Most economists are of the view that through the inspection of economic data it is possible to identify early warning signs regarding boom bust cycles. What is the rationale behind this way of thinking? During the 1930s the National Bureau of Economic Research (NBER) introduced the economic indicators approach to ascertain business cycles. A research team led by W.C. Mitchell and Arthur F. Burns studied about 487 economic data points in order to establish what business cycles are all about. Mitchell and Burns had concluded that [b]usiness cycles are a type of fluctuation found in the aggregate economic activity of nations…. a cycle consists of expansion occurring at about the same time in many economic activities, followed by similarly general recessions,

Topics:

Frank Shostak considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Most economists are of the view that through the inspection of economic data it is possible to identify early warning signs regarding boom bust cycles. What is the rationale behind this way of thinking?

Most economists are of the view that through the inspection of economic data it is possible to identify early warning signs regarding boom bust cycles. What is the rationale behind this way of thinking?

During the 1930s the National Bureau of Economic Research (NBER) introduced the economic indicators approach to ascertain business cycles. A research team led by W.C. Mitchell and Arthur F. Burns studied about 487 economic data points in order to establish what business cycles are all about. Mitchell and Burns had concluded that

[b]usiness cycles are a type of fluctuation found in the aggregate economic activity of nations…. a cycle consists of expansion occurring at about the same time in many economic activities, followed by similarly general recessions, contractions, and revivals which merge into the expansion phase of the next cycle; this sequence of changes is recurrent but not periodic.1

In this way of thinking, business cycles are seen as broad swings in overall economic activity. The NBER research team concluded that because the causes of business cycles are complex and not properly understood it is much better to focus on the outcome of these causes as manifested through the economic data.

It is held that a careful inspection of the data makes it possible to establish peaks and troughs in general economic activity. The peaks and troughs identified by the NBER serve as a point of reference to classify various individual data as leading, coinciding, or lagging. Once the data is classified, it can be assembled into the leading, the coincident, and the lagging groups, known as the leading, coincident, and lagging indices.

These indices are seen as economic signposts that are expected to alert analysts and policymakers regarding the state of a business cycle. When the leading index starts to display signs of weakening, this is seen as a possible indication of weakness in economic activity in the months ahead.

The coincident index confirms that the peak of the cycle may have been reached, while the lagging index provides the final confirmation. Hence by means of these three indicators, it is held, the stage of a business cycle can be ascertained.

The indicators approach that was inspired by the NBER methodology was designed to be as impartial as possible in order to be seen as purely scientific. Murray Rothbard had the following comment on the NBER methodology,

Its numerous books and monographs are very long on statistics, short on text or interpretation. Its proclaimed methodology is Baconian: that is, it trumpets the claim that it has no theories, that it collects myriads of facts and statistics, and that its cautiously worded conclusions arise solely, Phoenix-like, out of the data themselves. Hence, its conclusions are accepted as unquestioned holy “scientific” writ.2

Establishing the Essence of Boom-Bust Cycles

Should we regard any decline in the leading index as a precursor for a future economic decline? For how many months must the index decline before we can be certain of an upcoming economic recession?

In addition, if one is to wait for the leading index signal to be confirmed by the coincident index, then what is the point of having the leading index? After all, it is supposed to alert policymakers and businesspersons before the boom or the bust has started. Furthermore, in this way of thinking the lagging index must still provide the final confirmation.

It would appear that by the time the final verdict is given the economy could be already in a deep economic slump or in a strong economic boom. If the driving factors of boom-bust cycles are not known, as the NBER underlying methodology holds, how is it possible to make sense of movements in economic indicators?

How could the government and the central bank employ measures to counter something that is unknown?

Contrary to the NBER philosophy, data does not speak by itself and never issues any “signals” as such. It is the interpretation of the data guided by a theory which generates various “signals.”

According to Ludwig von Mises,

The historian does not simply let the events speak for themselves. He arranges them from the aspect of the ideas underlying the formation of the general notions he uses in their presentation. He does not report facts as they happened, but only relevant facts.3

Hence, to make sense of data one requires a theory beforehand. The purpose of a theory is to provide the essence of the subject of the investigation. The theory should reflect the essence of reality. If it fails to mirror reality, then regardless of how elegant the theory is, it cannot help us in the understanding of the subject of analysis. Note that the NBER framework is about being “practical,” i.e., without any coherent theory. In this way of thinking being practical is labelled as being scientific.

By stating that business cycles are about swings in the data, one says nothing about what business cycles are all about. One only describes fluctuations in the data. One does not explain these fluctuations. In order to ascertain what business cycles are, one must identify the driving force behind these cycles.

Boom-Bust Cycles and the Central Bank

To establish the essence of the boom-bust cycle, we must establish how this phenomenon emerged.

