Any domino-like expanding crisis will unfold in a status quo lacking any coherent response. Longtime readers know I’ve often referenced The Fourth Turning, the book that makes the case for an 80-year cycle of existential crisis in U.S. history. The first crisis was the constitutional process (1781) following the end of the Revolutionary War, whether the states could agree on a federal structure; the 2nd crisis was the Civil War (1861) and the 3rd crisis was global...

Read More »Labor Day Reflections on Retirement and Working for 49 Years

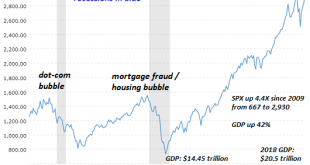

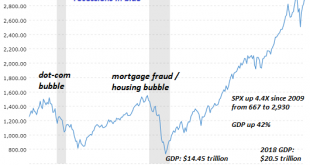

What happens when these monstrous speculative bubbles pop? Let’s start by stipulating that if I’d taken a gummit job right out of college, I could have retired 19 years ago. Instead, I’ve been self-employed for most of the 49 years I’ve been working, and I’m still grinding it out at 65. By the standards of the FIRE movement (financial independence, retire early), I’ve blown it. The basic idea of FIRE is to live frugally and save up a hefty nestegg to fund an early...

Read More »Dear Trump Advisors: Prop the Market Up Now and Lose in 2020, or Let the Market Crash and Win in 2020

The Everything Bubble has topped out, and trying to push it higher for the next 14 months is a sure way to increase the damage next year. One of the more reliable truisms is that Americans vote their pocketbook: if their wallets are being thinned (by recession, stock market declines, high inflation/stagnant wages, etc.), they throw the incumbent out, even if they loved him the previous year when their wallets were getting fatter. (Think Bush I, who maintained high...

Read More »The Fantasy of Central Bank “Growth” Is Finally Imploding

Having destroyed discipline, central banks have no way out of the corner they’ve painted us into. It was such a wonderful fantasy: just give a handful of bankers, financiers and corporations trillions of dollars at near-zero rates of interest, and this flood of credit and cash into the apex of the wealth-power pyramid would magically generate a new round of investments in productivity-improving infrastructure and equipment, which would trickle down to the masses in...

Read More »The Benefits of a Profoundly Shattering Recession

Does anyone really think The Everything Bubble can just keep inflating forever? What do I mean by a profoundly shattering recession? I mean, a systemic, crushing recession that can’t be reversed with central bank magic, a recession that only deepens with time. The last real recession was roughly two generations ago in 1981; younger generations have no experience of a profound recession, and perhaps older folks have forgotten the shock, angst and bitterness. A...

Read More »Our Wile E. Coyote Federal Reserve

Whatever the Fed chooses to do, it’s already failed.. Wile E. Coyote has gotten a bad rap: in all fairness, his schemes are ingenious, if overly complicated, and it’s not his fault that the Acme detonator misfires or the Road Runner doesn’t respond as predicted. Every set-up to nail the Road Runner should work. That it fails and leaves him suspended over the cliff for a woefully brief second to intuit his impending doom really isn’t his fault. Wile E. Coyote and the...

Read More »The Internal War in the Deep State Claims Its High Profile Casualty: Jeffrey Epstein

The “traditionalist” Neocons are going to have to decide to fish or cut bait. I’ve been writing about the fracturing Deep State for the past five years: The conflict has now reached the hot-war stage where bodies are turning up, explained away by the usual laughable covers: “suicide,” “accident” and “heart attack.” That Jeffrey Epstein’s death in a secure cell is being labeled “suicide” tells us quite a lot about the...

Read More »The Gulag of the Mind

Befuddled and blind, we wander toward the cliff without even seeing it, focusing on our little screens of entertainment and self-absorption. There are no physical barriers in the Gulag of the Mind–we imprison ourselves, and love our servitude. Indeed, we fear the world outside our internalized gulag, because we’ve absorbed the narrative that the gulag is secure and permanent. We’ve also absorbed the understanding that...

Read More »Nothing Is Guaranteed

There are no guarantees, no matter how monumental the hubris and confidence. The American lifestyle and economy depend on a vast number of implicit guarantees— systemic forms of entitlement that we implicitly feel are our birthright. Chief among these implicit entitlements is the Federal Reserve can always “save the day”: the Fed has the tools to escape either an inflationary spiral or a deflationary collapse. But there...

Read More »Main Street Small Business on the Precipice

Small businesses on the precipice need only one small shove to go over the edge, and there won’t be replacements filling the fast-multiplying empty storefronts. As a generality, the average employee (including financial pundits) has no real experience or understanding of what it takes to start and operate a small business in the U.S. Government employees in the agencies that oversee and enforce regulations on small...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org