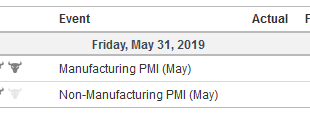

As May winds down, the light economic calendar will allow investors to take their cues from the evolution of three disruptive forces–trade, Brexit and the US economy. With actions against Huawei and possibly a handful of Chinese surveillance equipment producers, the US raised the stakes. The retaliatory tariffs are effective on June 1, but Beijing has not formally responded to the moves against Chinese companies. ...

Read More »FX Daily, May 23: Trade, Brexit, and Disappointing Flash PMIs Weigh on Global Markets

Swiss Franc The Euro has fallen by 0.43% at 1.121 EUR/CHF and USD/CHF, May 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The deterioration of the investment climate is spurring the sales of stocks and the buying of bonds. The dollar is firm. China and the US appear to be digging as if the trade tensions will remain for some time and the breech is beginning...

Read More »FX Daily, May 22: Sterling Can’t Get Out of Its Own Way

Swiss Franc The Euro has fallen by 0.24% at 1.1253 EUR/CHF and USD/CHF, May 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is a nervous calm in the capital markets. Yesterday’s rally in US shares failed to excite global investors. China, Hong Kong, and Taiwan markets fell, while Japan was mixed. Foreign investors continued to sell Korean shares, but the...

Read More »Rare Earths may Provide Leverage

Many American observers argue that the trade imbalance gives the US an advantage in a trade war with China. The US enjoys escalation dominance in tariffs because Chinese imports of US goods are so much less than the US imports of Chinese goods. However, the focus on quantities may be misleading. For example, the ability to find substitutes for the more expensive tariff imports could be a critical part of the evaluation....

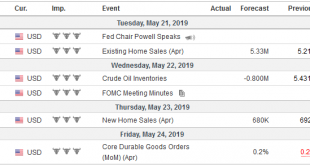

Read More »FX Daily, May 21: Equities Find Some Traction while the Dollar Firms

Swiss Franc The Euro has risen by 0.12% at 1.1275 EUR/CHF and USD/CHF, May 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are paring some of their recent losses. The MSCI Asia Pacific Index is posting its first back-to-back gain in a month, led by a more than 1% rally in China. Heightened prospects for an Australian rate cut in a few weeks helped...

Read More »Cool Video: End of Tariff Truce Spurs Over Correction

The S&P 500 recorded a key reversal on May 1, and the end of the tariff truce ensured follow-through selling. With today’s early losses, it is off nearly 3.5% this month. In my brief chat with Stuart Varney at Fox Business, I suggest that the stretched technical condition left the market vulnerable to a “buy in May and go away” scenario. There was some suggestion that comments by Atlanta’s Fed’s Bostic playing down...

Read More »FX Daily, May 20: Politics Overshadows Economics Today, but Japan’s Economy Unexpectedly Expanded in Q1

Swiss Franc The Euro has fallen by 0.11% at 1.1261 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Encouraged by the election results, investors bid up Indian and Australian currencies and equities. Japan offered a pleasant surprise by reporting the world’s third-largest economy expanded in Q1. Most other equity markets in Asia...

Read More »FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China’s own willingness to flaunt the international rules are defeating the strategy. President Trump may suggest that China would prefer to negotiate with his main Democrat rival 18-months away from the election, by both Pelosi and...

Read More »FX Daily, May 17: China Questions US Sincerity

Swiss Franc The Euro has risen by 0.04% at 1.1285 EUR/CHF and USD/CHF, May 17(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Since the presidential tweets on May 3, the US had the initiative in the negotiations with China, but today, China has pushed back. It is cool to the idea promoted by the US that trade talks will resume shortly. Now it may take the...

Read More »FX Daily, May 16: US Struggles to Strike a Less Strident Tone

Swiss Franc The Euro has risen by 0.02% at 1.1299 EUR/CHF and USD/CHF, May 16(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Retail sales and industrial production disappointed in both the US and China prior to the end of the tariff truce, declared by the US in a series of presidential tweets on May 5. The reaction function of the US to the drop in equities was...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org