In the Journal of Economic Literature, William Roberds reviews Christine Desan’s “Making Money: Coin, Currency, and the Coming of Capitalism” and he provides his own perspective on European monetary history. … the transition of the Bank of England’s notes from the status of experimental debt securities (in 1694) to “as good as gold” (1833) required more than a century of legal accommodation and business comfort with their use. Desan emphasizes England’s traditions of nominalism (as...

Read More »“Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money),” Die Volkswirtschaft, 2016

Die Volkswirtschaft 1–2 2017, December 21, 2016. HTML, PDF. Banning inside money creation would be unnecessary, insufficient, not enforceable, and besides the point. The way forward is to grant everyone access to central bank reserves and let investors choose between reserves and deposits.

Read More »“80,000 Hours”

80,000 hours, that’s how many hours we typically spent working over a lifetime, according to Benjamin Todd and the 80,000 hours team. They have published a book/ebook on how to make the best of it. Their advice for a dream job: Look for work you’re good at, work that helps others, supportive conditions: engaging work that lets you enter a state of flow; supportive colleagues; lack of major negatives like unfair pay; and work that fits your personal life. The book discusses strategies to...

Read More »Ayn Rand in the White House

In the Washington Post, James Hohmann reports that U.S. President-elect Donald Trump and his candidate for secretary of state, Rex Tillerson, share an affection for Ayn Rand’s “objectivist” philosophy. Trump identifies with Howard Roark, the main character in [Rand’s] “The Fountainhead” while Tillerson prefers “Atlas Shrugged” which I reviewed here. Other prospective members of the new administration also hold objectivist views while Stephen Bannon rejects “unenlightened capitalism” a la...

Read More »The Nature of Code

Daniel Shiffman’s book The Nature of Code (posted online) provides a nice introduction to concepts such as particle systems, cellular automata, fractals, or neural networks and shows how to code them using Processing.

Read More »How Does the Blockchain Transform Central Banking?

The blockchain technology opens up new possibilities for financial market participants. It allows to get rid of middle men and thus, to save cost, speed up clearing and settlement (possibly lowering capital requirements), protect privacy, avoid operational risks and improve the bargaining position of customers. Internet based technologies have rendered it cheap to collect information and to network. This lies at the foundation of business models in the “sharing economy.” It also lets...

Read More »Banking on the Blockchain

In the NZZ, Axel Lehmann offers his views on the prospects of blockchain technologies in banking. Lehmann is Group Chief Operating Officer of UBS Group AG. New possibilities: Higher efficiency; lower cost; more robustness and simpler processes; real-time clearing; no need for intermediaries; information exchange without risk of interference automated “smart contracts;” automated wealth management; more control over transactions; better data protection; improved possibilities for macro...

Read More »“Elektronisches Notenbankgeld ja, Vollgeld nein (Reserves for All, But no Sovereign Money),” NZZ, 2016

Neue Zürcher Zeitung, June 16, 2016. PDF, HTML. Ökonomenstimme, June 17, 2016. HTML. Vollgeld seems attractive because it decouples the supply of money from intermediation. By enabling everyone to use legal tender for electronic payments, electronic base money would satisfy a need. Vollgeld would prevent bank runs, at least partly; render deposit insurance unnecessary and reduce moral hazard; could help stabilize the credit cycle; and would redistribute seignorage to the central bank. But...

Read More »Deposit Insurance: Economics and Politics

On VoxEU, Charles Calomiris and Matthew Jaremski discuss the origins of bank liability insurance. They argue that it is redistribution, not the aim to boost efficiency, which explains a lot of the action. … there are two theoretical approaches to explaining the creation and expansion of deposit insurance. The first is an economic approach grounded in potential efficiency gains from limiting bank runs (i.e. the public interest motivation). The second is a political approach grounded in the...

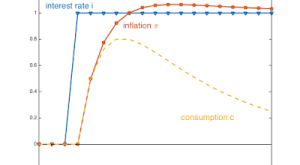

Read More »Neo-Fisherianism Turns Mainstream

On his blog, John Cochrane offers a stripped down model and some intuition for why inflation would rise after an increase in the interest rate. The model features the usual Euler (IS) equation and a Mickey Mouse Phillips curve—inflation is proportional to consumption (or output). The intuition: During the time of high real interest rates — when the nominal rate has risen, but inflation has not yet caught up — consumption must grow faster [the Euler equation, DN]. … Since more consumption...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org