Like so many other things that were once affordable, owning pets is increasingly pricey. One of the few joys still available to the average household is a pet. At least this is what I thought until I read 5 money-saving tips people hate, which included the lifetime costs of caring for a pet. It turns out Poochie and Kittie are as unaffordable as college, housing and healthcare (and pretty much everything else). Over the course of 15 years, small-dog Poochie will set...

Read More »Here’s How We Are Silenced by Big Tech

This is how they silence us: your content has been secretly flagged as being “unsafe,” i.e. “guilty of anti-Soviet thoughts;” poof, you’re gone. Big Tech claims it isn’t silencing skeptics, dissenters and critics of the status quo, but it is silencing us. Here’s how it’s done. Let’s start with Twitter. Twitter claims it doesn’t shadow ban (Setting the record straight on shadow banning), which it defines as deliberately making someone’s content undiscoverable to...

Read More »Financial Storm Clouds Gather

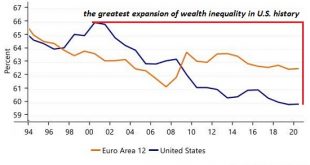

The price of this “solution”–the undermining of the financial system–will eventually be paid in full. The financial storm clouds are gathering, and no, I’m not talking about impeachment or the Fed and repo troubles–I’m talking about much more serious structural issues, issues that cannot possibly be fixed within the existing financial system. Yes, I’m talking about the cost structure of our society: earned income has stagnated while costs have soared, and households...

Read More »Automation and the Crisis of Work

Technology, like natural selection, has no goal. When it comes to the impact of automation (robots, AI, etc.) on jobs, there are two schools of thought: one holds that technology has always created more and better jobs than it destroys, and this will continue to be the case. The other holds that the current wave of automation will destroy far more jobs than it creates, but the solution is to tax the robots and use these revenues to distribute the wealth to everyone...

Read More »The New Orthodoxy: Blasphemy, Heresy and the New Inquisition

A corrupt Orthodoxy devoid of new ideas, an Orthodoxy devoted to maintaining the wealth, status and power of insiders regardless of cost, is a brittle, fragile, unstable system. When the ruling Elites sense their control of the populace is waning, they seek to regain full control via the imposition of a strict Orthodoxy, enforced by an Inquisition. We are living in just such an era. Everywhere we turn, a New Orthodoxy reigns. Dissent is blasphemy, and any narratives...

Read More »Markets That Live by the Fed, Die by the Fed

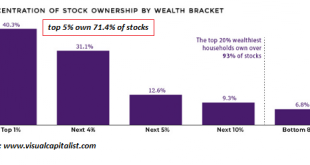

The “everything bubble” is not permanent. All eyes are again on the Federal Reserve, as everyone understands that the Fed is the market— the stock market, the bond market, the art market, the housing market, etc. All markets have been driven higher by one force: central bank money creation and distribution to the financial sector of financiers and corporations, the richest of the rich. What few seem to grasp (because they’re paid not to?) is the Fed is powerless over...

Read More »The Black Swan Is a Drone

What was “possible” yesterday is now a low-cost proven capability, and the consequences are far from predictable. Predictably, the mainstream media is serving up heaping portions of reassurances that the drone attacks on Saudi oil facilities are no big deal and full production will resume shortly. The obvious goal is to placate global markets fearful of an energy disruption that could tip a precarious global economy into recession. The real impact isn’t on...

Read More »What a Relief that the U.S. and Global Economies Are Booming

Doing more of what’s failed for ten years will finally fail spectacularly.. It was a huge relief to see the charts of the Baltic Dry Index (BDI) and the U.S. retail sector ETF (RTH): both have soared to the moon, signaling that both the U.S. and global economies are booming: the BDI is widely regarded as a proxy for global shipping, which is a proxy for global trade and economic activity. Batic Dry Index, 2018-2019 - Click to enlarge Amazon is 18% of the RTH...

Read More »The Inevitable Bursting of Our Bubble Economy

All of America’s bubbles will pop, and sooner rather than later. Financial bubbles manifest three dynamics: the one we’re most familiar with is human greed, the desire to exploit a windfall and catch a work-free ride to riches. The second dynamic gets much less attention: financial manias arise when there is no other more productive, profitable use for capital, and these periods occur when there is an abundance of credit available to inflate the bubbles. Humans...

Read More »These Are Not Signs of a Healthy Market

If these three charts reflect a “normal” “healthy” Bull market, then why are they so uncommon? The implicit narrative of the latest rally in stocks is that this is just another normal rally in the ongoing 10-year long Bull market. Nice, but do these three charts look “normal” to you? Let’s take a quick glance at a daily chart of the S&P 500 (SPX), a weekly chart of TLT, the exchange-traded fund of the US Treasury 20-year bond, and silver. In other words, let’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org