Both the current President and his predecessor claim credit for low unemployment. To what extent are recent lows in unemployment rates due to the policies of these two Presidents’ policies?There are several causes of low unemployment. First, reducing minimum wage rates lowers unemployment, mostly for teens. Higher minimum wage rates correlate with higher unemployment rates (see the next graph). The real purchasing power of the current $7.25 minimum wage is nearly at an all-time low (see the second graph below). Inflation has devalued the real minimum wage, especially in the past few years. Also, Congress hasn’t raised the money rate of the Federal minimum wage in many years. Unemployment rates have risen since April 2023, but so have some state

Read More »Articles by D.W. MacKenzie

Overtime Tax Exemption: Pros and Cons

September 30, 2024Former President Trump has proposed exempting overtime income from taxation. Is this a good idea? Some economists may point out that exempting overtime hours from taxation targets marginal labor supply. Increasing marginal take home pay from taxes encourages work, can increase aggregate supply and economic growth.Other economists may point out that overtime hours are highly cyclical; tax revenue from overtime hours rises during economic booms and falls during recessions. What this means is that exempting overtime hours from taxation automatically increases budget deficits leading into a recession, and automatically decreases budget deficits going into an economic boom. Economists who still cling to the Demand Side theory of John Maynard Keynes

Read More »Who Caused the Recent Wave of Inflation?

September 5, 2024A study from The Federal Reserve Bank of San Francisco claims that most of the price inflation that plagued the US economy over the past few years was due to global supply chain disruptions, due to the Covid-19 pandemic. Is this a valid study, or an attempt by the Fed to evade responsibility for our recent economic troubles?There are several problems with this study. First, this study aims at establishing a correlation between supply chain disruptions and “above trend” price-inflation rates. The two-percent trend used in this study is actually just the minimum rate of inflation that the Fed has targeted deliberately since 1996. It is disingenuous for the Fed to treat the two-percent minimum inflation rate that it chose as a “trend,” for which it lacks

Read More »Food Price Controls are a Losing Issue

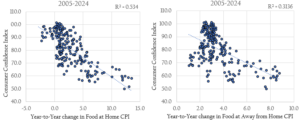

September 5, 2024The central problem with government economic policies is that many bad economic policies are politically advantageous. Hence, politicians enact policies that many of them know don’t work just to stay in power. Price controls are bad economic policy. Democrat Presidential candidate Kamala Harris wants to empower the Federal Trade Commission to stop “food price gouging” with what would amount to price ceilings.Price ceilings cause shortages of goods and wasteful queuing, in this case for food. Why might such a bad policy win Harris, or any candidate, votes? First, many people don’t understand economics, don’t understand why price controls are bad policy. Second, a majority or people want government to secure a supply of affordable food. Consequently, increases in

Read More »Greedflation and Debtflation are Nonsense

August 21, 2024Popular discussions of inflation and the economy have produced more heat than light, if not heat and darkness. President Biden has made multiple remarks on his record, which taken singly are each incorrect. Taken together, Biden’s remarks on Bidenomics are incoherent.Biden claims that his main fiscal stimulus policy, the American Recovery Plan delivered record reductions in unemployment without causing inflation. Biden has insisted that corporate greed (Greedflation) caused the recent wave of price inflation. Biden also claims credit for deficit reduction. There is little evidence of fiscal stimulus working, ever. There is a theory in economics according to which larger fiscal deficits increase total spending, and this increases economic activity and reduces

Read More »Reich vs Reality: Free Markets Work Best

July 25, 2024Robert Reich recently asserted that “free markets” aren’t neutral or free, are actually shaped by those who wield power. Reich believes that government powers have been subverted by private interests- this part of his analysis is actually true in many cases. Reich hopes for some sort of miracle whereby countervailing government powers will work in the public interest to suppress greedy monopolists- this part of his analysis is delusional and dangerous.Reich ignores the reality that governmental involvement in the economy of each nation varies. Some countries, like North Korea, have government run economies. Other nations, like Taiwan and Ireland, have far less governmental involvement in their economies. Scholars in several think tanks have

Read More »The SCOTUS Chevron Decision: Pros and Cons

July 4, 2024Many people who appreciate free markets are hailing the recent Chevron decision. Striking down Chevron curtails the powers of many officials in regulatory agencies, but how does this really affect entrepreneurs and markets? There are two important things to note here. First, striking down Chevron didn’t remove any regulations from US industry, this ruling transferred powers to interpret regulatory rules. Second, there are two sides to regulatory capture.Former lobbyist Jack Abramoff has pointed out that entrepreneurs lobby for two reasons. Sometimes entrepreneurs’ lobby regulatory agencies to gain an advantage over rivals. Other times entrepreneurs lobby regulatory agencies just to be left alone. Most entrepreneurs engage in regulatory capture

Read More »The Latest BLS Unemployment Report, More Signs of Recession

June 13, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Robert Reich is Wrong, and Dangerous

June 11, 2024Robert Reich has embarked on an intellectual journey- he intends to debunk 10 economic myths. The first of these 10 supposed myths is the idea that economics is a value free objective science. Reich offers a brief history lesson, in which he describes how Adam Smith developed economics as a branch of moral philosophy . Patrick Carroll has pointed out that Reich’s argument entails a fallacious appeal to tradition. Reich’s reference to Adam Smith is also argument by authority. Adam Smith did play a large role in developing economics, but his economics was flawed and should not be merely accepted.Reich also commits the moralistic fallacy. The moralistic fallacy is the idea that if something is “good” or morally desirable it must also be natural or at least feasible.

Read More »The Folly of Federal Reserve Stabilization Policy: Part II 1985-2023

March 4, 2024Many economists think the Federal Reserve can use Phillips Curve tradeoffs between inflation and unemployment to guide Fed macro stabilization policy. Inflationary Fed policies may act as a monetary stimulus, to regulate unemployment. Data from 1948 to 1985 indicates that the Phillips Curve doesn’t actually exist. Does the data since 1985 reveal stable Phillips Curve tradeoffs- estimates of the effects of inflation on unemployment that may guide future policies?Monthly inflation data from 1985 to 1992 correlates with unemployment concurrently at a rate of 20% (see figure 7 below). Year over year inflation data from 1985 to 1992 correlates with unemployment at a rate of 52% (see figure 8). The estimate in figure 8 assumes that unemployment rates

Read More »The Folly of Federal Reserve Stabilization Policy: Part I 1948-1985

March 1, 2024The Federal Reserve Board is responsible for formulating macro stabilization policy. More specifically, the Federal Reserve Board seeks tradeoffs between inflation and unemployment rates. Fed officials need meaningful data to formulate useful policies. Data on the unemployment rate that coincides with zero inflation provides a starting point for policy formulation. Fed officials also need data on the rate at which inflation reduces unemployment rates. Finally, data on any correlation between inflation and unemployment rates enables Fed officials to estimate the probability of policy success. What do economists know about all of this?Irving Fisher discovered a tradeoff between unemployment and inflation in the 1920’s.

Economists did not notice this tradeoff until