All bubbles pop, period. The financial elites are pushing a narrative that asset prices, sales and profits will all return to January 2020 levels as soon as the Covid-19 pandemic fades. Get real, baby. Nothing is going back to January 2020 levels. Rather than the “V-shaped recovery” expected by Goldman Sachs et al., the crash in asset prices will eventually gather momentum. Why? It’s simple: for 20 years we’ve over-invested in speculative bubbles and squandered borrowed money on consumption and under-invested in productivity-increasing assets. To understand why the market value of assets will relentlessly reprice lower–a process sure to be interrupted with manic rallies and false dawns of hope that a return to speculative good times is just around the corner–let’s

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

All bubbles pop, period.

The financial elites are pushing a narrative that asset prices, sales and profits will all return to January 2020 levels as soon as the Covid-19 pandemic fades. Get real, baby. Nothing is going back to January 2020 levels. Rather than the “V-shaped recovery” expected by Goldman Sachs et al., the crash in asset prices will eventually gather momentum.

Why? It’s simple: for 20 years we’ve over-invested in speculative bubbles and squandered borrowed money on consumption and under-invested in productivity-increasing assets. To understand why the market value of assets will relentlessly reprice lower–a process sure to be interrupted with manic rallies and false dawns of hope that a return to speculative good times is just around the corner–let’s start with the basics: the only sustainable way to increase broad-based wealth is to boost productivity across the entire economy.

That means producing more goods and services with less capital, less labor and fewer inputs such as energy.

Rather than boost productivity, we’ve lowered productivity via mal-investment and by propping up unproductive sectors with immense sums of borrowed money–money that accrues interest.

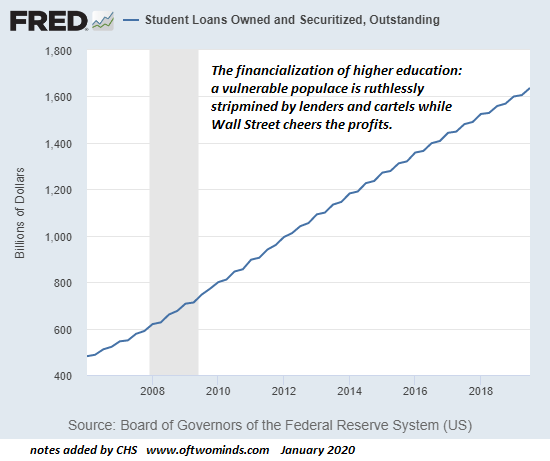

The poster child for this dynamic is higher education: rather than being pushed to innovate as costs skyrocketed, the higher education cartel passed its inefficiencies and bloated cost structure onto students, who have paid for the bloat with $1.6 trillion in student loans few can afford. (See chart below.)

As for Corporate America squandering $4.5 trillion on stock buybacks (Wolf Richter)– the effective gains on productivity from this stupendous sum is not just zero–it’s negative, as the resulting speculative bubble suckered in institutions and individuals who’d been stripped of safe returns by the Federal Reserve’s low-interest-rates-forever policy.

What could that $4.5 trillion have purchased in terms of increasing the productivity of the entire economy? Considerably more than the zero productivity generated by stock buybacks.

The net result of uneven gains in productivity and the asymmetric distribution of whatever gains have been made is stagnant wages for the bottom 90% and rising costs for everyone. Those of us who are self-employed or owners of small businesses know that healthcare insurance costs have been ratcheting higher by 10% or more annually for years.

Whatever gains in health that have been purchased with the additional trillions of dollars poured into the healthcare cartels have been offset with declining life spans, soaring addictions to opioids and numerous broad-based declines in overall health.

| The widespread addiction to smartphones and social media have deranged and distracted millions, crushing productivity while greatly increasing loneliness, insecurity and a host of social ills.

Two dynamics define the economy in the 21st century: 1. We have substituted debt-driven speculation for productive investment 2. We have substituted debt for earnings This is why the repricing of speculative-bubble assets can’t be stopped: debt-driven speculation is not a sustainable substitute for investing in increasing productivity, and debt-fueled consumption masquerading as “investment” is not a sustainable substitute for limiting consumption to what we earn and save. All bubbles pop, period. Once Corporate America’s credit lines are pulled and its revenues and profits plummet, the financial manipulation of stock buybacks will end. That spells the end of the 12-year bull market in stocks. As the tide of speculative mania ebbs and confidence wanes, the world’s housing bubbles will all pop, and the $1.4 million bungalows will drift back down to their Bubble #1 highs around $400,000, and perhaps even drop from there. As for collectibles and other play-things of the super-wealthy: the bids will soon vanish and yachts will be set adrift to avoid paying the dock fees. |

Student Loans Owned and Securitized, Outstanding 2008-2019 |

Tags: Featured,newsletter