The “everything bubble” is not permanent. All eyes are again on the Federal Reserve, as everyone understands that the Fed is the market— the stock market, the bond market, the art market, the housing market, etc. All markets have been driven higher by one force: central bank money creation and distribution to the financial sector of financiers and corporations, the richest of the rich. What few seem to grasp (because they’re paid not to?) is the Fed is powerless over what actually matters in a healthy economy: 1. The Fed is powerless to create productive, profitable ventures for capital to invest in. Productivity has gone nowhere in the Fed’s reign while speculative profits leveraged by the Fed’s free money for financiers have soared. 2. The Fed is powerless to

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

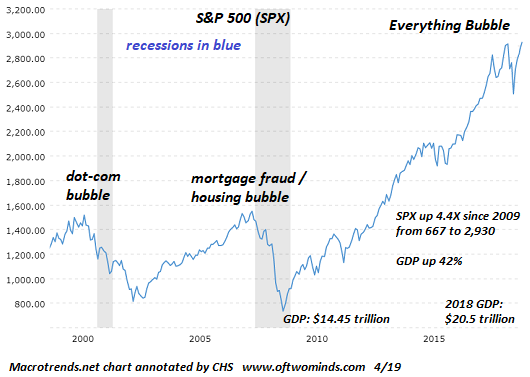

The “everything bubble” is not permanent.

All eyes are again on the Federal Reserve, as everyone understands that the Fed is the market— the stock market, the bond market, the art market, the housing market, etc. All markets have been driven higher by one force: central bank money creation and distribution to the financial sector of financiers and corporations, the richest of the rich.

What few seem to grasp (because they’re paid not to?) is the Fed is powerless over what actually matters in a healthy economy:

1. The Fed is powerless to create productive, profitable ventures for capital to invest in. Productivity has gone nowhere in the Fed’s reign while speculative profits leveraged by the Fed’s free money for financiers have soared.

2. The Fed is powerless to raise wages. Despite ginned-up claims that wages are finally rising 3% a year after a decade of stagnation, wages are still losing purchasing power once real-world inflation is factored in.

3. The Fed cannot force creditworthy households and enterprises to borrow more money, nor can they stop banks from lending to the only people who want to borrow more money, those who are credit risks, i.e. borrowers who will default at the first spot of bother.

4. The Fed is powerless to stop the New Gilded Age consequences of their policies via The Cantillon Effect: it’s not just how the money is created, but how it’s distributed. Those who get the Fed’s nearly free money can use it to buy productive assets and pursue speculations such as stock buy-backs, while everyone else who didn’t get a single dollar of the Fed’s trillions experiences a loss of purchasing power as the Fed’s new money expands the money supply without actually expanding the real economy.

The only power the Fed has is to incentivize profiteering via stock buy-backs and speculations of the super-wealthy–the power, in other words, to create a New Gilded Age of obscene wealth inequality.

| The Fed’s New Gilded Age is generating political blowback, and eventually the masses will awaken to the fact that the Fed is the enemy of the people because it is the sole enabler of the unproductive, parasitic, predatory corporate/insider class that’s skimmed something like 87% of all the “wealth” “created” by the Fed’s policies.

The Fed has created an economy in which capital has been stripped of low-risk yield. All capital must become gambling chips in the casino to earn a return, but gambling is intrinsically risky, and the asymmetry between the risk–rising–and the return–increasingly paltry–is setting the markets up for a fall the Fed is powerless to stop, and a political blowback to the Fed’s New Gilded Age that is it equally powerless to stop. Markets that live by the Fed also die by the Fed. The Fed’s abject, pathetic powerlessness over what actually matters will be revealed in the years ahead, and everyone will look back on the decades in which the Fed was viewed as god-like as a form of mass delusion. The “everything bubble” is not permanent. Gambling is risky, and the Fed has rigged the world’s larget casino to benefit its banking / financier / corporate cronies. But bubbles burst for reasons outside the control of the Fed, a reality that’s about to become undeniable. |

S&P 500, 2000-2015(see more posts on S&P 500 Index, ) |

Tags: Featured,newsletter