slender volume under the title Grundsätze der Volkswirtschaftslehre. It is customary to trace the influence that the milieu exerted upon the achievements of genius. People like to ascribe the exploits of a man of genius, at least to some extent, to the operation of his environment...

Read More »Inflation, War, and Oil: How Today’s Crises Are Rehashing the 1970s

Persistently loose monetary policies always have negative growth and distributional effects that impair political stability. In extreme cases, there are civil wars and armed conflicts between countries. Original Article: “Inflation, War, and Oil: How Today’s Crises Are Rehashing the 1970s” Consumer price inflation has risen to 8.3 percent in April 2022 in the United States and 7.5 percent in the euro area. This raises the question of who is responsible. In the US,...

Read More »The Backstory of the Great Reset, or How to Destroy Classical Liberalism

As should be clear by now, Francis Fukuyama’s declaration in The End of History: The Last Man (1992) that we had arrived at “the end of history” did not mean that classical liberalism, or laissez-faire economics, had emerged victorious over communism and fascism, or that the final ideological hegemony signaled the end of socialism. In fact, for Fukuyama, the terminus of history was always democratic socialism or social democracy. As Hans-Hermann Hoppe noted in...

Read More »To Succeed, the AfCFTA Must Be about Actual Free Trade, Not Government-Managed “Free Trade”

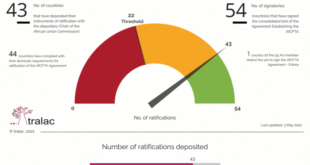

The African Continental Free Trade Area (AfCFTA) is the world’s largest free trade area by the number of countries. It is the most ambitious and, given demographic trends, the most promising free trade project on earth. The AfCFTA matters very much to Africa’s economies separately and to the continent’s collaborative and integrated economic development. If successful, it also carries significant implications for the global economy. As such, the AfCFTA matters. Not...

Read More »Austrian Economists Are Not Surprised by the Shortages

While supporters of the Biden administration fault Putin for shortages, Austrian economists know the answer lies in Washington’s monetary and economic mismanagement. Original Article: “Austrian Economists Are Not Surprised by the Shortages” In the last few years, it seems as if there has been a hot new story about a different commodity facing some form of shortage every single day. Most recently we have seen a baby formula shortage. However, that is most certainly...

Read More »Christianity and the Development of Human Capital: Challenging the Narratives

While the standard secular narrative is that Christianity held back science and human development, history tells a different story, one of literacy and the development of human capital. Original Article: “Christianity and the Development of Human Capital: Challenging the Narratives” Undeniably, the advent of Christianity has fundamentally transformed the world. But this startling fact has been obscured by thinkers eager to depict Christianity as a backward religion...

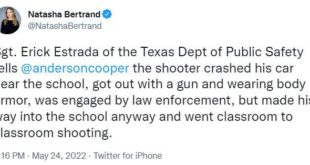

Read More »Police Botched the Uvalde Standoff. Now Gun Controllers Want to Give Police More Power.

First it was Columbine. Then it was Parkland. Now, we learn that at Robb Elementary School, police officers again stood around outside a school while the killer was inside with children. NPR reports today: Frustrated onlookers urged police officers to charge into the Texas elementary school where a gunman’s rampage killed 19 children and two teachers, witnesses said Wednesday, as investigators worked to track the massacre that lasted upwards of 40 minutes and ended...

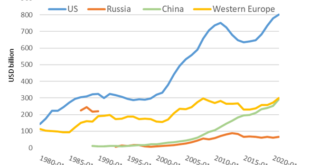

Read More »Peace through Strength? Excessive US Military Spending Encourages More War

The Russian invasion of Ukraine has brought America’s foreign policy interventions under the limelight once again. Ryan McMaken argues that the US administration’s claim that countries should not have the right to a sphere of influence, implicitly addressing Russia, is hypocritical. The US opposes a sphere of influence for Russia and other regional powers, while at the same time has steadily expanded its own global outreach. Among other, one can judge how true this...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org