According to Murray Rothbard,

Before the Industrial Revolution in approximately the late eighteenth century, there were no regularly recurring booms and depressions. There would be a sudden economic crisis whenever some king made war or confiscated the property of his subjects; but there was no sign of the peculiarly modern phenomena of general and fairly regular swings in business fortunes, of expansions and contractions.4

The boom-bust cycle phenomena is somehow linked to the modern world. The source of the recurrent boom-bust cycle turns out to be the alleged “protector” of the economy—the central bank itself. The central bank’s ongoing policies that are aimed at fixing the unintended consequences that arise from its earlier attempts at stabilizing the so-called economy are key factors behind the recurrent boom-bust cycles.

Fed policymakers regard themselves as being the responsible entity authorized to bring the so-called economy onto the path of stable economic growth and stable prices (policymakers decide what the “right” stable growth path should be). Consequently, any deviation from the stable growth path sets the Fed’s response in terms of either a tighter or a looser stance.

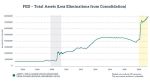

These responses to the effects of previous policies on economic data give rise to the fluctuations in the growth rate of the money supply out of “thin air” and in turn to the recurrent boom-bust cycles. (Note that money out of “thin air” is the result of the central bank loose monetary policy).

Observe that loose central bank monetary policy, which results in an expansion of money supply out of “thin air,” sets in motion an exchange of nothing for something, which amounts to a diversion of wealth from wealth-generating activities to non-wealth-generating activities.

In the process, this diversion weakens wealth generators, and this in turn weakens their ability to grow the overall pool of wealth. The emergence of activities on the back of a loose monetary policy is what an economic “boom” is all about—observe that these activities cannot stand on their “own feet.” These activities are also characterized as bubble activities. Also, note that once the central bank’s pace of monetary expansion strengthens the pace of the diversion of wealth towards bubble activities also strengthens.

Once, however, the central bank tightens its monetary stance, this slows down the diversion of wealth from wealth producers to bubble activities. Bubble activities that sprang up on the back of the previous loose monetary policy are now getting less support; they fall into trouble—an economic bust emerges. Observe that during the economic slump the liquidation of bubble activities that emerged during the previous boom is taking place. Note again that bubble activities emerged on the back of increases in the money supply out of “thin air.”

Hence, the more of such activities were generated during the economic boom, the greater the cleansing of such activities that is required in order to revitalize the economy—and the greater the economic recession is consequently going to be.

Changes in Monetary Policy and Time Lags

Now, what typifies the emergence of an economic slump such that businesses that were once thriving experience difficulties or go under? They do not fail because of firm-specific entrepreneurial errors but rather in tandem with whole sectors of the economy.

People who were wealthy yesterday have become poor today. Factories that were busy yesterday are shut down today, and workers are out of jobs. Businesspersons are confused and they cannot make sense of why certain business practices that were profitable yesterday are losing money today.

Bad business conditions emerge when least expected—just when all businesses hold the view that a new age of steady and rapid progress has emerged. An economic slump emerges without much warning and in the midst of “good news.”

Again, contrary to the indicators approach, boom-bust cycles are about activities that sprang up on the back of the loose monetary policies of the central bank. It is not about the strength of various economic data as such.

Now, if central bank policies set boom-bust cycles in motion, obviously these policies cause economic fluctuations. Furthermore, when the central bank changes its monetary policy, the effect of the new stance does not assert itself instantaneously—it takes time.

The effect starts at a particular point and shifts gradually from one market to another market, from one individual to another individual. Consequently, the previous monetary stance may dominate the scene for many months to come before the new stance begins to assert itself.

Just by following the growth rate of money supply, one could get some idea regarding boom-bust cycles in the months ahead.

Given that the time lag in money supply growth and economic activity growth is variable, the assessment as far as the future is concerned can be only qualitative.

Without establishing the underlying causes of boom-bust cycles, employing policies in response to changes in economic indicators to counter economic cycles is likely to destabilize the economy. A major cause of boom-bust cycles is the institution that supposedly “defends us” against this menace. This institution is the central bank itself.

- 1. Quoted in Allan P. Layton and Anirvan Banerji “What Is a Recession?: A Reprise,” Applied Economics 35, no. 16 (2003): 1789–97.

- 2. Murray N. Rothbard, Making Economic Sense, 2d ed. (Auburn, AL: Ludwig von Mises Institute, 2006), p. 232.

- 3. Ludwig von Mises, Human Action: A Treatise on Economics, scholar’s ed. (Auburn, AL: Ludwig von Mises Institute, 1998), p. 47

- 4. Murray N. Rothbard, “Economic Depressions: Their Cause and Cure,” in The Austrian Theory of the Trade Cycle and Other Essays, ed. Richard M. Ebeling (Auburn, AL: Ludwig von Mises Institute,1996), pp. 65–93, esp. p. 69.

Tags: Featured,newsletter