Narrative Economics: How Stories Go Viral and Drive Major Economic EventsRobert J. Shiller Princeton: Princeton University Press, 2019xxi + 377 pp. Abstract: Much of Shiller’s new book is about how economic narratives form, spread, and fade. Drawing on medical evidence about the spread of infectious disease, Shiller argues that “economic fluctuations are substantially driven by contagion of oversimplified and easily transmitted variants of economic narratives.” But Shiller ignores the powerful role of monetary disorder, whether in forming the narrative or determining the contagion rate, or as a competitor to the narrative. Ignoring or downplaying money’s role leaves Narrative Economics a disappointment. recession — housing bubble —monetary policy — narrative

Topics:

Brendan Brown considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Narrative Economics: How Stories Go Viral and Drive Major Economic Events

Narrative Economics: How Stories Go Viral and Drive Major Economic Events

Robert J. Shiller

Princeton: Princeton University Press, 2019

xxi + 377 pp.

Abstract: Much of Shiller’s new book is about how economic narratives form, spread, and fade. Drawing on medical evidence about the spread of infectious disease, Shiller argues that “economic fluctuations are substantially driven by contagion of oversimplified and easily transmitted variants of economic narratives.” But Shiller ignores the powerful role of monetary disorder, whether in forming the narrative or determining the contagion rate, or as a competitor to the narrative. Ignoring or downplaying money’s role leaves Narrative Economics a disappointment.

recession — housing bubble —monetary policy — narrative economics — business cycle

Brendan Brown ([email protected]) is a nonresident senior fellow at the Hudson Institute and an associated scholar of the Mises Institute.

Robert J. Shiller in his new book focuses on an issue of fundamental importance to understanding economic and financial market cycles—the rise and fall of narratives. The book is full of promise, written by an author acclaimed for his pioneering work in applying psychology research about impaired mental processes in decision-making to economic and financial market analysis.

A well-known proposition of modern psychology, termed the representativeness heuristic by authors Daniel Kahneman and Amos Tversky (1973), is that people form their expectations based on the prominence of an idealized narrative rather than estimated probabilities. Shiller gives the example that we judge the danger of an emerging economic crisis by its similarity to a remembered story of a previous crisis rather than by any logic.

Much of this book is about how economic narratives form, spread, and eventually fade. But there is an aim beyond that. In Shiller’s own words, “A key proposition of this book is that economic fluctuations are substantially driven by contagion of oversimplified and easily transmitted variants of economic narratives.” He draws on medical evidence about the spread of infectious diseases to develop his thesis.

The speed and extent with which a narrative penetrates a population (for example of global investors) is determined by the contagion rate relative to the recovery rate. The latter in this context means forgetting or losing interest in the presumed facts disproving the narrative. The contagion rate can be greatly lifted by the endorsement of a celebrity (who may in some cases be its originator).

There is much in the book about the narratives that form in various asset markets. Given Shiller’s renowned research into the housing market, the reader will likely be drawn to his analysis here. The author identifies price index publication as a trigger to narrative creation. According to Shiller, the start of data agglomeration on stock market indices triggered greater contagion and the origination of narratives about equities from the 1930s onward, and he attributes the same role to the Case-Shiller data on US housing prices from the 1990s. Indices and their movement become a trigger to regular storytelling by journalists.

Shiller concludes that narrative economics should have a key role in economic theory. To understand both secular and cyclical developments, we must identify the economic narratives that are powerful and active contemporarily, and how they are waxing or waning. Collecting better information about changing narratives should begin now. Shiller does not suggest that this is a simple endeavor. Narratives mutate, recur, and are often complex. Optimistically, though, he asserts that economic research is already on its way to finding better quantitative methods to understanding narratives’ impact on the economy.

Unfortunately, the author’s citation of narratives that have played key roles in past economic and financial outcomes is far from convincing. And there is an elephant in the room that the author ignores totally—the powerful role of monetary disorder, whether in forming the narrative or determining its contagion rate, or as a competitor to the narrative in providing an explanation for economic and financial fluctuations. Shiller’s focus on disease epidemiology and his ignoring or downplaying of money’s role leaves readers questioning his propositions in two ways.

First, surely there are powerful groups in the political economy whose purposes the spread of a narrative serves well. These groups, whether business or political, out of self-interest might apply propaganda techniques to help a narrative spread. For example, we can think of monopolists in search of a narrative to justify their huge actual or potential profits. Similarly, the promoters of highly valued new enterprises (the so-called unicorns) in Silicon Valley may be delighted that a narrative is going viral in which their innovation will be the new road to El Dorado. A narrative in which digitalization forms the basis of a third industrial revolution, analogous to steam power in the first one or electricity in the second, could suit both fine groups fine.

