If you want to understand how the economy is being transformed, look at the intersection of Big Tech, financialization and the central state.

The two dynamics transforming the economy–technology and financialization–are intertwined yet widely viewed as unrelated. Critics and proponents of each largely ignore the other dynamic: critics of institutionalized fraud and other manifestations of financialization implicitly assume the economy will return to some golden age if we get rid of financialization’s skims and scams.

They are largely blind to the reality that the speed with which technology is transforming the economy is increasing: there is no golden era to return to. The economy they long for (strong unions, full employment, rising wages, declining inequality, political bipartisanship, financial stability and security, etc.) has already slid into the dustbin of history.

They are equally blind to the reality that the central state they revere as the “solution” to financialization is itself the source of wealth/power asymmetry and the enforcer of Big Tech and Big Finance domination.

Proponents of technology implicitly assume that financialization’s skims and scams have no impact on technology’s golden promise of glorious advances which both enrich the few who own the technology and free the many to enjoy robots doing their work and endless entertainment (for a modest monthly fee, of course).

They are largely blind to the inconvenient reality that replacing tens of millions of workers with robots and software means there is no longer a mass-consumption economy for all the technological wonders, as the supposed solution–Universal Basic Income (UBI)–can’t provide either paid work or enough income for the millions who will be receiving UBI subsistence to borrow or spend enough to keep the consumer economy afloat.

Financialization’s solution–creating more credit / debt– simply insures that the UBI recipients will be devoting much of their subsistence income to debt service rather than tech toys.

In reality, both dynamics reinforce the disruptive effects of the other on non-elites. Financialization concentrates wealth and political power in the hands of those closest to the sources of cheap credit–central banks and private-sector banks.

Financialization enables tech companies to borrow billions on the cheap and use the money to buy back their own shares, increasing the value and further concentrating ownership of the most profitable tech companies.

With billions in profits and credit (via selling low-yield bonds), giant tech corporations have the wherewithal to invest in bleeding-edge technologies–and pay the top researchers sums that cannot be matched by lesser firms.

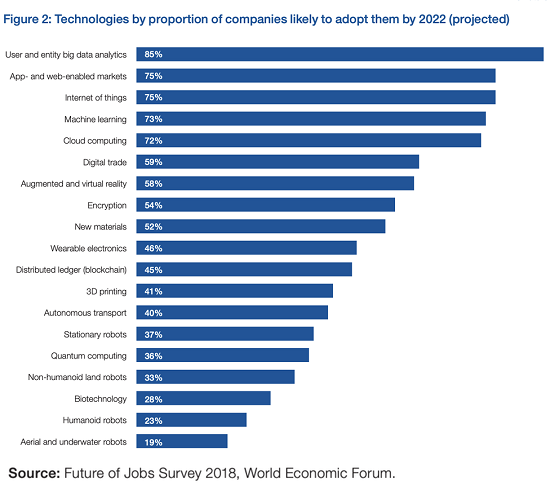

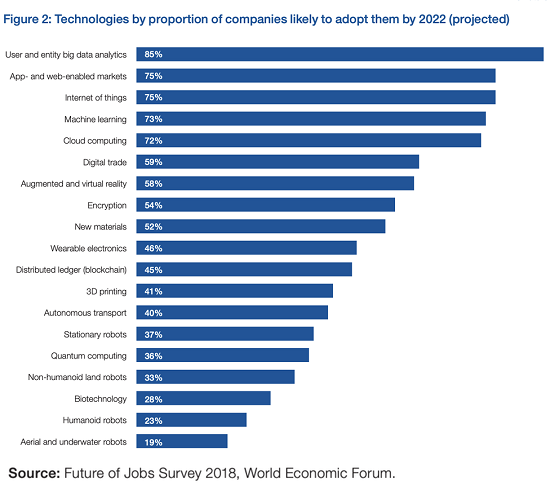

Companies are faced with Andy Grove’s famous summary of technological change: adapt or die. As the chart below illustrates, companies in virtually every sector are being forced to adopt technologies that reduce human labor while increasing productivity. Those who fail to do so effectively enough and soon enough will be outpaced by global competitors.

Unless of course the corporations have enough capital to purchase political power: once a corporation is powerful enough to buy regulatory moats and other forms of political cover, they reap the monopolistic benefits of what analyst Simons Chase calls the negative network effect: they “lock in” their monopoly via regulatory capture and the enforcement of the state.

Consider network effects, the popular economic construct applied to market concentration and increasing returns for strategies pursued by some leading tech companies. This dynamic economic agent is also known as demand side economies of scale.

W. Brian Arthur, the economist credited with first developing the theory, described the condition of increasing returns as a game of strategic positioning and building up a user base to the point where “lock in” of dominant players occurs. Companies able to tap network effects have been rewarded with huge valuations and highly defensible businesses.

But what about negative network effects? What if the same dynamic applies to the U.S.’s pay-to-play political industry where the government promotes or approves of something through a policy, subsidy or financial guarantee due to private sector influence. Benefits accrue only to the purchaser of the network effects, and consumers, induced by the false signal of large network size, ultimately suffer from asymmetric risk and experience what I’m calling a loss of intangible net worth for each additional member after the “bandwagon” wears off.

| If this were the case, then you would see companies experience rapid revenue growth (out of line with traditional asset leverage models), executives accumulating huge fortunes and political campaign coffers swelling.

But the most striking feature would be the anti-social outcomes, the ones not available without the instant critical mass of government-supported network effects, the ones that, at scale, monetize a society’s intangible net worth.

In effect, the negative network effect generated by America’s pay-to-play political structure creates a winner take most economy in the tech sector that mirrors the the winner take most dynamic of financialization.

Non-elites already live in a winner take most economy–a reflection of asymmetrical concentrations of wealth and power in tech and financial corporations. The commoditization of credit and institutionalized fraud such as corporate buybacks have served to strengthen the negative network effect that arise from the unholy alliance of Big Tech and the central state.

If you want to understand how the economy is being transformed, look at the intersection of Big Tech, financialization and the central state. |

. |

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Tags:

Featured,

newsletter