Many economists think the Federal Reserve can use Phillips Curve tradeoffs between inflation and unemployment to guide Fed macro stabilization policy. Inflationary Fed policies may act as a monetary stimulus, to regulate unemployment. Data from 1948 to 1985 indicates that the Phillips Curve doesn’t actually exist. Does the data since 1985 reveal stable Phillips Curve tradeoffs- estimates of the effects of inflation on unemployment that may guide future policies?Monthly inflation data from 1985 to 1992 correlates with unemployment concurrently at a rate of 20% (see figure 7 below). Year over year inflation data from 1985 to 1992 correlates with unemployment at a rate of 52% (see figure 8). The estimate in figure 8 assumes that unemployment rates

Topics:

D.W. MacKenzie considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Many economists think the Federal Reserve can use Phillips Curve tradeoffs between inflation and unemployment to guide Fed macro stabilization policy. Inflationary Fed policies may act as a monetary stimulus, to regulate unemployment. Data from 1948 to 1985 indicates that the Phillips Curve doesn’t actually exist. Does the data since 1985 reveal stable Phillips Curve tradeoffs- estimates of the effects of inflation on unemployment that may guide future policies?

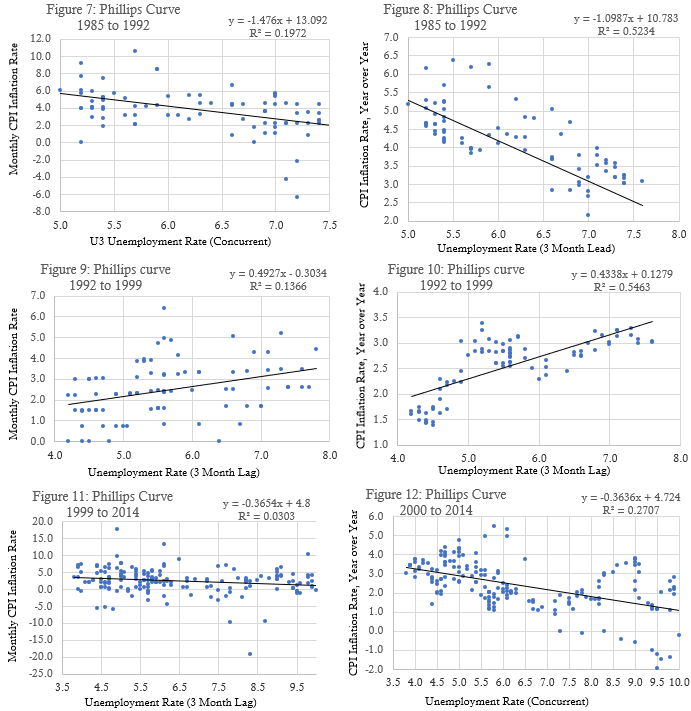

Monthly inflation data from 1985 to 1992 correlates with unemployment concurrently at a rate of 20% (see figure 7 below). Year over year inflation data from 1985 to 1992 correlates with unemployment at a rate of 52% (see figure 8). The estimate in figure 8 assumes that unemployment rates lead by three months- but the correlation between inflation and unemployment in figure 8 diminishes without this three month lead. The Phillips Curve in figure 8 offers greater precision, but Fed officials obviously can’t use lagging inflation rates to regulate leading unemployment rates.

Inflation leads unemployment for Phillips Curves from 1992 to 1999. With inflation leading for a time officials might use inflation to target desired unemployment rates. But, other problems exist with 90’s Phillips Curve data. The data points in figure ten exhibit an odd pattern, and the line of best fit in figure ten points in the wrong direction. The data points in figure nine have a “normal dispersion” around the line of best fit, but the correlation for unemployment and monthly inflation during the 90’s is only 13.6% and the line of best fit in figure 9 also points in the wrong direction. The Phillips Curve relation doesn’t merely shift for the 1990’s, it rotates far enough to create a positive relation between unemployment and inflation.

Phillips Curve tradeoffs reappear from 1999 to 2014. Monthly unemployment lags inflation at the beginning of the 21st century, but with a measly correlation of only 3% (see figure 11). Year over year inflation correlates concurrently with unemployment at a decent rate of 27%, from 2000-2014. Does the reappearance of the Phillips Curve at the start of the 21st Century enable officials to formulate useful stabilization policies. No. Examination of unemployment and inflation data from 1948 to 2014 tells us that Phillips Curves are unstable in terms of correlation coefficients, slope coefficients, lead-lag relationships, and in terms of different measures of inflation. The data on Phillips Curve tradeoffs since 2014 is not useful to policymakers either. Available data indicates that there is no scientifically measurable basis for predicting the effects of Fed policy on future economic conditions. How can the Fed use an unstable and unpredictable Phillips Curve “relation” to stabilize future economic conditions?

Economists gave up trying to use Phillips Curve tradeoffs to “fine tune the economy” when we accepted that Phillips Curves shift. Many economists still insist that they can “coarse tune the economy”. Inflation/unemployment data for the 1948-2023 time period fits Lucas’s critique and dismissal of all Phillips Curves. Friedman’s theory of a shifting Phillips Curve seriously underestimates the instability of this alleged curve. The best course of action for contemporary economists would be to admit that there is no real basis for even the modest Fed policy goal to coarse tune the macroeconomy. The Fed should simply target zero inflation, or be disbanded.

Note: The views expressed on Mises.org are not necessarily those of the Mises Institute.

Tags: Featured,newsletter