Swiss National Bank maintains expansionary monetary policy The SNB is maintaining its expansionary monetary policy with a view to ensuring price stability and providing ongoing support to the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The Swiss franc remains highly valued. The SNB’s expansionary monetary policy provides favourable financing conditions, contributes to an appropriate supply of credit and liquidity to the economy, and counters upward pressure on the Swiss franc. SNB Switzerland Conditional

Topics:

Swiss National Bank considers the following as important: 1.) Monetary Data, 1) SNB and CHF, Featured, newsletter, Switzerland inflation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss National Bank maintains expansionary monetary policyThe SNB is maintaining its expansionary monetary policy with a view to ensuring price stability and providing ongoing support to the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. The Swiss franc remains highly valued. The SNB’s expansionary monetary policy provides favourable financing conditions, contributes to an appropriate supply of credit and liquidity to the economy, and counters upward pressure on the Swiss franc. |

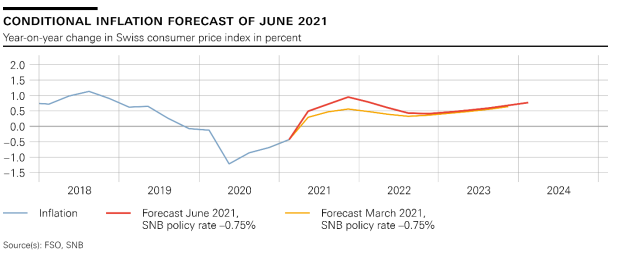

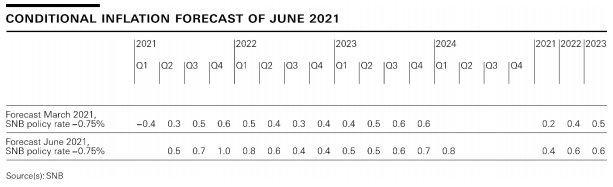

SNB Switzerland Conditional Inflation Forecast, June 2021 |

| The new conditional inflation forecast for 2021 and 2022 is slightly higher than in March.This is primarily due to higher prices for oil products and tourism-related services, as well as for goods affected by supply bottlenecks. In the longer term, the inflation forecast is virtually unchanged compared with March. The new forecast stands at 0.4% for 2021, and 0.6% for both 2022 and 2023. The conditional inflation forecast is based on the assumption that the SNB policy rate remains at −0.75% over the entire forecast horizon. |

Conditonal Inflation Forecast of June 2021 |

| Coronavirus and the measures implemented to contain it are continuing to shape the global economy more than a year after the outbreak of the pandemic. GDP shrank again in many countries in the first quarter, and remained significantly below pre-crisis levels. The pandemic situation has eased in many areas in recent months, and vaccination programmes are progressing. Containment measures have thus been gradually relaxed in many countries over the past several weeks. The SNB’s baseline scenario for the global economy anticipates that the major advanced economies will ease containment measures further through to the summer. Against this backdrop, the SNB expects strong growth in the second and third quarters. However, the after-effects of the pandemic will continue to weigh on demand for some time yet. Utilisation of global production capacity is therefore likely to only gradually return to normal. This scenario for the global economy is subject to high uncertainty, with risks on the upside and downside alike. On the one hand, further waves of infection could slow the economy once again. On the other, the monetary and fiscal policy measures implemented could support the recovery more strongly than anticipated in the baseline scenario, as could a rapid improvement in consumer and business sentiment. |

In Switzerland, too, the second wave of the pandemic interrupted the economic recovery at the beginning of the year. The tightening of containment measures led to a renewed decline in GDP in the first quarter. However, the contraction was much less pronounced than in the first wave of the pandemic in spring 2020.

The economic indicators have improved significantly of late. This is in part attributable to the easing of public health measures in Switzerland, and in part to the economic recovery abroad. Swiss GDP can therefore be expected to show strong growth in the second quarter. There are also signs of an improvement in the labour market.

In its baseline scenario for Switzerland, the SNB anticipates a continuation of the economic recovery in the second half of the year. This is also based on the assumption that the containment measures will be eased further.

Against this backdrop, the SNB expects GDP growth of around 3.5% for 2021. The upward revision compared with March is primarily attributable to the lower-than-expected decline in GDP in the first quarter. Swiss GDP is likely to return to its pre-crisis level by the middle of the year. However, production capacity will remain underutilised for some time yet.

Owing to the pandemic, the forecast for Switzerland, as for the global economy, remains subject to heightened uncertainty.

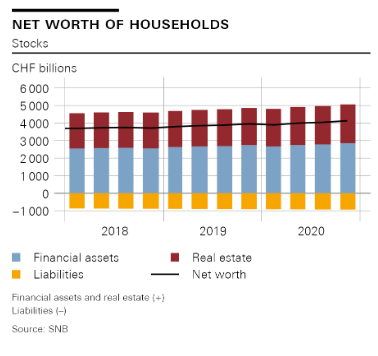

Mortgage lending and residential property prices have risen strongly in recent quarters. Overall, the vulnerability of the mortgage and real estate markets has increased further. The SNB regularly reassesses the need for the countercyclical capital buffer to be reactivated.

More detailed information on the monetary policy decision can be found in Thomas Jordan’s introductory remarks, available from 10 am. Fritz Zurbrügg’s remarks focus on the financial stability report, while Andréa Maechler’s remarks address the situation on the financial markets.

Tags: Featured,newsletter,Switzerland inflation