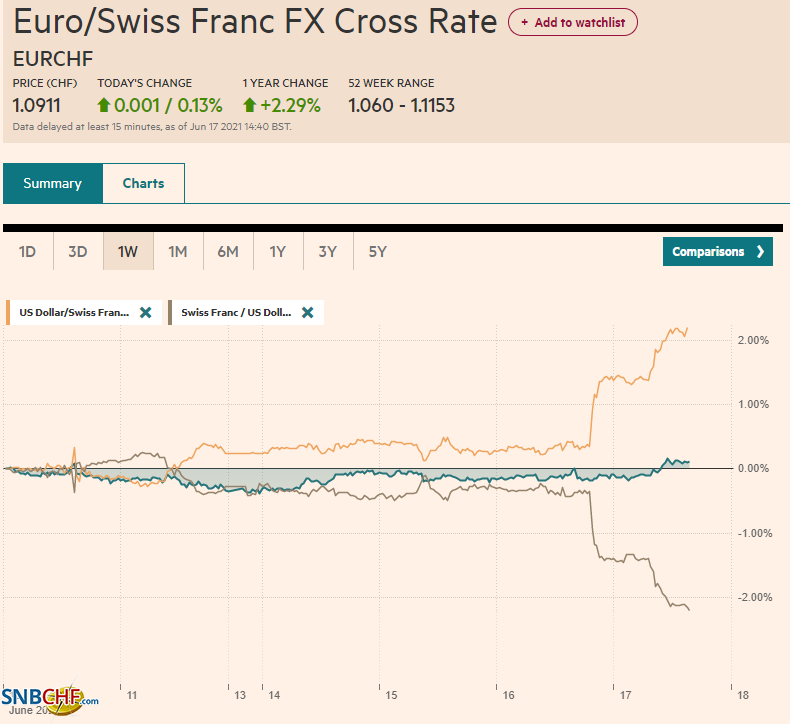

Swiss Franc The Euro has risen by 0.13% to 1.0911 EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A more hawkish than expected Federal Reserve sent the US dollar and interest rates higher and spurred an equity sell-off. The knock-on effect sent ripples through the capital markets today. Most equity markets in the Asia Pacific region fell. China, Hong Kong, and Taiwan were notable exceptions. Europe’s Dow Jones Stoxx 600 is snapping a nine-day advance, with losses led by information technology and utilities. Financials and energy sectors are posting modest gains. US futures are off around 0.3%-0.5%. The US 10-year yield jumped eight basis points yesterday, the most in three

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Brazil, China, Currency Movement, Featured, Federal Reserve, newsletter, Norges Bank, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.13% to 1.0911 |

EUR/CHF and USD/CHF, June 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: A more hawkish than expected Federal Reserve sent the US dollar and interest rates higher and spurred an equity sell-off. The knock-on effect sent ripples through the capital markets today. Most equity markets in the Asia Pacific region fell. China, Hong Kong, and Taiwan were notable exceptions. Europe’s Dow Jones Stoxx 600 is snapping a nine-day advance, with losses led by information technology and utilities. Financials and energy sectors are posting modest gains. US futures are off around 0.3%-0.5%. The US 10-year yield jumped eight basis points yesterday, the most in three months. It is slightly softer today, around 1.56%. European yields are 3-5 bp higher, while strong data from Australia (jobs) and New Zealand (Q1 GDP) saw benchmark 10-year rates jump 9 and 13 basis points, respectively. The dollar remains firm, but the Antipodean currencies and yen are showing some resilience. Emerging market currencies are lower, and the JP Morgan Emerging Market Currency Index is off for the fifth consecutive session. Gold, which had been probing $1900 at the end of last week, is now flirting with support near $1800. Iron ore prices are lower for the second day, while steel rebar fell for a third session. Copper prices are lower for the third time this week. A larger than expected draw of US inventories (-7.3 mln barrels) may be helping limit oil’s pullback. July WTI has backed off from testing $73 but remains above $71. |

