One sure way to identify a system “optimized for failure” is if all the insiders are absolutely confident the system is “optimized for my success”. I often discuss optimization here because it offers an insightful window into how systems become fragile and break down. When we optimize something, we’re aiming to get the most bang for our buck: maximize our efficiency, profit, productivity, etc., while minimizing our costs. To maximize our goal, whatever it is–profits, power, whatever– we strip away redundancy and buffers because these add costs and don’t boost our desired output. They create resilience, i.e. the ability to survive disruptions, but the logic of optimization is relentless: get rid of all extraneous costs, because resilience doesn’t boost the bottom

Topics:

Charles Hugh Smith considers the following as important: 5.) Charles Hugh Smith, 5) Global Macro, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

One sure way to identify a system “optimized for failure” is if all the insiders are absolutely confident the system is “optimized for my success”.

I often discuss optimization here because it offers an insightful window into how systems become fragile and break down. When we optimize something, we’re aiming to get the most bang for our buck: maximize our efficiency, profit, productivity, etc., while minimizing our costs.

To maximize our goal, whatever it is–profits, power, whatever– we strip away redundancy and buffers because these add costs and don’t boost our desired output. They create resilience, i.e. the ability to survive disruptions, but the logic of optimization is relentless: get rid of all extraneous costs, because resilience doesn’t boost the bottom line.

This trade-off–trading resilience for optimization–looks brilliant when everything goes according to plan. But when events veer outside the narrow parameters of the optimized system, the system breaks down: supply chains break, safety procedures fail, and so on.

Even more consequentially, optimization strips away anti-fragility, Nassim Taleb’s term for the ability to not just survive disruptions but emerge stronger and more adaptable.

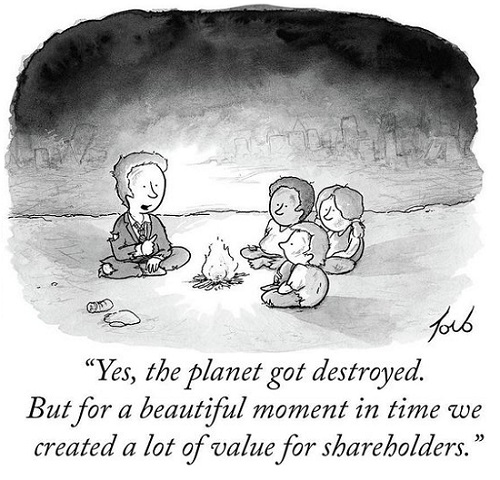

What happens when inflexible, sclerotic systems optimized to benefit self-serving insiders encounter chaotic turbulence or conditions outside the expected parameters? They collapse because the system is optimized for failure. Put another way: when a system is optimized to benefit insiders at the expense of resilience and anti-fragility, it is effectively optimized to fail because life is not programmable to a steady-state, predictable stability.

2021 is already optimized for failure in key ways:

2021 is already optimized for failure in key ways:

1. The mRNA vaccines have not been properly tested to answer essential questions such as: can a vaccinated individual retain enough of the virus to infect an unvaccinated individual?

As I explained before, the only way to really test a viral vaccine is to put the vaccinated volunteers in a controlled setting saturated with the virus for many hours. If none of the volunteers have any virus in their post-exposure serological tests, then the vaccine works. If the volunteers still have the virus but didn’t become severely ill, this doesn’t mean they can’t infect others.

One of the problems is the goal of the Covid vaccine trials wasn’t to determine if the virus was eliminated by the volunteers’ immune system; the goal of the trials was to determine whether the vaccinated individuals became severely ill with Covid or not–with “severely ill” being conveniently left undefined.

Individuals who’d already had Covid and who took the vaccine were not tested separately for safety and after-effects, so this remains an unknown.

The unanswered questions about the vaccines’ real-world results will be answered in due time, but not in the lab; they’ll be answered in a public-health “experiment” without precedent.

If you wanted to design a testing process that was optimized for failure, you’d end up with this haphazard, hurried process careening toward approval. The trials and testing of the Covid vaccines are not equivalent to those applied to previous generations of vaccines.

The bigger the claims and the harder the sell, the greater the number of red flags raised. If a product works as wonderfully as advertised, it will sell itself. If “consumers” have to be coerced into buying the product, that speaks volumes–whether we’re free to discuss it or not.

