Die Eidgenössische Finanzmarktaufsicht FINMA hat in einem Enforcementverfahren festgestellt, dass die Bank SYZ SA gegen die Geldwäschereibestimmungen verstossen hatte. Die Verstösse erfolgten im Kontext einer sehr bedeutenden Geschäftsbeziehung mit einem Kunden aus Angola. Im Februar 2020 eröffnete die FINMA ein Enforcementverfahren gegen die Bank SYZ SA, um Hinweisen auf Verstösse gegen die Geldwäschereibestimmungen nachzugehen. Diese Hinweise betrafen eine sehr...

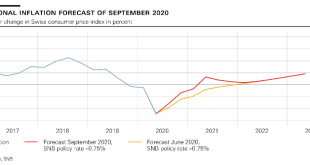

Read More »Monetary policy assessment of 24 September 2020

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic continues to exert a strong influence on economic developments. The SNB is therefore maintaining its expansionary monetary policy. In so doing, it aims to cushion the negative impact of the pandemic on economic activity and inflation. The SNB is keepingthe SNB policy rate and interest on sight deposits at the SNB at −0.75%.In view of the fact that the Swiss franc is still highly...

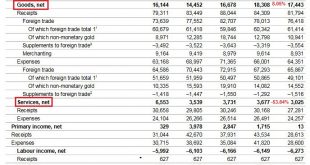

Read More »Swiss balance of payments and international investment position: Q2 2020

Current Account Key figures: Current Account: Down 52.14% against Q2/2019 to 9.878 bn. CHF of which Goods Trade Balance: Minus 13.55% against Q2/2019 to 15.193 bn. of which the Services Balance: Minus 39.69% to 1.158 bn. of which Investment Income: Minus 70.07% to 3.012 bn. CHF. Current Account Switzerland Q2 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, )...

Read More »Versicherungsmarkt Schweiz: deutlich höhere Ergebnisse

Die aggregierten Daten über den Schweizer Versicherungsmarkt zeigen eine deutliche Steigerung der Ergebnisse 2019. Diese fallen pro Teilbranchen zwar unterschiedlich aus, sind aber hauptsächlich auf die Ergebnisse am Kapitalmarkt zurückzuführen. Dies und weitere Statistiken zum Versicherungsmarkt zeigt der heute veröffentlichte Versicherungsmarktbericht der Eidgenössischen Finanzmarktaufsicht FINMA. Die schweizerischen Versicherungsunternehmen erzielten im...

Read More »Umsetzung FIDLEG/FINIG: FINMA bewilligt erste Aufsichtsorganisationen

Die Eidgenössische Finanzmarktaufsicht FINMA erteilt OSIF und OSFIN die ersten Bewilligungen als Aufsichtsorganisationen, zuständig für die Aufsicht über Vermögensverwalter und Trustees. Weiter liess sie die erste Registrierungsstelle für Kundenberaterinnen und Kundenberater zu. Das Eidgenössische Finanzdepartement anerkannte ausserdem die ersten Ombudsstellen nach FIDLEG für Finanzdienstleister. Die FINMA erteilt dem Organisme de Surveillance des Instituts...

Read More »Willkommen in einer Zukunft ohne Zins

Die SNB, die EZB und andere Zentralbanken erwarten auch langfristig keine Zinswende – und machen Nullzinsen zur Regel. Eine Übersicht der Prognosen. Hält sich die Option offen, die Leitzinsen noch tiefer ins Minus zu senken: Die EZB in Frankfurt. Foto: Keystone Diese Woche ist die Welt einer Zukunft ohne positive Zinssätze ein Stückchen näher gerückt. Schwedens Notenbank erneuerte ihren Zinspfad. Erstmals geht sie davon aus, dass sie den Leitzins mindestens bis...

Read More »Swiss Balance of Payments and International Investment Position: Q1 2020

Current Account Key figures: Current Account: Down 13.72% against Q1/2019 to 17.4 bn. CHF of which Goods Trade Balance: Plus 8.05% against Q1/2019 to 17.4 bn. of which the Services Balance: Minus 53.84% to 3.02 bn. of which Investment Income: Minus 0.54% to 6.3 bn. CHF. Current Account Switzerland Q1 2020(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch...

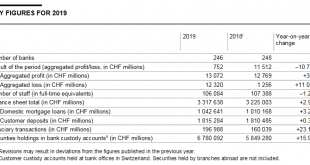

Read More »Banks in Switzerland 2019

The Swiss National Bank has today published its report Banks in Switzerland 2019 and the corresponding data for its annual banking statistics.1 The most important figures are summarised below. 1The figures in Banks in Switzerland are based on data in banks’ (parent companies’) individual financial statements, as required by law. The reporting entity ‘parent company’ includes bank offices in Switzerland and legally dependent branches abroad. Banks’ consolidated...

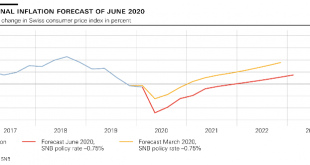

Read More »Swiss National Bank forecasts deflation until 2022

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market. The coronavirus pandemic has led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The bank presented a new lower inflation forecast than the one it issued in March 2020. The red line in the chart above shows deflation exceeding...

Read More »SNB Monetary Policy Assessment June 2020 and Videos

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic and the measures implemented to contain it have led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The SNB’s expansionary monetary policy remains necessary to ensure appropriate monetary conditions in Switzerland. The SNB is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and in light of the highly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org