Second, monetary inflation’s impairs normal rational skepticism in the marketplace and thereby might give a major fillip to the contagion power of certain narratives. Yet Shiller makes no mention of this possibility. That is odd, especially in the context of the present cycle, during which central banks have been pursuing radical experimentation, meaning that investors are faced with negative returns on money and government bonds. A hunger for yield becomes evident among interest income famine investors. This desperation and its corollary—susceptibility to speculative storytelling—are consistent with the psychological evidence behind prospect theory (see Kahneman 2011). According to this theorem, if someone is presented with a choice between a certain loss or a bad bet with some chance of gain, and whose actuarial value is greater than the certain loss, he or she will take the gamble.

The researchers into prospect theory do not make the following point. Rather than admitting to ourselves that the bet is bad, we latch on to speculative narratives. We discard our normal rational cynicism, so turning the bad bet into a good bet in our minds (see Brown 2017). For example, turning to the third industrial revolution narrative above, interest income famine investors might be over-gullible, overlooking serious flaws and downsides in the new technology as reflected in the generally disappointing growth of living standards (on average, over the whole population).

Beyond these two troubling aspects, Shiller is prone in this book to cite certain economic judgments as final and universal that are far from settled. Some readers may feel that Shiller is a John Maynard Keynes enthusiast, exaggerating the power of narratives attributable to that economist. To be fair, however, it is a fact that Keynesian narratives, whether in original or mutated (neo-Keynesian) form have penetrated far into economic (including monetary) policymaking around the globe. Shiller understandably seeks to explain this penetration in line with his principles of narrative economies.

The author does suggest that the contagious success of Keynesian economic narratives depends on any factors other than inherent brilliance. As well as stressing the importance of Keynes’s celebrity status, Shiller mentions the role of the Hicksian IS-LM diagram in propagating Keynesian economics. The resemblance of its two schedules to the well-known supply and demand curves of simple price theory has indeed been crucial. But Shiller does not consider explicitly the attraction of Keynesian doctrine to politicians seeking to win elections by fine tuning the economy or by ignoring red ink in the budget resulting from tax cuts and increased outlays. It is no wonder that such governments and their advisors are keen to propagandize Keynesian narratives.

In general, however, Shiller tends to exaggerate the spread of narratives, underestimating the heterogeneity of opinion in the economy and the marketplace, even when these seem very powerful.

Let’s give some illustrations of the above reservations concerning narrative economics as Shiller develops them in the book.

Shiller quotes the spread of the message in Keynes’s polemic The Economic Consequences of the Peace (1919) as an example of an economic narrative that had tremendous power, which he attributes in part to the role of Keynes as a celebrity (including his membership in the Bloomsbury Circle). For Shiller this narrative was based on substantial truth: “Keynes was right (about the fatal consequences of reparations as demanded in the Treaty). World War Two began amongst lingering anger twenty years later and cost 62 million lives.”

But Shiller fails to mention the huge flaws in the 1919 polemic: for example, Keynes failed to consider the possibility of an economic miracle in Germany that would pull in huge amounts of foreign capital (as occurred from 1924–28, albeit eventually blighted by the fantastic asset inflation fueled by the Federal Reserve). Although the unquantified reparation demands in the Peace Treaty did initially result in a massive bill, presented to Berlin in 1921, the Dawes Plan (1924) scaled these demands down hugely.

Undoubtedly the reparations narrative formed a key part of the National Socialist propaganda campaign in the years 1929–30. (Germany and its creditors were then negotiating a new reparations deal, the Young Plan.) Yet the success of that propaganda, and more generally the rise of Hitler (who became Chancellor in January 1933), reflected fundamentally the calamitous bust of the global bubble with the Weimar Republic at the epicentre. The source of the bubble had been the huge monetary inflation (camouflaged in goods markets by rapid productivity growth and an abundance of commodity supplies) generated by the Federal Reserve between 1921 and 1928.

The spread of the Keynesian narrative about the disaster of reparations in The Economic Consequences of the Peace depended in large part on its appeal to two powerful political groups—the nationalists (including National Socialists) in Germany, who could cite a celebrity English economist to validate their view that reparations were unacceptable, and US isolationists, who scored early success in their opposition to the Versailles Treaty and collective security via the League of Nations.

We should also note that in the marketplace of 1919–21, Keynes’s narrative was far from dominant. There was a huge tide of speculators buying Reichsmarks in the belief they had become so cheap that only recovery could lie ahead (see Brown 2011). Keynes himself lost a fortune (almost going bankrupt) in shorting the Reichsmark at this time, believing his own narrative.

