(Disclosure: Some of the links below may be affiliate links) Investart is a new online Robo-advisor service that lets you invest in Exchange Traded Funds (ETFs) for free! And not only that! They actually let you invest with custom strategies. So, you could use it either as a Robo-advisor or as a broker for ETFs! I only recently discovered this service. But it looks exciting. I even started investing some money myself. So, it is time I review Investart. In this article, I will review Investart in-depth, with its advantages and disadvantages, and compare it against similar services! This article was written in collaboration with Investart. Investart Investart is a Swiss company founded in 2016 by Richard Toolen. The service was publicly launched in 2019. And in

Topics:

Mr. The Poor Swiss considers the following as important: 9) Personal Investment, 9) The Poor Swiss, Featured, Investing, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

(Disclosure: Some of the links below may be affiliate links)

Investart is a new online Robo-advisor service that lets you invest in Exchange Traded Funds (ETFs) for free! And not only that! They actually let you invest with custom strategies. So, you could use it either as a Robo-advisor or as a broker for ETFs!

I only recently discovered this service. But it looks exciting. I even started investing some money myself. So, it is time I review Investart.

In this article, I will review Investart in-depth, with its advantages and disadvantages, and compare it against similar services!

This article was written in collaboration with Investart.

Investart

Investart is a Swiss company founded in 2016 by Richard Toolen. The service was publicly launched in 2019. And in 2021, they announced that they dropped their fees to zero!

Since they are not charging management fees, they have to make money with other services. Indeed, they are proposing several financial services:

- Financial consultation

- Pension planning

- Wealth planning

So, you could invest your money there and then consult with them to plan your financial life and your future investments in the future. Keep in mind that I have not tested their paid services, only their online investment platform.

If you want more information on the company itself, I interviewed Investart CEO Richard Toolen. This should give you more information on this service.

Investing with Investart

So, let’s review how you can invest with Investart.

The interesting thing is that Investart is a Robo-Advisor, not a broker. But it can do a little bit of both. And it can do it well. I would say that Investart is a portfolio investing service. The service can create a portfolio for you, or you can create a portfolio, and the service will automatically invest your money into the portfolio.

There are three ways to invest with Investart:

- Accumulate. You can set a target amount of money you want to reach as well as your target date. They will then derive a portfolio and an amount to invest each month to reach this amount on your target date.

- Grow. You can set an initial investment and a monthly investment, and the service will create a portfolio for you to grow this money.

- Manage yourself. You can create your own portfolio from scratch and choose your ETFs.

Moreover, if you use the Accumulate or Grow methods, you can choose between Conservative, Balanced or Aggressive strategies. In that case, the allocation to bonds will vary. Given the current state of bonds, I would think it would be better to keep CHF cash. But this is not a huge deal since most Robo-Advisors are doing the same thing.

Indeed, even if you start from Accumulate or Grow methods, you can modify the portfolio and switch to a Manage Yourself strategy. That way, if you do not like the bonds, you can switch them over to cash. Of course, you will then have to manage your portfolio yourself.

| Your assets will be rebalanced for both Grow and Accumulate methods if they deviate too much (more than 5%) from the target allocation.

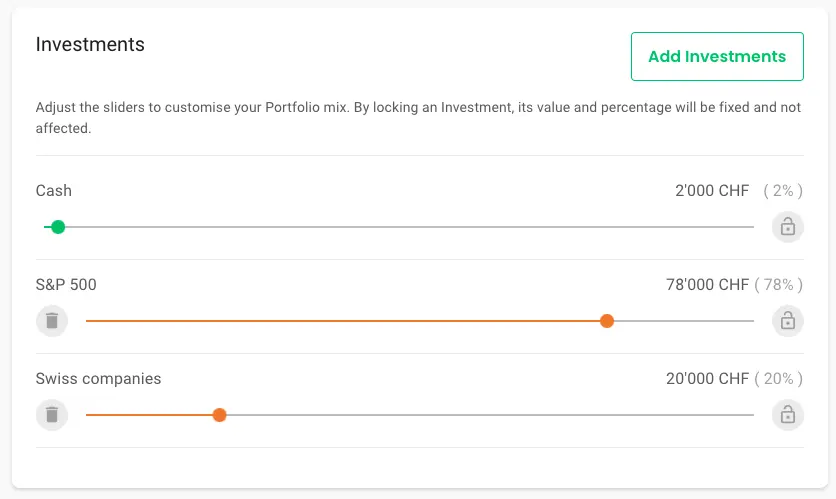

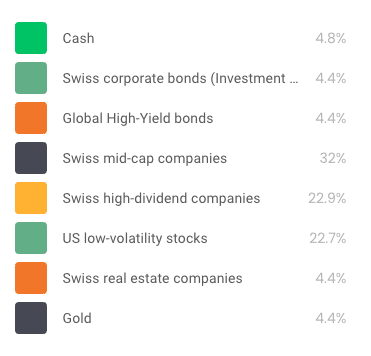

With a custom portfolio, rebalancing is semi-automatic. Once your current allocation deviates more than 5% from the target allocation, you have the option to rebalance. You will then be able to trigger the rebalance yourself from the web interface. Rebalancing is checked daily. So, it means you cannot change your portfolio during the day and expect changes to be done. This is an excellent thing since this will prevent intra-day trading, which is not a good idea. Here is an example of an Aggressive Grow portfolio that Investart generated for me: |

