The Swiss National Bank is today publishing financial accounts data for Q4 2021. Data on household wealth are thus available for the whole of 2021; a commentary is provided below. This is followed by a detailed look at the development of the financial net worth of the Swiss economy’s institutional sectors since the onset of the coronavirus pandemic. Financial wealth of households increased significantly in 2021 Household financial assets increased by CHF 202 billion to CHF 3,037 billion (up 7.1%) in 2021. This significant rise was due to both capital gains and transactions: On the one hand, households benefited from rising stock market prices; on the other, they purchased securities and increased their occupational pension entitlements. The increase observed in

Topics:

Swiss National Bank considers the following as important: 1) SNB and CHF, 1.) SNB Press Releases, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

The Swiss National Bank is today publishing financial accounts data for Q4 2021. Data on household wealth are thus available for the whole of 2021; a commentary is provided below. This is followed by a detailed look at the development of the financial net worth of the Swiss economy’s institutional sectors since the onset of the coronavirus pandemic.

Financial wealth of households increased significantly in 2021

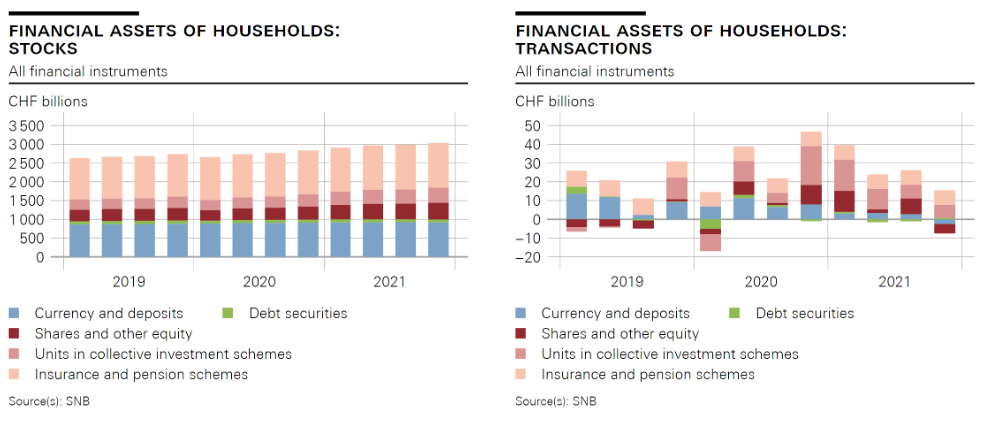

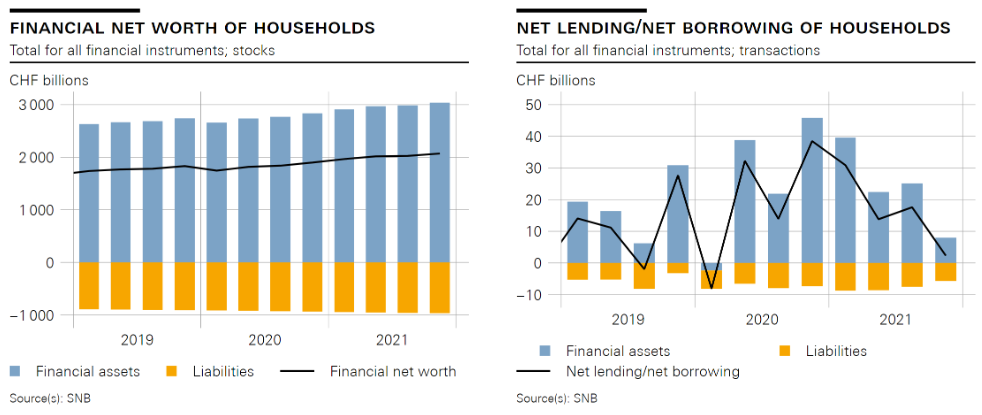

Household financial assets increased by CHF 202 billion to CHF 3,037 billion (up 7.1%) in 2021. This significant rise was due to both capital gains and transactions: On the one hand, households benefited from rising stock market prices; on the other, they purchased securities and increased their occupational pension entitlements. The increase observed in the previous year thus continued. |

|

| Household liabilities, mainly mortgages, grew steadily over the course of 2021. Overall, they rose by CHF 31 billion to CHF 967 billion (up 3.3%).