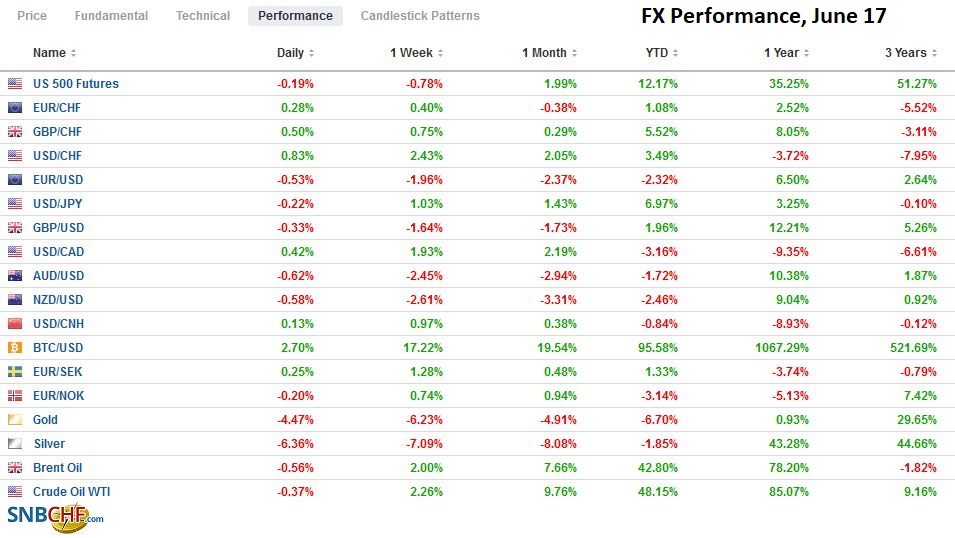

FX Performance, June 17 |

Asia Pacific

US sanctions are pushing China to accelerate the development of its own semiconductor industry. To be sure, Beijing was already moving into import-substitution strategies and took another step today. Vice Premier Liu He, who has been a key trade negotiator, has been tapped to spearhead China’s effort to develop the domestic semiconductor industry, seeking to promote a third-generation capacity. The US has moved in a similar direction.

The median forecast in the Bloomberg survey was for Australia to have gained around 30k jobs in May after losing about the same amount in April. Instead, a jump of 115k jobs was reported, of which 97.5k were full-time positions. Australia lost 860k jobs when the pandemic struck. Since those dark days, Australia has gained over a million jobs. The participation rate stood at 65.9% at the end of 2019. Last month, it was at 66.2% (65.9% in April). The unemployment rate tumbled from 5.5% in April to 5.1% in May. It was at 5.0% at the end of 2019. The strength of the jobs data will likely allow the Reserve Bank of Australia to adjust its policies next month. Slowing its bond purchases and maybe not extending its 3-year interest rate target (under its yield curve control) seems reasonable. Separately, New Zealand reported Q1 21 GDP rose 1.6%. The median forecast was for a 0.5% expansion after contracting by 1% in Q4 20.

The US dollar posted a big outside up day yesterday against the yen, trading on both sides of Tuesday’s range and closing above the high. Follow-through buying lifted it a little through JPY110.80 in early Asia before easing toward JPY110.55 by early morning in Europe. The high for the year was set in late March near JPY111.00.

The Australian dollar is heavy. Since mid-May, it stalled near $0.7800 and probing just below $0.7600 in Europe. The 200-day moving average is found near $0.7555, and the year’s low set in April was slightly above $0.7530.

The Federal Reserve has aided the PBOC’s efforts to stabilize the yuan. The dollar gapped higher and reached almost CNY6.4330, its best level since May 24 and the biggest gain in more than four months. Last month’s highs were roughly between CNY6.4430 and CNY6.4665. The PBOC pushed on the open door by setting the greenback’s reference rate at CNY6.4298, while the bank model’s surveyed by Bloomberg expected a CNY6.4268 fix. This is an unusually large gap recently. Note that yuan’s use on SWIFT fell to 1.9% in May, the lowest of the year after recording a six-year high near 2.5% in March.

