After a buoyant year 2022, sponsorship deals with blockchain and cryptocurrency companies for the Formula One (F1) race are shrinking this year on the back of high-profile collapses and turbulent markets. A Bloomberg analysis found that while all teams had at least one crypto-native sponsors in 2022, that proportion declined to 70% this year, as of June. The trend suggests that F1 may be re-evaluating its ties with the crypto industry amid the FTX scandal and a prolonged “crypto winter”. Mercedes-AMG signed in 2021 a sponsorship agreement with now bankrupt FTX but the deal was suspended last year when the exchange shut down. Mercedes team principal Torger Christian Wolff said in a statement that the collapse of FTX has left Mercedes in “utter disbelief” and that

Topics:

Fintechnews Switzerland considers the following as important: 6c.) Fintechnews, Blockchain/Bitcoin, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

After a buoyant year 2022, sponsorship deals with blockchain and cryptocurrency companies for the Formula One (F1) race are shrinking this year on the back of high-profile collapses and turbulent markets.

A Bloomberg analysis found that while all teams had at least one crypto-native sponsors in 2022, that proportion declined to 70% this year, as of June. The trend suggests that F1 may be re-evaluating its ties with the crypto industry amid the FTX scandal and a prolonged “crypto winter”.

Mercedes-AMG signed in 2021 a sponsorship agreement with now bankrupt FTX but the deal was suspended last year when the exchange shut down. Mercedes team principal Torger Christian Wolff said in a statement that the collapse of FTX has left Mercedes in “utter disbelief” and that the sector needs to be regulated.

“We considered FTX because they were one of the most credible and solid, financially sound partners that were out there,” Wolff said.

“Out of nowhere we can see that a crypto company can basically be on its knees and gone [in] one week. That shows how vulnerable the sector still is. It’s unregulated and I believe it needs to find its way into regulations because there’s so many customers, investors and partners like us that have been left in utter disbelief at what has happened.”

According to filings, Mercedes may now have a claim in FTX’s bankruptcy process. Going into 2023, the team has no crypto-native sponsor for this year’s race.

FTX, a crypto exchange once worth US$32 billion, went under in November 2022 after a dramatic series of events led to a run on deposits and a selloff of FTT, its in-house crypto token. It has been estimated that US$8 billion of customer’s funds was missing.

An analysis by Decrypt shows that before its collapse, FTX spent big bucks on sports sponsorships, inking deals with the likes of Miami Heat, Major League Baseball, the Golden State Warriors, the Washington Wizards and Capitals, and giant esports team TSM. Star athletes like Tom Brady, Steph Curry, and Naomi Osaka also signed on to endorse the exchange in return for equity in the startup.

Besides Mercedes, Ferrari is another team that’s bearing the brunt of the volatile market. In January, the team’s long-term arrangement with Velas came to an abrupt end, with sources telling London Insider that the blockchain company forced its way out of the deal amid the crypto bear market.

AlphaTauri also lost its crypto sponsor, removing smart contract platform Fantom from its list of partners earlier this year; Alfa Romeo dropped its sponsor, Vauld, following troubles at the crypto lender in 2022; Red Bull Racing terminated earlier than expected the multi-year agreement it signed in 2021 with blockchain network Tezos; and Animoca Brands, which had been operating a licensed non-fungible token (NFT) game called F1 Delta Time since 2019, shut down the game last year.

Cryptocurrencies witnessed a tumultuous year 2022, marked by a series of high-profile business failures and slumping markets. Total market capitalization was cut in half last year, starting off 2022 at US$2.2 trillion to hit an annual low of US$1 trillion in November, according to a report by The Block.