Example of an Investart aggressive portfolio |

| This is a typical portfolio, although probably a little overcomplicated for me. The amount of bonds is too high for my case. I do not think an aggressive portfolio should need any bond or gold. And it could have a better international diversification. However, this is a typical portfolio generated by most investing models. If you look at other Swiss Robo-Advisors, they will always add bonds to a portfolio. So. I am not surprised by this portfolio.

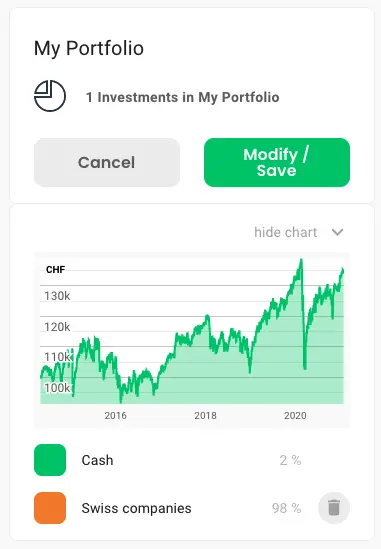

But again, this is not a huge deal since more involved investors can choose their own portfolios. For this, we have access to a large list of Exchange Traded Funds (ETFs). When I wrote this article, there were 70 ETFs. They have a large selection of ETFs for Switzerland, Europe, and the United States. They even have a few (4) ETFs for sustainable investing. But they plan to add more options in the future. For instance, here is one simple custom portfolio I did: |

|

You can do a lot of things with your custom portfolio. But there are a few things we should note:

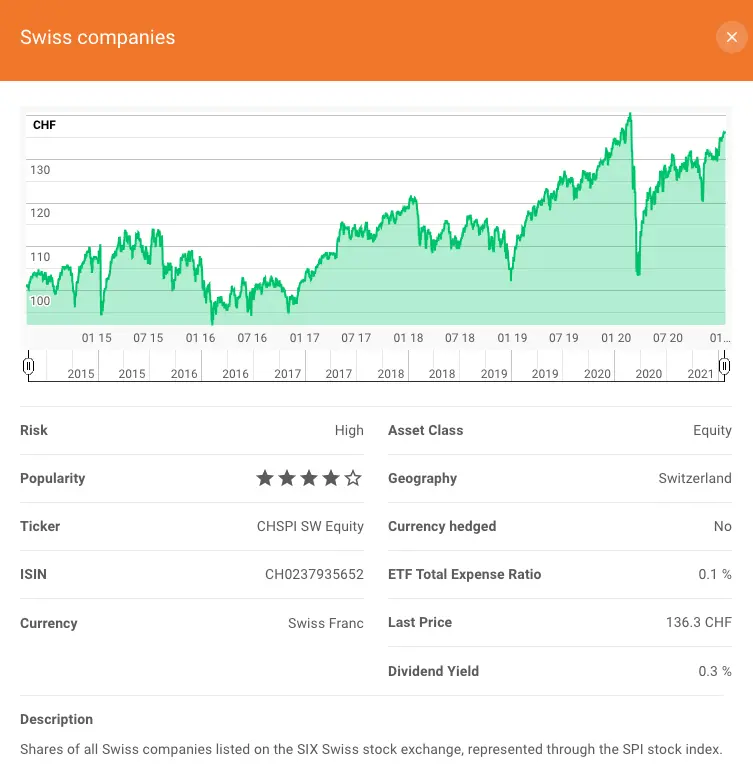

You can start investing with Investart with at least 2000 CHF. It is not possible to invest with amounts lower than this. One great thing is that they share the exact ETFs they are investing into. For instance, the Swiss Companies block is investing in CHSPI, my favorite ETF for Swiss stocks: Overall, the investing options at Investart are excellent. For people that are not experts (or do not want to spend the time), the generated portfolios are acceptable. For others, the fact that we can create custom portfolios is really interesting. However, some limitations will make this not entirely optimal. First, we do not have access to U.S. ETFs. Unfortunately, Swiss regulations make these ETFs unavailable to retail investors. Also, many of the ETFs are currency-hedged, which may not be the best option for everybody. |

