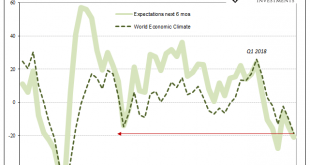

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work. On the other side, though, there’s not nearly the same level confidence. Earnings are derived from several factors but chiefly the economic climate in which companies operate....

Read More »For Labor And Recession, The Bad One

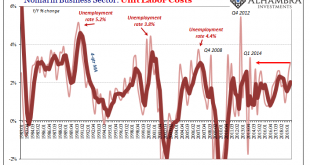

There’s a couple of different ways that Unit Labor Costs can rise. Or even surge. The first is the good way, the one we all want to see because it is consistent with the idea of an economy that is actually booming. If workers have become truly scarce as macro forces sustain actual growth such that all labor market slack is absorbed, then businesses have to compete for them bidding up the price of marginal labor. This is, of course, the exact scenario we’ve been...

Read More »The Real Boom Potential

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving. For many of them, it is the typical broken windows stuff. The war devastated Europe and much of the...

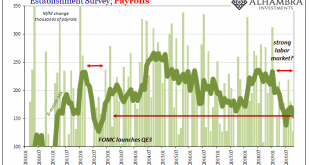

Read More »Red Flags Over Labor

Better-than-expected is the new strong. Even I’m amazed at the satisfaction being taken with October’s payroll numbers. While you never focus too much on one monthly estimate, this time it might be time to do so. But not for those other reasons. Sure, GM caused some disruption and the Census is winding down, both putting everyone on edge. The whisper numbers were low double digits, maybe even a negative headline estimate. Markets had been riding pure pessimism...

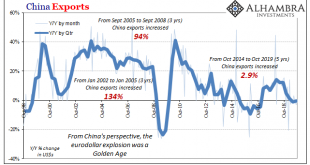

Read More »A Perfect Example of the Euro$ Squeeze

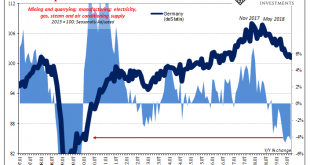

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate. Four percent doesn’t sound like much, but in the context of German IP it is well within recession territory....

Read More »Still Stuck In Between

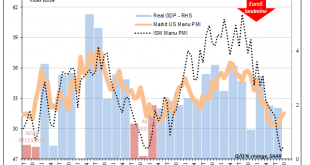

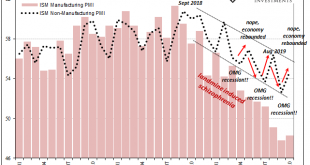

Note: originally published Friday, Nov 1 There wasn’t much by way of the ISM’s Manufacturing PMI to allay fears of recession. Much like the payroll numbers, an uncolored analysis of them, anyway, there was far more bad than good. For the month of October 2019, the index rose slightly from September’s decade low. At 48.3, it was up just half a point last month from the month prior. Most of that was related to a curious surge in New Export Orders. Having dropped to...

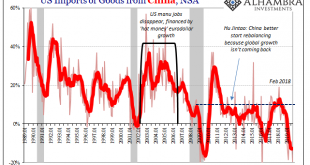

Read More »The Sudden Need For A Trade Deal

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018? I don’t mean to ask what his rationale was, more along the lines of, why 2018? Why...

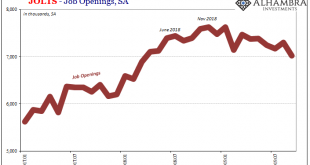

Read More »From Friends to Nemeses: JO and Jay

It was one of the first major speeches of his tenure. Speaking to the Economic Club of Chicago in April 2018, newly crowned Federal Reserve Chairman Jerome Powell was full of optimism. At that time, however, optimism was being framed as some sort of bad thing. This was the height of inflation hysteria, where any sort of official upgrade to the economic condition was taken as further “hawkishness.” Things were so good, they said, the situation was in danger of...

Read More »You Have To Try Really Hard Not To See It

In early September, the Institute for Supply Management (ISM) released figures for its non-manufacturing PMI that calmed nervous markets. A few weeks before anyone would start talking about repo, repo operations, and not-QE asset purchases, recession and slowdown fears were already prevalent. It hadn’t been a very good summer to that end, the promised second half rebound failing to materialize being more and more replaced by central banker backpedaling here as well...

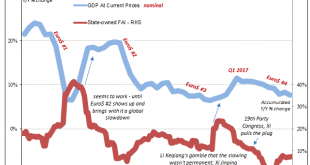

Read More »More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus. China GDP, 2007-2019(see more posts on China Gross Domestic Product, )...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org