So, the stock market has dropped. Every government in the world has responded to the coronavirus with drastic, if not unprecedented, violations of the rights of the people. Not to mention, extremely aggressive monetary policy. And, they are about to unleash massive fiscal stimulus as well (for example, the United States government is about to dole out over $2 trillion worth of loot). The question on everyone’s mind is what will be the consequences? The standard...

Read More »Alchemy Rediscovered by Research Scientist, Report 1 April

“The Medievals were smarter than most people think,” says Dr. Michael Mus. “I mean, sure, they tortured people for believing that the sun was the center of our solar system, and they burned witches at the stake. But they knew a thing or two about gold.” Picture of Dr. Michael Mus Dr. Mus is working to perfect a method of turning lead and other base metals into gold. He says he is so close, that he will only need one more grant from the King government. Then he says,...

Read More »Cash is Toilet Paper, Market Report 23 March

The price of gold dropped $31, and that of silver fell even more by proportion, $2.14. The gold-silver ratio hit a hit of over 126 before closing the week around 119. This exceeds the high in the ratio last hit in the George H.W. Bush recession. Last week, we were warming up to silver, if not recommending it. We said: “While we would not recommend betting on silver with leverage at this moment, we certainly would not be short silver right now. If you don’t own any,...

Read More »Aplanando la economía «por el virus»

Escribo esto el 18 de marzo, después de haber visto un cambio de 180 grados en la forma de pensar sobre las enfermedades contagiosas. Anteriormente, poníamos a los enfermos en cuarentena y respetamos el derecho de los sanos a seguir con sus vidas. Ahora estamos al borde de la ley marcial. En nuestro afán por combatir el coronavirus, estamos cerrando los viajes, las reuniones públicas, los restaurantes, etc. Así es como se ve un pánico masivo. Sin mencionar que ya...

Read More »Is Now a Good Time to Buy Gold? Market Report 16 March

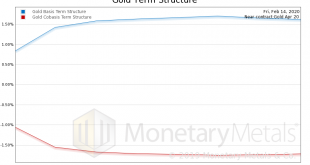

We got hate mail after publishing Silver Backwardation Returns. It seems that someone thought backwardation means silver is a backward idea, or a bad bet. “You are a *&%#! idiot,” cursed he. “Silver is the most underpriced asset on the planet,” he offered as his sole supporting evidence. He doesn’t know that backwardation means scarcity, not that a commodity’s price is too high. Since we wrote that on March 2 (our Reports are always based on the prior Friday’s...

Read More »Socialism and Gold

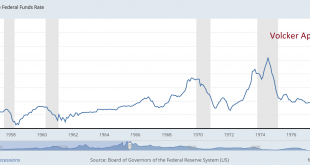

Most people assume that the central bank prints money when it buys bonds. They further assume that this increase in the quantity of money causes an increase in the general price level. And, this leads them to assume that the value of the money is 1 / P (P is the general price level). Therefore, when the central bank prints money to buy bonds, it is diluting the value of the money held by everyone—in proportion to the amount printed divided by the total amount in...

Read More »Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data. So we won’t say anything more about it today. On 17 Feb, we wrote about the widening bid-ask spread...

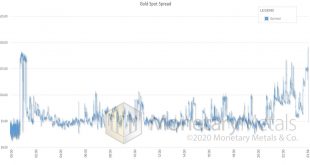

Read More »Widening Bid-Ask Spreads, Gold and Silver Market Report 17 February

The price of gold rose $14 and the price of silver fell $0.07. The gold-silver ratio rose further with this price action. Welcome to our new Gold and Silver Market Report, or “Market Report” for short. We are separating this from the economics essay, which was attached for many years. As they used to say in many toy commercials of yore, “batteries sold separately”—or in this case essays. The new Market Report is going to depart from the familiar old format of four...

Read More »Monetary Metals Gold Brief 2020

We apologize for not posting articles during January. We have been busy, and going forward will publish a separate Market Report every Monday morning plus macroeconomics essays later in the week, as time permits. This is our annual analysis of the gold and silver markets. We look at the market players, dynamics, fallacies, drivers, and finally give our predictions for the prices of the metals over the coming year. Introduction Predicting the likely path of the...

Read More »Open Letter to John Taft, Report 17 Dec

Dear Mr. Taft: I eagerly read your piece Warriors for Opportunity on Wednesday, as I often do about pieces that argue that capitalism is not working today. You begin by saying: “Financial capitalism – free markets powered by a robust financial system – is the dominant economic model in the world today. Yet many who have benefited from the system agree it’s not working the way it ought to.” Leaving aside that our financial system is not robust—the interest rate is...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org