|

FeesLet’s now review the fees of investing with Investart. The best thing with Investart is that there are no fees to invest with them! Yes, you read that right, no fees! They do not charge any management fees or transaction fees. Everything is included: transaction fees, foreign exchange fees, and Swiss Stamp Tax Duty. The only fee you will pay is the fee of the ETFs you are using. And this can go very low. For instance, the CHSPI ETF (the best ETF for Swiss Stocks) only has a Total Expense Ratio of 0.1%. Such a level of fee is as good as you can get. So, Investart is going to be significantly cheaper than most other investing services. Since investing fees are extremely important, this can make a significant difference in the long-term. Create an Investart accountCreating an Investart account can be started online. To start the signup process, you can go on Investart and click the big green Sign Up button on the top right corner. Then, you will have to choose whether you want a Demo or a Real account. |

Choose between a Demo Investart account or a real account |

| The first step is to choose a username and a password. Then, you will have to verify your ID. The verification can be done with your passport or your national ID.

The verification was not smooth at all for me. I tried to do it from my computer with my webcam (full HD), and it never worked. After 10 tries, I gave up and switched to my phone, and it worked directly. So, I would encourage you to do the verification on your phone. But this means people on computers need to use two devices. After this, you will have to fill in your personal information and then your employer information. Then, you will have to give information about your net worth and your trading experience. This is fairly standard. The only weird part is that you have to set the different components of your net worth. And you have to set if they are going to contribute to the investart account. These are the same questions you get if you open an Interactive Brokers account, and Interactive Brokers mandate these questions. Then, you will have to accept all the terms and conditions. And you will have to sign the documents digitally. The final step is to upload proof of residence. Then, you will be connected to your account. You will probably see a Demo portfolio on your account. But do not worry. This portfolio will be transformed into a Real (non-demo) portfolio once funding has been getting through. The first time you log in to your account, you will also have to set up Two-Factor Authentication (2FA). This is a great idea, and it will increase your security! Your Investart account will be instantly created. However, you will need to wait for the Interactive Brokers account itself to be created. And this is a manual process at IB that can take one or two days. In my case, it took one working day to be created. In the meantime, you will have access to your account as a Demo account. You will then receive an email indicating that your account has been created, and you can deposit money on it. You have to do a bank transfer (directly to Interactive Brokers) to top up your portfolio. Once the money has been received and processed (one more working day), your account will be fully operational. Here is my funded simple portfolio: |

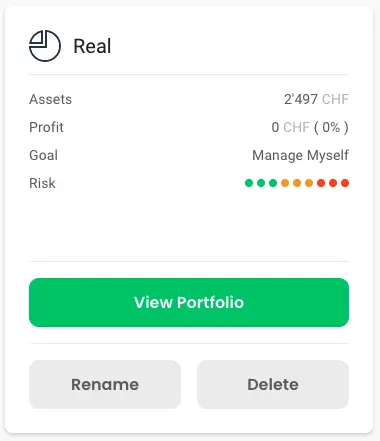

My real portfolio on Investart |

| I have funded my account with 2500 CHF, and it was invested the next day in my straightforward portfolio. I decided to invest in the CHSPI ETF (Swiss companies), which is part of my IB portfolio.

Overall, the account creation process at Investart is okay but could be improved. Several things could be improved and cleaned up. For instance, the verification process on a computer camera should be improved. It would also be great if this would be faster. But since the main bottleneck is creating the IB account and the money transfer, Investart cannot do much on the speed side. |

My straightforward portfolio on Investart |

Security

Of course, we need to look at this service’s security if we invest any money through it.

From a technical standpoint, everything looks good with Investart. They are using good encryption levels on their website. And they are sharing good information on their website about security. They are also following FINMA compliance for their network infrastructure, which is always a good thing.

One great thing is that Investart is forcing people with a real account to use a second-factor authentication! This is great since this adds a good layer of security.

I have not been able to find information about security issues with Investart. However, since they are very young, this does not mean much, even if it is already a good sign.

Your money and your shares are held by Interactive Brokers (IB) UK. Indeed, they are using IB as their trading platform for all operations. IB itself is extremely well regulated and well protected. Investart will open a dedicated IB account for each of the customers. This is excellent since this improves the segregation of assets.

The level of protection is entirely appropriate. IB UK is a member of the Financial Services Compensation Scheme (FSCS). This scheme offers compensation for up to 85’000 GBP in case of failure of IB. This a protection of slightly more than 100’000 CHF (depends on the exchange rate).

On top of that, IB UK is also part of the Securities Investor Protection Corporation (SIPC), this provides an extra level of protection. However, this may not last due to Brexit. But currently, this provides an extra 250’000 USD in protection.

Investart is regulated as an asset manager by VQF (The Financial Services Standards Association). And they are also registered with FINMA. VQF regularly audits them.

