A corrupt Orthodoxy devoid of new ideas, an Orthodoxy devoted to maintaining the wealth, status and power of insiders regardless of cost, is a brittle, fragile, unstable system. When the ruling Elites sense their control of the populace is waning, they seek to regain full control via the imposition of a strict Orthodoxy, enforced by an Inquisition. We are living in just such an era. Everywhere we turn, a New Orthodoxy reigns. Dissent is blasphemy, and any narratives...

Read More »Markets That Live by the Fed, Die by the Fed

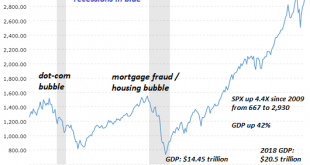

The “everything bubble” is not permanent. All eyes are again on the Federal Reserve, as everyone understands that the Fed is the market— the stock market, the bond market, the art market, the housing market, etc. All markets have been driven higher by one force: central bank money creation and distribution to the financial sector of financiers and corporations, the richest of the rich. What few seem to grasp (because they’re paid not to?) is the Fed is powerless over...

Read More »Some Thoughts on the Fed and Oil Shocks

Oil prices have spiked after the weekend attack on Saudi oil facilities. Will it impact the Fed tomorrow? No. We compare the current (but still unfolding) situation to past oil shocks from the 1970s and discuss the policy responses taken. RECENT DEVELOPMENTS The weekend bombing of Saudi oil facilities continues to reverberate. The drone strike removed about 5% of global supplies from the market, leading Brent oil to spike to $72 per barrel Monday before falling...

Read More »Focus Is On The Pre-recession Condition

Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession. Any economy which might slow down into a weakened state for whatever reasons becomes susceptible. What might be a minor,...

Read More »Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances. It was reported last week that Maersk and MPC would “temporarily suspend” their sailings on one of the biggest routes between Europe and Asia. Weakening...

Read More »Dollar Mixed, Oil Spikes as Markets Digest Saudi Attack

The weekend bombing of Saudi oil facilities continue to reverberate across global markets The currencies of the oil producing nations are likely to outperform near-term US rates continue to adjust ahead of the FOMC UK Prime Minister Johnson is in Luxembourg today to meet with EC President Juncker China reported weak August IP and retail sales . The dollar is mixed against the majors as markets continue to digest the attack on Saudi oil facilities. Yen and Loonie are...

Read More »The Black Swan Is a Drone

What was “possible” yesterday is now a low-cost proven capability, and the consequences are far from predictable. Predictably, the mainstream media is serving up heaping portions of reassurances that the drone attacks on Saudi oil facilities are no big deal and full production will resume shortly. The obvious goal is to placate global markets fearful of an energy disruption that could tip a precarious global economy into recession. The real impact isn’t on...

Read More »What a Relief that the U.S. and Global Economies Are Booming

Doing more of what’s failed for ten years will finally fail spectacularly.. It was a huge relief to see the charts of the Baltic Dry Index (BDI) and the U.S. retail sector ETF (RTH): both have soared to the moon, signaling that both the U.S. and global economies are booming: the BDI is widely regarded as a proxy for global shipping, which is a proxy for global trade and economic activity. Batic Dry Index, 2018-2019 - Click to enlarge Amazon is 18% of the RTH...

Read More »Dollar Soft as Risk Sentiment Stoked Ahead of US Retail Sales

US-China relations appear to be thawing Trading was volatile after the ECB decision; we are still dollar bulls EM has benefitted from the shift in the global backdrop this week The US data highlight is August retail sales Vietnam cut rates 25 bp to 6.0%; Turkey reported July current account and IP The dollar is mostly softer against the majors ahead of the US retail sales data. Sterling and Swissie are outperforming, while Kiwi and Loonie are underperforming. EM...

Read More »The Inevitable Bursting of Our Bubble Economy

All of America’s bubbles will pop, and sooner rather than later. Financial bubbles manifest three dynamics: the one we’re most familiar with is human greed, the desire to exploit a windfall and catch a work-free ride to riches. The second dynamic gets much less attention: financial manias arise when there is no other more productive, profitable use for capital, and these periods occur when there is an abundance of credit available to inflate the bubbles. Humans...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org