Europe

The ECB’s chief economist Lane played down the debate the central bank is expected to have in September about the elevated bond buying. The ECB’s program is more flexible than other central bank efforts. The Federal Reserve, for example, is committed to buying a fixed quantity of at least $80 bln of Treasuries and $40 bln Agency MBS a month. The ECB has an “envelop” that it taps in a very flexible way. We have pointed out that since the ECB escalated its purchases in March, the euro and European rates rose. While the euro has come off sharply with the Fed’s move, the general observation holds. The level of the ECB’s bond-buying does not drive the exchange rate or interest rates.

Norway’s central bank has sharpened its message. Previously, it indicated that a rate hike in the second half might be appropriate. At today’s meeting, it signaled a likely hike in September. The krone is trading a bit heavier today in the face of the dollar’s broad-based gains, though it is firmer against the euro. The news is not unexpected. The Swiss National Bank is the other extreme. It affirmed its policy rate at minus 75 bp. The SNB tweaked its inflation forecast slightly higher, but like the ECB and Fed, it sees the price pressures as transitory. It now sees CPI rising to 1% this year, though average 0.4%. It anticipates a 0.6% rate for the next two years. The outcome of Turkey’s central bank meeting is awaited. President Erdogan, who has eroded the central bank’s independence, seemed to have signaled they can be patient for a rate hike until July-August. Turkey’s key repo rate stands at 19.0%.

The euro was sold through $1.20 yesterday, and follow-through selling today has pushed it to almost $1.1935. The $1.1920 area corresponds to the (61.8%) retracement objective of the euro’s rally since the end of March when it bottomed near $1.1700. The single currency is trying to stabilize in Europe. Look for the $1.2000 level to offer initial psychological resistance, and it also houses the 200-day moving average.

Sterling is proving a bit more resilient. The Bank of England meets next week, and at its last meeting, it decided to slow its bond purchases. Sterling punched below $1.40 yesterday for the first time since May 10. Today it approached $1.3960, the (50%) retracement of the rally since the spring lows near $1.3670. The next retracement target (61.8%) is a little below $1.3900. The euro is trading around GBP0.8550, its lowest level in more than two months. The year’s low set in early April near GBP0.8470.

America

We framed the FOMC meeting around three questions, and they were answered. First, the median projection now sees not one but two hikes in 2023. Seven of the 18 see a hike next year. As we have noted, the December 2022 Eurodollar futures contract had priced that scenario. Second, Chair Powell indicated that the discussion about the pace of asset purchases has begun. It will evolve as more data is available. Powell reiterated that the Fed will give advanced notice of tapering, which gives the market little reason to second-guess the Jackson Hole/September FOMC meeting time frame for a formal announcement. Third, the Fed increased the rate it pays on reserves (excess and required) and what it offers on its reverse repo facility by five basis points to 15 bp and 5 bp, respectively. The two-year yield rose by four basis points yesterday, which was the most since February, and it closed above 20 bp for the first time since June 9, 2020.

Today’s data pales in comparison to yesterday’s developments. Weekly initial jobless claims are expected to continue to unwind the Covid gains. The June Empire State manufacturing survey eased more than expected, and there may be downside risks to today’s Philly Fed survey. On the other hand, May’s leading economic indicator index should point to continued robust growth. The median Fed projection for GDP this year was lifted to 7% from 6.5% in March. Next year’s median was unchanged at 3.3%, while the 2023 growth was lifted to 2.4% from 2.2%.

The CAD1.20 area proved solid support for the US dollar, and its recovery began before yesterday but accelerated with Fed’s moves. The greenback surpassed the (38.2%) retracement objective of the slide since the Bank of Canada’s hawkish meeting on April 21 yesterday near CAD1.2255. Today it is approaching the next (50%) retracement objective near CAD1.2330. The (61.8%) retracement is slightly above CAD1.2400. Canada reports its international portfolio flows for April today but is not a market-mover typically even in the best of times.

The dollar’s rally pushed above the 200-day moving average against the Mexican peso for the first time since March yesterday (~MXN20.41). It advanced further toward MXN20.48 in Europe before steadying. Initial support is now seen near MXN20.30. Brazil delivered the well-telegraphed 75 bp hike yesterday, its third of that magnitude in the series, and suggested another one of the same size is likely in August.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Brazil,China,Currency Movement,Featured,federal-reserve,newsletter,Norges Bank