Overall, I think that investing with Investart is safe. They are taking the necessary measures to ensure the security of the invested money. The technical security is also quite good. The only thing in their disfavor is their young age as a public investment company.

Investart vs a broker

Investart is not a broker, but it lets you invest in a portfolio of ETFs. For a passive investor, it is all that matters. So, it is interesting to compare Investart with other brokers.

Compared to any brokers, Investart will be cheaper since they are no custody fees and no transaction fees. So, only a free broker could complete in that category.

However, with an actual broker, you will have access to many more ETFs than the 70 ETFs available at Investart. Now, for most people, these 70 ETFs will be enough. But if you have some niche needs, this may not be the case.

If we compare with Swiss brokers, I actually think that Investart is better for simple and passive investors. They will be much cheaper and offer enough ETFs.

If we compare with the best broker for Swiss investors, Interactive Brokers, IB still leads the way. Investart will be slightly cheaper, but IB is already very cheap. And IB will offer U.S. ETFs that will let you save more fees than what you save in transaction fees. Nevertheless, it is the only Swiss service that even comes close to IB.

So, overall, Investart could be an excellent alternative to a broker, especially a Swiss broker. That is if you can make a portfolio with the choice of 70 ETFs.

The main advantage of Investart is that it is much easier to use than a traditional broker. Here is a video by Investart that tells the difference:

Investart vs a Robo-Advisor

Investart offers the same services as a Robo-Advisor. Indeed, with the Grow and Accumulate strategies, your portfolio will be adapted based on their financial models. So, we can compare Investart with other Robo-Advisors.

From a fee point of view, Investart is going to be better than all Robo-Advisors. Since they have no management fees, they will be significantly cheaper than affordable Robo-Advisors like Selma and True Wealth.

Since they give you strong strategies, they provide the same level of features as other Swiss Robo-advisors. Having about 70 ETFs in the choice makes it very interesting. And no other Swiss Robo-Advisor gives access to U.S. ETFs, so they are all equal in that matter.

Investart has a few missing features compared to other Robo-advisors. For instance, they do not have options for sustainable investing. Also, the reporting is a little lacking compare to other Robo-Advisors to give you an overview of your finances.

The other disadvantage would be about the young age of the company compared to most-established services. But since they are well regulated, I do not think this is a big issue.

Overall, investart is much cheaper than other Swiss Robo-Advisors. As such, it has a major advantage. So, if you are looking for an affordable Robo-Advisor with a good investment portfolio, it is a good choice.

FAQ

Is Investart really free?

Yes, Investart lets you invest for free in a selection of Exchange Traded Funds (ETFs). You will not pay any transaction fees or management fees of any sort.

Since they invest in ETFs, you will still have to pay for the ETFs fees yourself (the TER).

How does Investart make money?

Since Investart is free for investing, it has to generate income in other ways. For this, they are providing paid services to their users. For instance:

- Pension planning

- Wealth planning

- Personal consultations for investing

What happens if Investart goes bankrupt?

The great thing with Investart is they are opening IB accounts in the name of each investor. So, if they went bankrupt, this money would still only belong to the user. The money would not be part of the bankruptcy settlement.

In case of bankruptcy, the user could claim the Interactive Brokers account as his own. That way, he would be able to keep his shares and continue investing. Of course, this means he would have to pay IB fees, and he would not have a managed portfolio. But this is a great way to ensure the safety of the money.

Investart Advantages

Let’s summarize the main advantages of Investart:

- No management fees

- No transaction fees

- Invest in index ETFs

- You can create your own portfolio

- Transparency on the ETFs being used

- Well-regulated

- Good technical security

Investart Disadvantages

Let’s summarize the main disadvantages of Investart:

- Very young company

- A risk that they will not survive or will introduce new fees

- No access to U.S. ETFs

- A limited set of ETFs to invest in

- Focuses on currency-hedged ETFs

- You need to keep at least 2% in cash

- Few options for sustainable investing

- Online verification process could be better from a desktop computer

- It takes a few days to open an account

Conclusion

Overall, I am very impressed by Investart! Their offer is exciting. It is actually so interesting that I just opened an account and started investing with Investart to test it.

The great thing about Investart is that it lets you invest without any management fees! Actually, without any fees of any sort! You can use Investart like a Robo-Advisor, and it will choose a portfolio based on your needs. Or you can manage your own portfolio directly.

Of course, nothing is perfect. For instance, there is no access to U.S. ETFs, and you have only a limited set (about 70) of ETFs you can invest in. Also, Investart is a very young company, and they still have to work on their business model. So, we will have to wait and see how this works in the long-term.

If you need help setting your portfolio, you can look at my guide for creating your own ETF portfolio from scratch.

What about you? What do you think about Investart?

Tags: Featured,Investing,newsletter