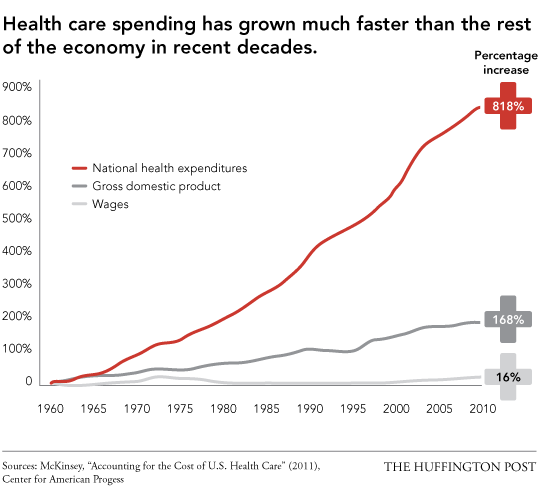

2. The fiscal-monetary “solution” being readied for 2021–print/borrow as many trillions as needed to prop up zombie corporations and obsolete institutions–is optimized for failure. The unstated goal here is to save everything that’s been rigged to benefit self-serving insiders and never mind the consequences: we’ve “proven” we can print infinite trillions with no ill effects.

This appears to be true until diminishing returns hit the wall and linear dynamics suddenly spin into non-linear semi-chaos. At that point, all the levers that we reckoned were god-like in their stability and power–the Treasury selling bonds which the Federal Reserve then buys, and all the other financial tricks and manipulations–no longer work as expected.

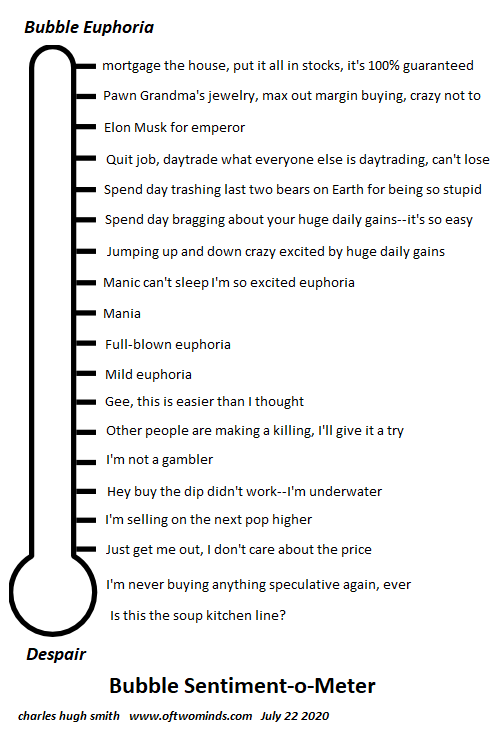

3. The sacrosanct “solutions” that we worship as secular gods–central bank-dominated “markets” and the machinery of politics–are both optimized for failure. The “market” and politics have both incentivized extremes of indebtedness, leverage, corruption, fraud and waste, all under the happy belief that the banquet of consequences will never be served. Alas, the tables are groaning with consequences that have been piling up for 12 long years of excess speculation, manipulation and happy-talk PR.

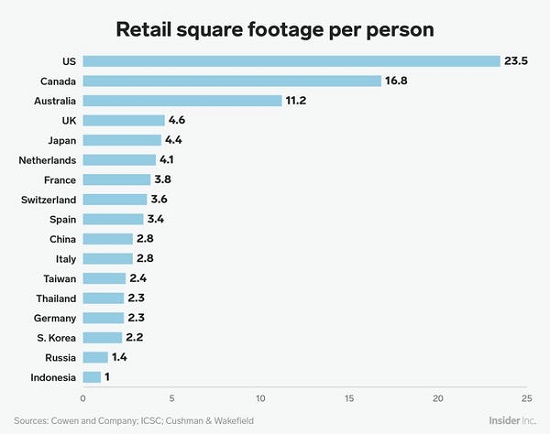

The policies of the past 20 years boil down to this: if we keep blowing ever-larger private-sector asset bubbles, rewarding the few who own most of these assets, this “wealth” will magically restore our economic health. This is of course completely delusional: by concentrating wealth in the hands ofthe few, the policies have also concentrated political power in these same hands.

Ours is a system perfected for extremes of inequality and corruption.

If you set out to design a social-political-economic system that was supremely optimized for failure, you’d end up with America’s status quo. Today’s financiers are like French nobles being led off in chains discussing their next glorious party, oblivious to the end-game just ahead. The political class are like the elites haggling over games in Rome’s Forum in 475 AD, months before what was left of the empire collapsed in a heap.

4. America’s social cohesion has been lost, leaving only empty platitudes, suppression and coercion. “We’re all in this together” shouts the captain of the galley as those chained to the oars are flogged to keep a thoroughly corrupt and illusory “growth” alive. With civic virtue lost to the moral corruption of maximizing private gain by any means available, the foundations of society have crumbled, as I explained in Moral Decay Leads to Collapse.

One sure way to identify a system optimized for failure is if all the insiders are absolutely confident the system is optimized for my success regardless of how many policies serve the infinite greed of insiders and how many red warning flags are ignored.

Tags: Featured,newsletter