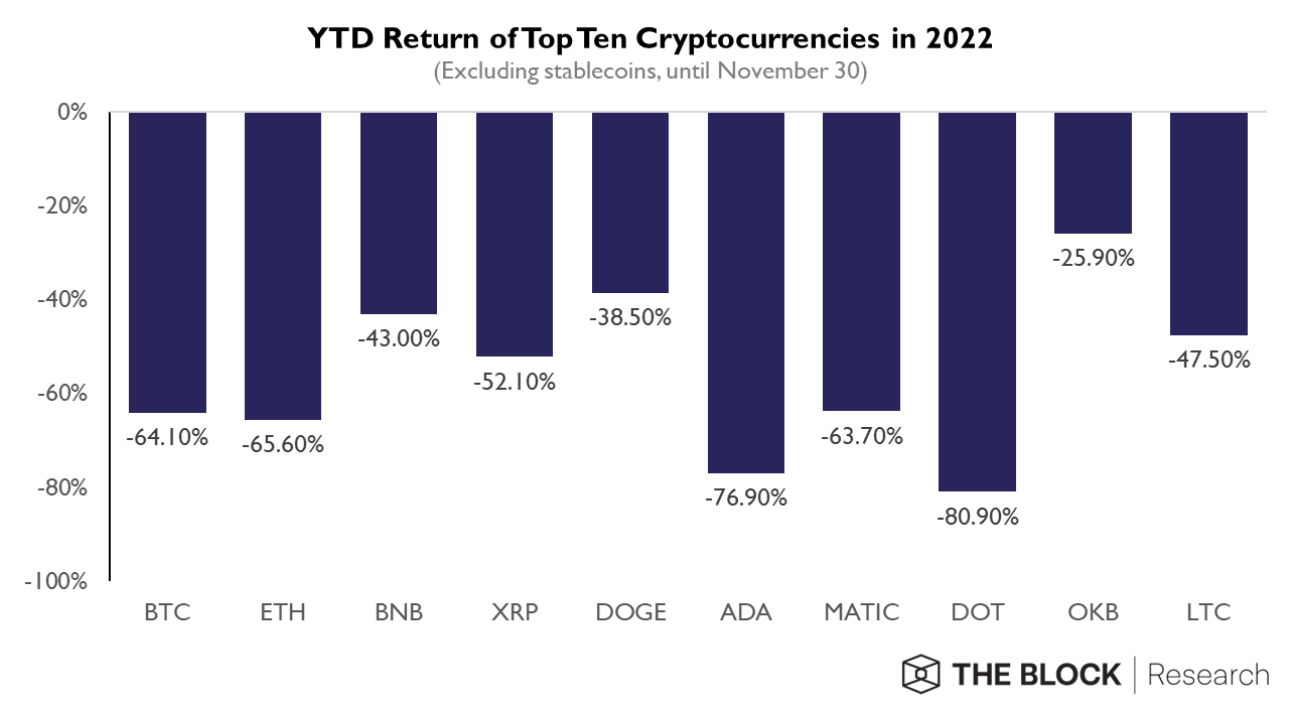

Bitcoin fell below its 2017-high in June 2022 and extended its drawdown to -64.1% year-to-date (YTD). All the top ten cryptocurrencies by market capitalization, excluding stablecoins, generated negative returns last year with Polkadot taking the biggest hit (-80.9%), followed by Cardano (-76.9%) and Ethereum (-65.6%).

Year-to-date return of top ten cryptocurrencies in 2022, Source: 2023 Digital Asset Outlook, The Block, Dec 2022

While some crypto startups are scaling back on their marketing spend, others are still aggressively investing in sports marketing.

In March, crypto exchange Kraken announced a new sponsorship and Web3 deal with Williams Racing, making it the team’s first-ever official crypto and Web3 partner. Stake, an online casino and sports betting platform dealing exclusively with cryptocurrencies, entered a multi-year partnership with Alfa Romeo in January. Meanwhile, deals including the US$150 million partnership between Red Bull Racing and crypto exchange Bybit, and Tezos’s arrangement with McLaren, are still alive.

Featured image credit: edited from Freepik

The post Formula 1 Sponsorship Deals with Blockchain Companies Shrink Amid Crypto Scandals and Bear Market appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Tags: Blockchain/Bitcoin,Featured,newsletter