The ongoing coronavirus pandemic has halted economies across the globe. With various countries on lockdown and companies unable to continue production, an economic downturn is inevitable. In light of this, the government of Denmark has come up with a strategy to avoid recession—paying 75 percent of private employees’ salaries. As long as companies do not fire people, the government is offering to pay 75 percent of their employees’ salaries, up to ,288 per month per employee. To be eligible for this support, a company has to give notice that it will have to lay off 30 percent of its workers or fire at least fifty people. Beyond this, the government is guaranteeing bank loans to companies and compensating them for fixed expenses. The total cost of this

Topics:

Aayush Priyank considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The ongoing coronavirus pandemic has halted economies across the globe. With various countries on lockdown and companies unable to continue production, an economic downturn is inevitable. In light of this, the government of Denmark has come up with a strategy to avoid recession—paying 75 percent of private employees’ salaries.

As long as companies do not fire people, the government is offering to pay 75 percent of their employees’ salaries, up to $3,288 per month per employee. To be eligible for this support, a company has to give notice that it will have to lay off 30 percent of its workers or fire at least fifty people. Beyond this, the government is guaranteeing bank loans to companies and compensating them for fixed expenses. The total cost of this undertaking is DKK 287 billion ($41 billion)—approximately 13 percent of the country’s GDP.

Will It Prevent Recession?

There are various proclaimed benefits to this measure, many of which on examination are rather shaky. One alleged benefit of this measure, for instance, is that it will help avoid recession. Jobs will not be lost, people will still be paid, and thus the government will save its citizens from recession.

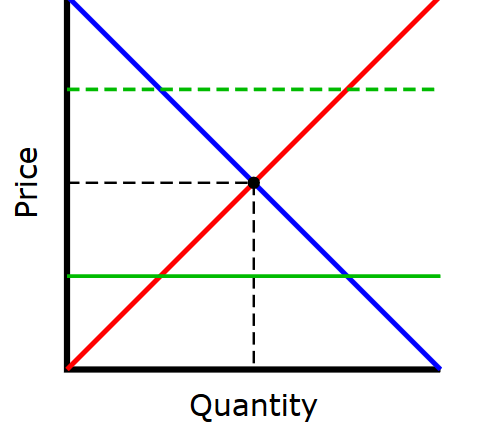

The problem, however, is that the planned measures do not serve to avoid recession. The wealth of a nation, as Adam Smith pointed out long ago, resides in the goods and services it creates. A halt on production inevitably impacts the goods and services produced, and no amount of circulation of currency can avoid a recession.

But the government is not only subsidizing payments, it is also putting forth the condition that those being paid in this way must not work. The government is, quite literally, paying people to do nothing. And although seeing paychecks come in will keep people happy, the economic repercussions of such policies will have to be borne eventually.

Will It Hasten Recovery?

Another purported benefit of the measure is that it will help the economy recover faster. Under normal circumstances, companies would have fire workers and then have to go through rounds of hiring and recruitment after the crisis. The costs and time involved in hiring would delay the recovery of the economy.

Yet if the government can recognize the time and monetary costs of recruitment, certainly companies can do so as well. It would make sense, then, for companies to make agreements with their employees to rehire them after the crisis, saving them recruitment costs. With the profit incentive driving them, companies are the entities most likely to do everything possible to minimize resource waste, be it in terms of idle time or money.

Furthermore, the money handed out today is based on the products of tomorrow. Since people will be paid without having produced, the value of currency in circulation will exceed the value of goods available. Inflation, then, is inevitable. Not only will the measures inflate the current prices of goods, but they will also eat up the hard-earned savings of people.

What Does This Mean Politically?

The government’s rationale for the spending is that things will be worse if they don’t act, and this puts them in a very defensible position. Irrespective of how much damage they cause the economy through their measures, they can always claim that it would have been worse if they hadn’t done what they did.

Moreover, the measures received bipartisan, almost unanimous, support, from the far left to the far right. Unions and employers’ associations are in support of it as well. With such consensus, even if the policies fail no one is likely to highlight the issue. The public itself is convinced that it is the right thing to do. Will economic disaster convince them otherwise, and shift them away from Keynesian policies and big government bailouts? Only time will tell.

Tags: Featured,newsletter