Financial net worth (financial assets less liabilities) thus increased by CHF 171 billion to CHF 2,070 billion (up 9.0%). The share of the increase in financial net worth due to transactions – designated ‘net lending/net borrowing’ – amounted to CHF 65 billion in 2021. This figure is high by historical standards, as in 2020 when it came to a record total of CHF 77 billion. This development is in line with the high savings rate of households during the coronavirus pandemic. |

|

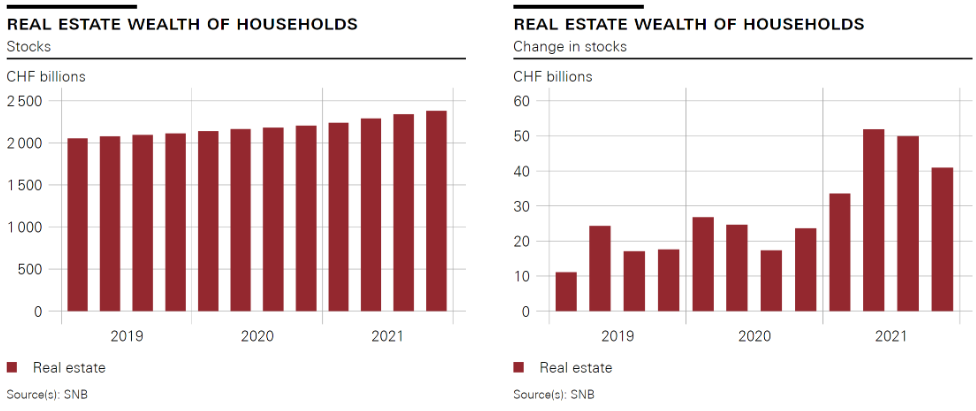

New high for household real estate wealth

Alongside financial assets, real estate assets play an important role in household wealth. At the end of 2021, the market value of real estate assets held by households rose to a new high of CHF 2,382 billion (up CHF 176 billion). This year-on-year increase of 8% was due in particular to rising property prices. |

|

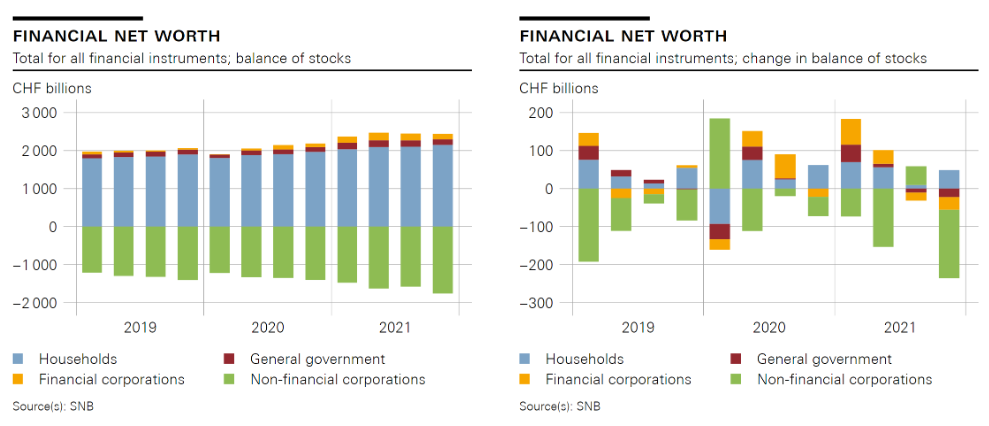

Development of financial net worth of domestic sectors since onset of coronavirus pandemicIn addition to household wealth, the Swiss financial accounts also show the financial assets and liabilities of the domestic sectors of the economy, as both stocks and flows. How has the financial net worth of the sectors evolved since the onset of the coronavirus pandemic? Between end-2019 and end-2021, the financial net worth of the domestic sectors increased by a total of CHF 21 billion to CHF 679 billion (up 3.1%). An increase was recorded for households1 (up CHF 252 billion or 13.3%), financial corporations (up CHF 105 billion or 263.4%) and general government (up CHF 20 billion or 15.5%), with all sectors benefiting from capital gains. The financial net worth of the general government sector recorded a new high at the end of 2021; the issuance of debt securities (transactions) was offset by capital gains – especially on the shares in SNB equity capital.2 The strong rise in the financial net worth of financial corporations was due not only to capital gains but also to a reduction in liabilities: Foreign investors reduced their participating interests in financial corporations in Switzerland. The financial net worth of non-financial corporations, on the other hand, decreased over the last two years by CHF 356 billion or 25.3%. Structurally, non-financial corporations have negative financial net worth, as – by definition – non-financial assets do not count towards financial net worth and their equity capital is recorded at market value. The higher stock market prices therefore caused a corresponding rise in financial liabilities and thus a decline in the financial net worth of non-financial corporations. 1 Incl. non-profit institutions serving households |

Data offering on Switzerland’s financial accounts

Data on the financial accounts and household wealth can be accessed on the data portal in the form of charts and configurable tables. Annual data are currently available for the period 1999 to 2021. Quarterly data are available from Q4 2014 to Q4 2021. Detailed notes on the methods used for the financial accounts and information on changes and revisions can also be found on the data portal.

Tags: Featured,newsletter