Swiss Franc The Euro has risen by 0.09% at 1.1209 EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are off to a subdued start to what promises to be a busy week, featuring the FOMC, BOE, BOJ meetings, and the flash June PMIs. Investors also expect some signal whether Presidents Trump and Xi will at the G20...

Read More »FX Weekly Preview: FOMC, EMU PMI, and Pre-G20 Positioning: Crossroads and Crosswinds

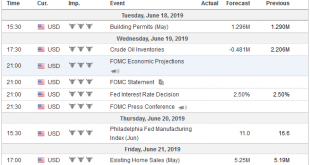

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last...

Read More »FX Daily, June 14: Waning Risk Appetite Going into the Weekend

Swiss Franc The Euro has fallen by 0.02% at 1.1201 EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Worries about an escalation in the Gulf following US accusations that Iran was behind yesterday’s two attacks and weaker growth impulses, while trade tensions remain high, are dampening risk appetites ahead of the weekend. Equities are...

Read More »FX Daily, June 13: Financial Statecraft or Whack-a-Mole

Swiss Franc The Euro has fallen by 0.32% at 1.1199 EUR/CHF and USD/CHF, June 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After roiling the markets by threatening escalating tariffs on Mexico, US President Trump has threatened China that if Xi does not meet him and return to the positions that the US claims it had previously, he will through on imposing...

Read More »Great Graphic: Euro’s (OECD) PPP

US President Trump recently bemoaned the fact that the euro is undervalued. While his critics complain that he is prone to exaggeration, in this case, the euro is undervalued. This Great Graphic a 30-year chart of the euro has moved around its purchasing power parity as measured by the OECD. Currently, the euro is about 22% undervalued, and it has been cheap to PPP since for the past five years. The OECD’s model...

Read More »FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Swiss Franc The Euro has risen by 0.08% at 1.125 EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng’s nearly 1.9% decline was...

Read More »FX Daily, June 11: Markets Take Another Small Step Away from the Edge

Swiss Franc The Euro has risen by 0.37% at 1.1235 EUR/CHF and USD/CHF, June 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities continues today in light news day. Nearly all the bourses in the Asia Pacific region rose, led by a 2.6% gain of the Shanghai Composite. The MSCI Asia Pacific Index rose for a third session. European equity...

Read More »FX Daily, June 10: Collective Sigh of Relief Lifts Equities, Yields, and the Dollar

Swiss Franc The Euro has risen by 0.11% at 1.1186 EUR/CHF and USD/CHF, June 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A global sigh of relief that the US will not tariff all its imports from Mexico. Equities are all higher, and the weekend demonstrations in Hong Kong over a bill allowing extraditions to the mainland for the first time did not deter...

Read More »FX Weekly Preview: US Policy Mix Flips and Will Take the Dollar with It

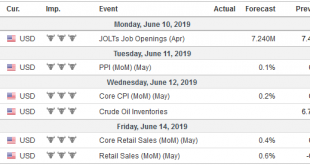

There is a new game, afoot. For the last couple of years, it has been about normalizing policy. Even the Bank of Japan, which has never declared it was tapering, has gradually reduced the amount of government bonds it purchases. Countries like the US, or Canada in 2017, who could raise interest rates were rewarded with stronger currencies. The tide has turned. The maturing business cycles may have been rolling over...

Read More »FX Daily, June 7: Jobs Data and Tariffs Dominate

Swiss Franc The Euro has risen by 0.11% at 1.1186 EUR/CHF and USD/CHF, June 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities continue to recover from the recent slide. Chinese and Hong Kong markets were on holiday today, but the MSCI Asia Pacific Index eked out a minor gain and ensured that its four-week slide ended. Europe’s Dow Jones Stoxx 600...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org