Let’s move backwards in history to the 1890s. Shiller maintains that the depression (and high unemployment) during much of this decade stemmed from the narratives about the bimetallist controversy that were being spread. Bryan’s Cross of Gold speech in 1896 was the epitome of a campaign advocating bimetallism that had already been waged for several years. Implementation would mean a major devaluation of the dollar against gold (and thereby the European gold currencies).

Shiller argues that an emotional bimetallist narrative about the hardships that much enterprise (including farmers) and ordinary working people would face if “Eastern intellectuals” had their way and the dollar stayed on the gold standard seriously aggravated general economic pessimism and thereby the weakness of the economy in these years. But there is an alternative hypothesis that Shiller does not consider.

The lack of confidence in the US remaining on the gold standard was reflected in a drain of gold and cash (the latter somewhat irrational) from the banks, a trigger to the great crash of 1893 (see Rothbard 2002). The drain forced interest rates up, adding to the forces of recession in the economy—analogous, though not identical, to the effect of speculation on the US exiting the gold standard on the length and duration of the Great Depression. Shiller’s discussion of gold narratives in this book includes the unquestioning recitation that the gold standard was a cause of the Great Depression, which is jarring for readers aware of the strong counterarguments.

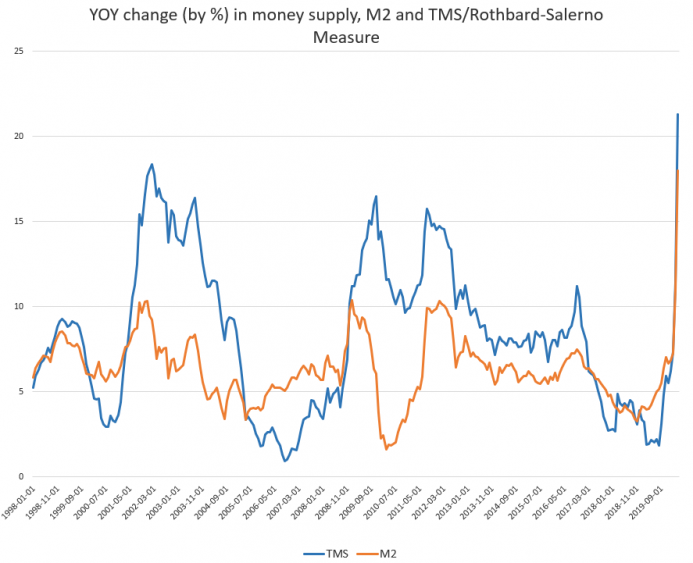

Similarly jarring is the author’s exclusive focus on narrative as the causal factor in the housing bubble and bust in the US from 2002–07. Shiller argues that the spread of narratives about housing prices always rising, the homeownership revolution, and the profit to be made in “flipping” all generated the bubble. But he makes absolutely no mention of President Bush’s nomination of Ben Bernanke to the Fed Board in 2002 or of his getting Alan Greenspan to sign on to a great monetary inflation ahead of the 2004 elections. Shiller subsumes these facts under a radical departure in US monetary history, “breathing inflation back into the economy.”

And no mention is made of the preceding great monetary inflation of 1995–99, during which the housing bubble had started to ferment. This inflation stemmed from the Greenspan Fed’s response to downward pressure on reported goods and services inflation (due to a productivity surge), by leaning against a rise of interest rates.

Further back, when Shiller recounts how the US economy suddenly rebounded from the Great Recession of 1920–21, he stresses narratives about “a return to normalcy.” But why is there no mention of the first great contracyclical monetary experiment of the Federal Reserve at that time (Rothbard 1972), which under tremendous political pressure made a huge injection of monetary base into the system? The same political forces resulted in the Fed unofficially turning toward price stabilization for the rest of the decade, even during a period of rapid productivity growth, which would fuel one of the greatest asset inflations in US history.

It is fine that Shiller advocates a major research drive into narrative economics. But if this is not to be a flawed endeavor, it must be built on a monetary pillar, and one which is well founded.

Shiller and his disciple researchers should examine one of the biggest narratives, false in the long run but self-fulfilling in the short run, and repeated tirelessly in much of the financial media. According to this narrative, central banks can improve economic outcomes through their rate manipulations and nonconventional tools. This narrative is not totally new. Part of the boom-or-bubble psychology of the 1920s was built on the narrative that the recently created Federal Reserve had the power to stabilize the economy and avoid the financial turbulence of previous eras. Similar narratives may be found in the 1960s, with the wonders of a new Keynesian Fed, and in the 1990s, with the Great Moderation due to the Maestro at the Fed. Nothing less than a ruthless and comprehensive criticism of such major monetary narratives should be expected from Shiller and his disciples in forging ahead with the new subdiscipline of economic narratives.

Tags: Featured,newsletter