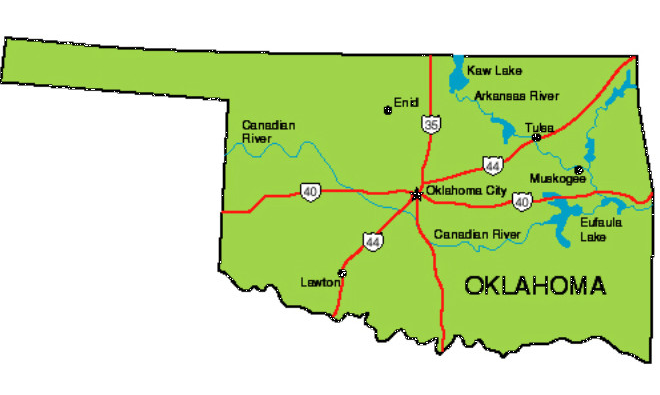

(Oklahoma City, Oklahoma — January 20, 2022) – An Oklahoma state representative introduced legislation today that would enable the State Treasurer to protect Sooner State funds from inflation and financial risk by holding physical gold and silver. Introduced by Rep. Sean Roberts, HB 3681 would include physical gold and silver, owned directly, to the list of permissible investments that the State Treasurer can hold. Currently, Oklahoma money managers are largely relegated to investing in low-yield, dollar-denominated debt instruments. Other than Ohio, no state is currently known to hold any precious metals, even as inflation and financial turmoil accelerate globally. Yes, Oklahoma’s own investment guidance prescribes safety of principal as a primary objective for

Topics:

Jp Cortez considers the following as important: 6a) Gold & Monetary Metals, 6a.) Gold Standard, Featured, newsletter

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

(Oklahoma City, Oklahoma — January 20, 2022) – An Oklahoma state representative introduced legislation today that would enable the State Treasurer to protect Sooner State funds from inflation and financial risk by holding physical gold and silver.

Introduced by Rep. Sean Roberts, HB 3681 would include physical gold and silver, owned directly, to the list of permissible investments that the State Treasurer can hold. Currently, Oklahoma money managers are largely relegated to investing in low-yield, dollar-denominated debt instruments.

Other than Ohio, no state is currently known to hold any precious metals, even as inflation and financial turmoil accelerate globally. Yes, Oklahoma’s own investment guidance prescribes safety of principal as a primary objective for investment of public funds.

“Currency debasement caused by federal monetary and fiscal policies has created an imminent risk of a substantial erosion in the value of Oklahoma’s investment holdings,” said Jp Cortez, policy director of the Sound Money Defense League.

“With most taxpayer funds currently held in debt paper carrying a negative real return, Oklahoma would be prudent to hedge today’s serious inflation risks with an allocation to the monetary metals.”

HB 3681 simply adds the authority to hold physical gold and silver bullion directly – and in a manner that does not assume the counterparty and default risks involved with other state holdings. Rep. Roberts’ measure does not grant authority to buy mining stocks, futures contracts, or other gold derivatives.

Additionally, HB 3681 prescribes safekeeping and storage requirements. The State Treasurer would hold the state’s bullion in a qualifying, insured, and independently audited depository, free of any encumbrances and physically segregated from other holdings.

Oklahoma has become a sound money hotspot, already earning 11th place on the 2021 Sound Money Index.

The Sooner State ended sales taxes on purchases of precious metals long ago. This week, Sen. Nathan Dahm introduced SB 1480, a measure to remove Oklahoma state income taxes from the exchange or sale of gold and silver sales.

The Sound Money Defense League and Money Metals Exchange strongly support these pro-sound money measures in Oklahoma and are actively working to ensure their success. Tennessee, Mississippi, Kentucky, and Alabama are just a few of the other states fighting their own sound money battles in 2022.

Tags: Featured,newsletter