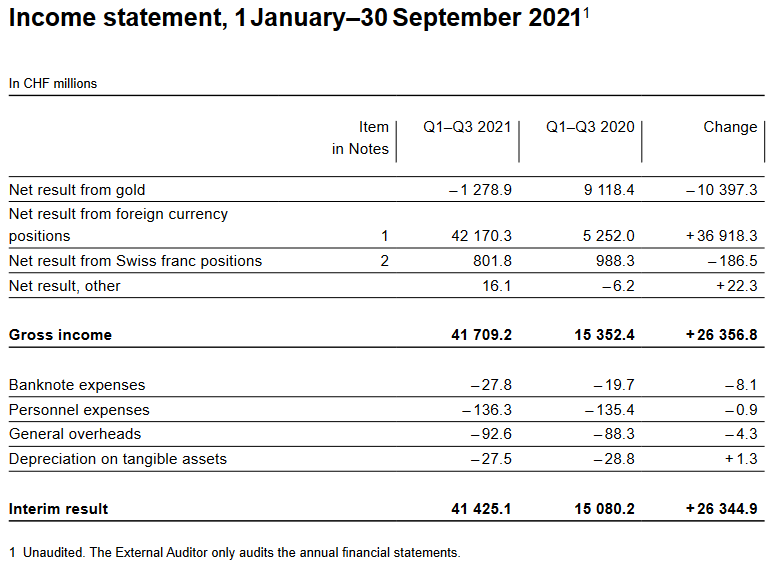

Confederation and cantons to receive distribution of CHF 6 billion According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion. The allocation to the provisions for currency reserves will be CHF 8.7 billion. After taking into account the distribution reserve of CHF 90.9 billion, the net profit will be over CHF 108 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit

Topics:

Swiss National Bank considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Confederation and cantons to receive distribution of CHF 6 billion

Confederation and cantons to receive distribution of CHF 6 billion

According to provisional calculations, the Swiss National Bank will report a profit in the order of around CHF 26 billion for the 2021 financial year. The profit on foreign currency positions amounted to just under CHF 26 billion. A valuation loss of CHF 0.1 billion was recorded on gold holdings. The net result on Swiss franc positions amounted to over CHF 1 billion.

The allocation to the provisions for currency reserves will be CHF 8.7 billion. After taking into account the distribution reserve of CHF 90.9 billion, the net profit will be over CHF 108 billion. This will allow a dividend payment of CHF 15 per share, which corresponds to the legally stipulated maximum amount, as well as a profit distribution to the Confederation and the cantons totalling CHF 6 billion.

The overall profit distribution of CHF 6 billion corresponds to the maximum distribution in accordance with the agreement between the Federal Department of Finance and the SNB of 29 January 2021. Of the total amount to be distributed (CHF 6 billion), one-third goes to the Confederation and two-thirds to the cantons. After these payments, the distribution reserve will amount to over CHF 102 billion.

A detailed report on the annual result with definitive figures will be released on 7 March 2022; the Annual Report will be published on 22 March 2022.

Tags: Featured,newsletter